India RegTech Market Size, Share, Trends and Forecast by Component, Deployment Mode, Enterprise Size, Application, End User, and Region, 2025-2033

Market Overview:

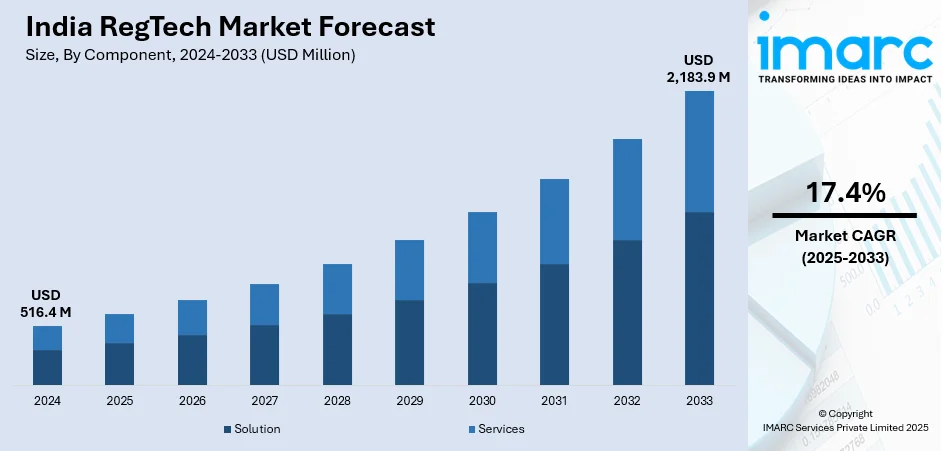

India RegTech market size reached USD 516.4 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,183.9 Million by 2033, exhibiting a growth rate (CAGR) of 17.4% during 2025-2033. The market is driven by the rapid advancements in technologies such as artificial intelligence (AI), machine learning (ML), and blockchain, providing innovative solutions for regulatory compliance. The demand is further fueled by the growing need for risk management, anti-money laundering (AML), and know-your-customer (KYC) solutions.

Market Insights:

- On the basis of component, the market has been divided into solution and services.

- On the basis of deployment mode, the market has been divided into cloud-based and on-premises.

- On the basis of enterprise size, the market has been divided into large enterprises and small and medium-sized enterprises.

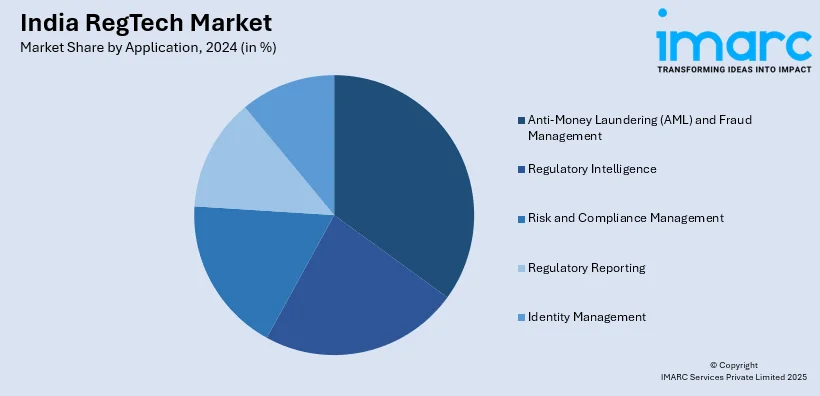

- On the basis of application, the market has been divided into anti-money laundering (AML) and fraud management, regulatory intelligence, risk and compliance management, regulatory reporting, and identity management.

- On the basis of end-user, the market has been divided into banks, insurance companies, fintech firms, IT and telecom, public sector, energy and utilities, and others.

Market Size and Forecast:

- 2024 Market Size: USD 516.4 Million

- 2033 Projected Market Size: USD 2,183.9 Million

- CAGR (2025-2033): 17.4%

RegTech, short for regulatory technology, refers to innovative solutions that leverage technology to streamline and enhance regulatory compliance processes in various industries. It encompasses a range of tools and systems designed to help businesses efficiently manage and comply with complex regulatory requirements. RegTech solutions often utilize advanced technologies such as artificial intelligence, machine learning, data analytics, and automation to monitor, interpret, and implement regulatory changes effectively. These technologies enable organizations to mitigate compliance risks, reduce manual efforts, and ensure adherence to evolving regulatory frameworks. By offering real-time insights, data accuracy, and improved reporting capabilities, RegTech plays a crucial role in enhancing transparency, efficiency, and agility within regulatory compliance workflows, ultimately assisting businesses in navigating the dynamic and demanding landscape of regulatory challenges.

To get more information on this market, Request Sample

India RegTech Market Trends:

The RegTech market in India is experiencing unprecedented growth, propelled by several key drivers that underscore its transformative potential. Firstly, regulatory complexity continues to escalate regionally, necessitating financial institutions to adopt advanced technological solutions. Consequently, the rising tide of regulations, such as anti-money laundering (AML) and know-your-customer (KYC) requirements, is steering organizations toward RegTech solutions for streamlined compliance processes. Moreover, the increasing prevalence of sophisticated financial crimes has heightened the demand for robust risk management tools. As financial institutions grapple with the evolving landscape of cyber threats and fraudulent activities, the imperative to deploy RegTech solutions becomes imperative for fortifying cybersecurity measures. In addition to this, the data-driven nature of regulatory compliance is fostering the integration of artificial intelligence and machine learning within the RegTech sector. The ability of these technologies to analyze vast datasets and identify patterns empowers organizations to proactively address compliance issues and mitigate risks. Furthermore, the agility and scalability offered by cloud-based RegTech solutions are amplifying their adoption. The cloud's flexibility facilitates seamless integration with existing systems, enhancing operational efficiency and reducing implementation timelines. This adaptability is particularly crucial in an era where digital transformation is a strategic imperative for financial institutions. In essence, the RegTech market in India is being propelled by a confluence of factors, ranging from regulatory pressures to technological advancements, as organizations seek agile and intelligent solutions to navigate the intricacies of compliance in the modern financial landscape.

Growth Drivers of the India RegTech Market

The India regtech market growth is significantly driven by the escalating regulatory complexities in industries like finance, insurance, and telecom, pushing organizations to adopt automated solutions for compliance. With increasing government regulations, such as anti-money laundering (AML), KYC, and data protection laws, companies are leveraging technologies like AI and blockchain to streamline their regulatory processes. Additionally, the rapid digital transformation across industries is boosting the demand for efficient regtech solutions, as companies look to reduce manual efforts, enhance data accuracy, and mitigate risks. Furthermore, the India regtech market analysis indicates that the integration of machine learning (ML) to analyze vast data sets and predict compliance issues is enabling organizations to make proactive decisions. Regulatory pressures, coupled with technological advancements, are accelerating the adoption of regtech solutions across India’s diverse sectors.

Opportunities in the India RegTech Market

The rise of FinTech companies and the expansion of digital payment systems in India are driving the need for efficient regtech solutions to handle real-time compliance with ever-evolving regulations. Government initiatives such as Digital India and Make in India are further facilitating the growth of the India regtech market share by encouraging businesses to adopt technology-driven solutions for regulatory compliance. Additionally, the cloud-based regtech solutions are gaining popularity due to their scalability, flexibility, and cost-effectiveness, enabling organizations of all sizes to manage complex regulatory requirements. The increasing focus on financial inclusion and transparency, combined with regtech’s AI-powered capabilities, provides significant growth potential. This shift towards digital solutions, alongside advancements in data analytics and cybersecurity, presents an optimal landscape for regtech adoption across various sectors in India.

Challenges in the India RegTech Market

Despite the strong India regtech market demand, several challenges need to be addressed to ensure further market expansion. The high costs associated with the implementation of regtech solutions, especially for small and medium-sized enterprises (SMEs), are a significant barrier to adoption. Additionally, many organizations still rely on legacy systems that are not easily compatible with new AI-based regtech platforms, creating integration challenges. Data privacy and security concerns, especially with the integration of cloud-based technologies, remain a critical issue in India. Furthermore, while regtech solutions offer advanced capabilities, the lack of a standardized regulatory framework in India for emerging technologies like blockchain and AI is hindering their full-scale deployment. The slow regulatory approval processes for these technologies further delay their adoption, which could otherwise help businesses address compliance and regulatory reporting more efficiently.

Some other trends contributing to the market growth include:

- Regulatory & Governance Updates: The regtech code of conduct by FACE, along with MSME compliance burdens, is shaping regulatory expectations, encouraging companies to invest in innovative solutions. Additionally, new AI supervision policies are leading to more rigorous standards and fostering compliance through automated tools.

- Tech Shifts & Innovations: The maturity of AI/ML in regtech is pushing for more proactive, real-time tracking of compliance data. Moreover, blockchain technology is being increasingly utilized for compliance, ensuring transparency and reliability in record-keeping and reporting.

- Industry and Ecosystem Growth: The fintech explosion in India, coupled with Digital India momentum, is driving the demand for regtech solutions. These solutions are enabling faster and more efficient financial transactions while ensuring compliance in the rapidly expanding digital economy.

India RegTech Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on component, deployment mode, enterprise size, application, and end user.

Component Insights:

- Solution

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes solution and services.

Deployment Mode Insights:

- Cloud-based

- On-premises

A detailed breakup and analysis of the market based on the deployment mode of manufacturer have also been provided in the report. This includes cloud-based and on-premises.

Enterprise Size Insights:

- Large Enterprises

- Small and Medium-sized Enterprises

The report has provided a detailed breakup and analysis of the market based on the enterprise size. This includes large enterprises and small and medium-sized enterprises.

Application Insights:

- Anti-Money Laundering (AML) and Fraud Management

- Regulatory Intelligence

- Risk and Compliance Management

- Regulatory Reporting

- Identity Management

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes anti-money laundering (AML) and fraud management, regulatory intelligence, risk and compliance management, regulatory reporting, and identity management.

End User Insights:

- Banks

- Insurance Companies

- FinTech Firms

- IT and Telecom

- Public Sector

- Energy and Utilities

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes banks, insurance companies, fintech firms, IT and telecom, public sector, energy and utilities, and others.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latest News and Developments:

- In March 2025, Pi Network celebrated Pi Day with the launch of several new initiatives to expand its ecosystem, including the .pi Domains Auction, PiFest shopping period, and enhanced Mainnet Ecosystem applications. The .pi domains, powered by Pi cryptocurrency, aim to create platform-level utility and foster engagement within the Pi community, with over 60 million Pioneers ready to transact. Additionally, the Mainnet Ecosystem UI was revamped for a more intuitive user experience.

- In May 2024, IndiaMART acquired a 10% stake in Baldor Technologies Private Limited (IDfy) for INR 89.69 Crores (USD 10.9 million). IDfy, a leader in KYC, background verification, and digital onboarding, reported FY 2023 revenue of INR 117 Crores (USD 14.3 million). This investment strengthens IndiaMART's position in the regtech space, particularly in fraud prevention and digital onboarding solutions.

- In February 2024, Signzy launched its One-Touch Know Your Customer (KYC) solution, enhancing digital onboarding for businesses by streamlining the KYC process. This new feature allows companies to configure KYC flows quickly, targeting industries like financial services, gig economy, and online gaming, and aims to reduce onboarding time and fraud through technologies such as Optical Character Recognition (OCR) and liveness detection.

India RegTech Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Solution, Services |

| Deployment Modes Covered | Cloud-based, On-premises |

| Enterprise Sizes Covered | Large Enterprises, Small and Medium-sized Enterprises |

| Applications Covered | Anti-Money Laundering (AML) and Fraud Management, Regulatory Intelligence, Risk and Compliance Management, Regulatory Reporting, Identity Management |

| End Users Covered | Banks, Insurance Companies, FinTech Firms, IT and Telecom, Public Sector, Energy and Utilities, Others |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India RegTech market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India RegTech market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India RegTech industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India RegTech market was valued at USD 516.4 Million in 2024.

The India RegTech market is projected to exhibit a CAGR of 17.4% during 2025-2033, reaching USD 2,183.9 Million by 2033.

Key factors include regulatory complexity, advancements in AI/ML, blockchain technology, and increasing demand for risk management and AML solutions. Additionally, the rise of digital transformation and the expansion of cloud-based RegTech solutions are driving adoption across various industries. The growing focus on data privacy and cybersecurity further enhances the demand for innovative RegTech technologies to ensure compliance with evolving regulatory standards.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)