India Polypropylene Market Size, Share, Trends and Forecast by Type, Process, Application, End User, and Region, 2025-2033

Market Overview:

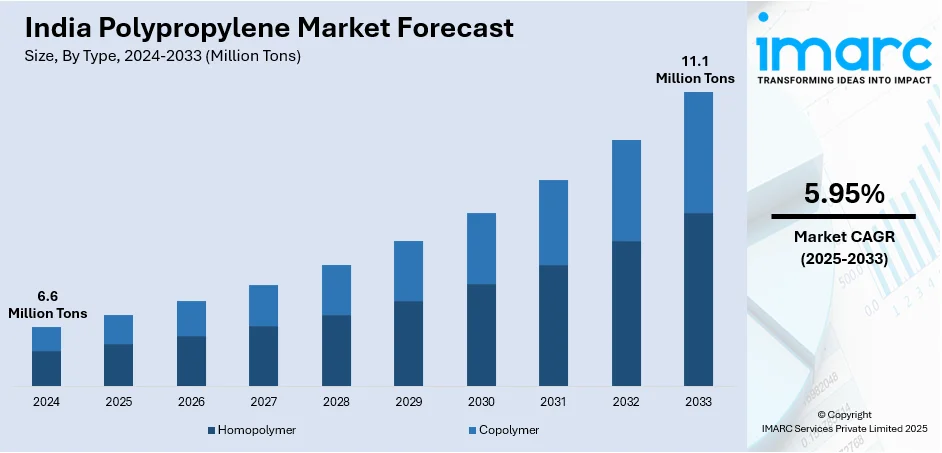

India polypropylene market size reached 6.6 Million Tons in 2024. Looking forward, IMARC Group expects the market to reach 11.1 Million Tons by 2033, exhibiting a growth rate (CAGR) of 5.95% during 2025-2033. The growing demand for lightweight and durable materials in the design and manufacturing of various consumer and industrial products is primarily driving the market growth across the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

6.6 Million Tons |

|

Market Forecast in 2033

|

11.1 Million Tons |

| Market Growth Rate 2025-2033 | 5.95% |

Polypropylene, commonly abbreviated as PP, stands as a versatile and widely used thermoplastic polymer in the field of materials science and industrial applications. This synthetic polymer belongs to the polyolefin family, characterized by its remarkable combination of advantageous properties, including high chemical resistance, thermal stability, and mechanical strength. Its popularity is attributed to its exceptional performance across a broad spectrum of applications, from packaging materials and textiles to automotive components and medical devices. With a chemical structure featuring long chains of propylene monomers, polypropylene exhibits a high level of crystallinity, contributing to its robustness and resistance to fatigue. It's widespread use in everyday items underscores its significance in modern manufacturing and underscores the polymer's role as a key contributor to advancements in materials science.

To get more information on this market, Request Sample

India Polypropylene Market Trends:

The polypropylene market in India has witnessed remarkable growth, underscoring the pivotal role this versatile thermoplastic polymer plays in the country's industrial landscape. As a member of the polyolefin family, it boasts high chemical resistance, thermal stability, and mechanical strength. Additionally, these attributes make it an ideal choice for a myriad of applications, spanning from packaging materials and textiles to automotive components and medical devices. Furthermore, the ability of polypropylene to be molded into various shapes and forms further contributes to its widespread use in manufacturing processes. Besides this, in India, the polypropylene market has experienced substantial demand from industries seeking robust and cost-effective solutions. The polymer's resilience and resistance to fatigue make it suitable for a range of applications, including packaging films, containers, pipes, and automotive parts. Moreover, the country's growing industrialization, coupled with an expanding consumer market, has fueled the demand for polypropylene, prompting increased production and investments in the sector. Besides this, the lightweight nature of polypropylene aligns with sustainability goals, contributing to fuel efficiency in automotive applications and reducing the environmental impact of packaging materials. As India continues its trajectory of economic growth and technological advancement, the polypropylene market is poised for further expansion in the coming years.

India Polypropylene Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type, process, application, and end user.

Type Insights:

- Homopolymer

- Copolymer

The report has provided a detailed breakup and analysis of the market based on the type. This includes homopolymer and copolymer.

Process Insights:

- Injection Molding

- Blow Molding

- Extrusion

- Others

A detailed breakup and analysis of the market based on the process have also been provided in the report. This includes injection molding, blow molding, extrusion, and others.

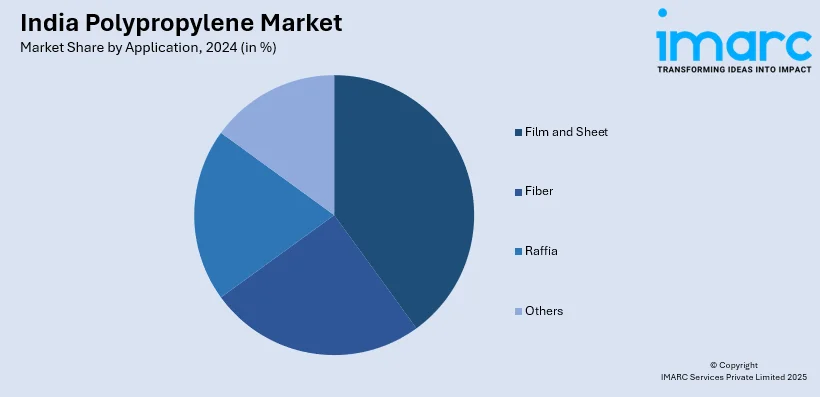

Application Insights:

- Film and Sheet

- Fiber

- Raffia

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes film and sheet, fiber, raffia, and others.

End User Insights:

- Packaging

- Automotive

- Building and Construction

- Medical

- Electrical and Electronics

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes packaging, automotive, building and construction, medical, electrical and electronics, and others.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Polypropylene Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Tons |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Homopolymer, Copolymer |

| Processes Covered | Injection Molding, Blow Molding, Extrusion, Others |

| Applications Covered | Film and Sheet, Fiber, Raffia, Others |

| End Users Covered | Packaging, Automotive, Building and Construction, Medical, Electrical and Electronics, Others |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India polypropylene market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India polypropylene market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India polypropylene industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The polypropylene market in India reached 6.6 Million Tons in 2024.

The India polypropylene market is projected to exhibit a CAGR of 5.95% during 2025-2033, reaching a volume of 11.1 Million Tons by 2033.

India’s polypropylene market is driven by rising demand in packaging, automotive, construction, and healthcare sectors due to its versatility, durability, and cost-effectiveness. Growing industrialization, evolving consumer needs, and government initiatives promoting domestic manufacturing further fuel its adoption, making polypropylene a key material across diverse applications in the country.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)