India Risk Management Market Size, Share, Trends and Forecast by Component, Deployment Mode, Enterprise Size, Industry Vertical, and Region, 2026-2034

Market Overview:

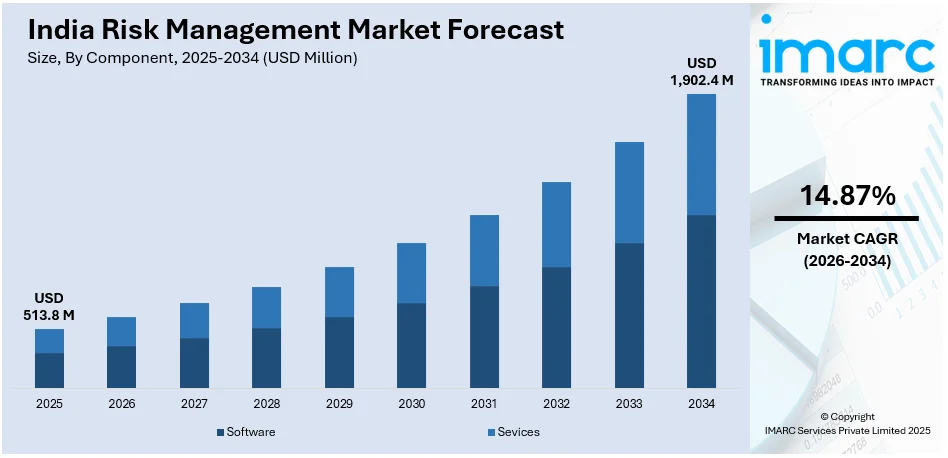

The India risk management market size reached USD 513.8 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,902.4 Million by 2034, exhibiting a growth rate (CAGR) of 14.87% during 2026-2034. The increasing utilization of online banking services, rising frequency and sophistication of cyber-attacks, and the growing number of construction projects in residential, commercial, and industrial areas represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 513.8 Million |

| Market Forecast in 2034 | USD 1,902.4 Million |

| Market Growth Rate (2026-2034) | 14.87% |

Risk management is a systematic and comprehensive approach for identifying, evaluating, and addressing potential risks that can impact the success or objectives of an organization, project, or individual. It involves a proactive and continuous process of analyzing internal and external uncertainties that can pose threats or opportunities. It effectively manages and controls risks, minimizes negative consequences, and maximizes potential benefits that multifaceted discipline entails several key steps, which start with risk identification, wherein potential risks are meticulously identified and categorized. It is a dynamic and evolving discipline that considers the complex and interconnected nature of threats. It recognizes that risks are not solely limited to financial aspects but encompass various dimensions, including operational, strategic, reputational, and compliance-related risks. It encourages organizations to embrace innovation, seize opportunities, and be mindful of potential pitfalls. It also plays a significant role in enhancing stakeholder confidence, as it demonstrates the commitment of organizations to responsible and sustainable practices. It aids in identifying potential weaknesses and vulnerabilities within the processes of organizations, systems, or strategies, which leads to continuous improvement and optimization.

To get more information on this market Request Sample

India Risk Management Market Trends:

Risk management is employed in the banking, financial services and insurance (BFSI) industry to address market fluctuations, credit risks, liquidity risks, and operational risks and protect their assets and maintain financial stability. This, coupled with the increasing utilization of online banking services on account of considerable reliance on smartphones and rising penetration of high-speed internet connection, represents one of the key factors strengthening the market growth in India. Moreover, the growing adoption of risk management in the healthcare sector to ensure patient safety, maintain compliance with regulations, and manage medical malpractice risks is influencing the market positively in the country. In addition, the rising frequency and sophistication of cyber-attacks are driving the demand for risk management measures to protect sensitive information and maintain business continuity. Apart from this, risk management finds application in the construction industry to identify potential hazards, control project costs, and mitigate delays and ensure worker safety and prevent accidents on construction sites. This, along with rapid urbanization and the rising number of construction projects in residential, commercial, and industrial areas, is propelling the growth of the market. Furthermore, the growing adoption of risk management practices by IT companies to secure sensitive data, protect against cyber threats, and ensure business continuity is creating a positive outlook for the market. Besides this, the increasing usage of risk management in the transportation sector for safety compliance, accident prevention, and managing liability in case of incidents involving vehicles or passengers is supporting the growth of the market.

India Risk Management Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India risk management market report, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on component, deployment mode, enterprise size, and industry vertical.

Component Insights:

- Software

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes software and services.

Deployment Mode Insights:

- On-premises

- Cloud-based

A detailed breakup and analysis of the market based on the deployment mode has also been provided in the report. This includes on-premises and cloud-based.

Enterprise Size Insights:

- Large Enterprises

- Small and Medium-sized Enterprises

The report has provided a detailed breakup and analysis of the market based on the enterprise size. This includes large enterprises and small and medium-sized enterprises.

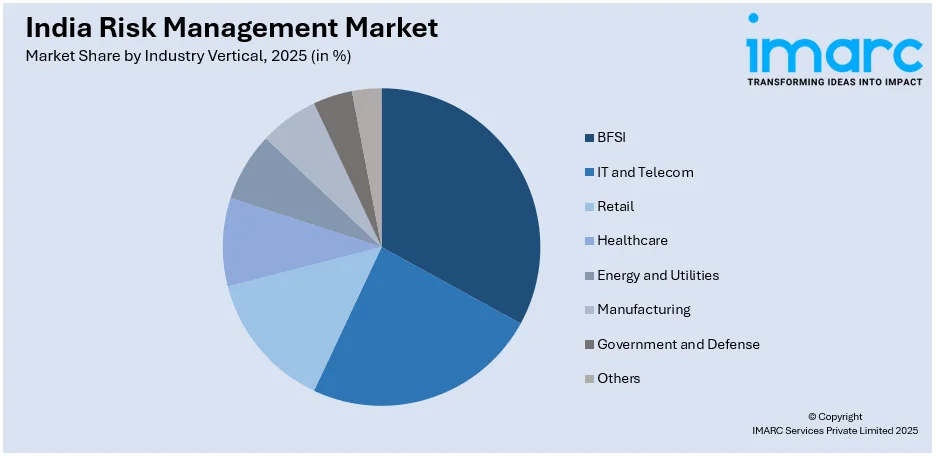

Industry Vertical Insights:

Access the comprehensive market breakdown Request Sample

- BFSI

- IT and Telecom

- Retail

- Healthcare

- Energy and Utilities

- Manufacturing

- Government and Defense

- Others

A detailed breakup and analysis of the market based on the industry vertical has also been provided in the report. This includes BFSI, IT and telecom, retail, healthcare, energy and utilities, manufacturing, government and defense, and others.

Regional Insights:

- South India

- North India

- West and Central India

- East India

The report has also provided a comprehensive analysis of all the major regional markets, which include South India, North India, West and Central India, and East India.

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Risk Management Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Components Covered | Software, Services |

| Deployment Modes Covered | On-premises, Cloud-based |

| Enterprise Sizes Covered | Large Enterprises, Small and Medium-sized Enterprises |

| Industry Verticals Covered | BFSI, IT and Telecom, Retail, Healthcare, Energy and Utilities, Manufacturing, Government and Defense, Others |

| Region Covered | South India, North India, West and Central India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India risk management market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the India risk management market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India risk management industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The risk management market in India was valued at USD 513.8 Million in 2025.

The India risk management market is projected to exhibit a CAGR of 14.87% during 2026-2034, reaching a value of USD 1,902.4 Million by 2034.

The India risk management market is driven by increasing cyber threats, stringent regulatory frameworks, rapid digitalization across sectors, and growing adoption of advanced technologies like AI and cloud computing. Additionally, expanding infrastructure, urbanization, and rising demand for enterprise risk solutions in BFSI, healthcare, and IT sectors fuel market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)