India Plastics Market Size, Share, Trends and Forecast by Type, Application, End User, and Region, 2026-2034

India Plastics Market Summary:

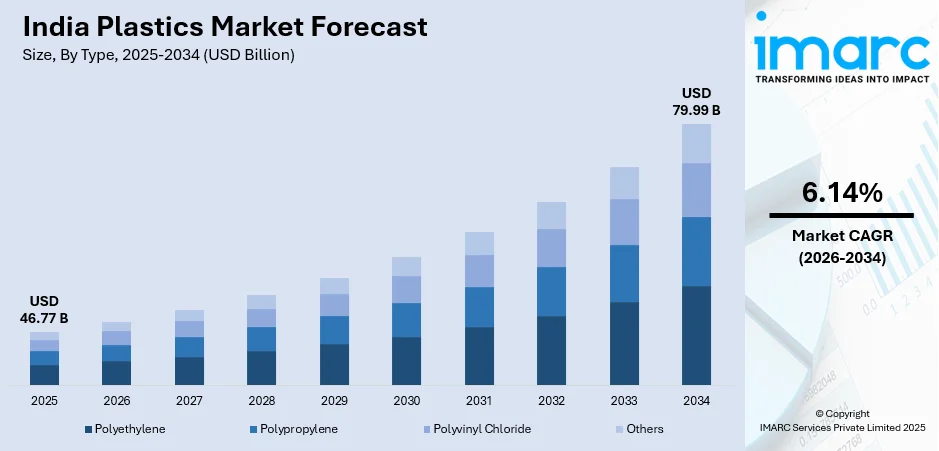

The India plastics market size was valued at USD 46.77 Billion in 2025 and is projected to reach USD 79.99 Billion by 2034, growing at a compound annual growth rate of 6.14% from 2026-2034.

The India plastics market is experiencing robust growth driven by rapid industrialization, urbanization, and expanding consumer demand across packaging, automotive, and construction sectors. The country's thriving manufacturing landscape, supported by government initiatives such as Make in India and Production-Linked Incentive schemes, is accelerating polymer consumption. Rising e-commerce activities, increasing healthcare sector requirements, and infrastructure development projects are further fueling demand for versatile plastic solutions, positioning India as a key contributor to the India plastics market share.

Key Takeaways and Insights:

- By Type: Polyethylene dominates the market with a share of 43% in 2025, driven by extensive applications in film manufacturing, blow-molded containers, and flexible packaging solutions across FMCG and industrial sectors.

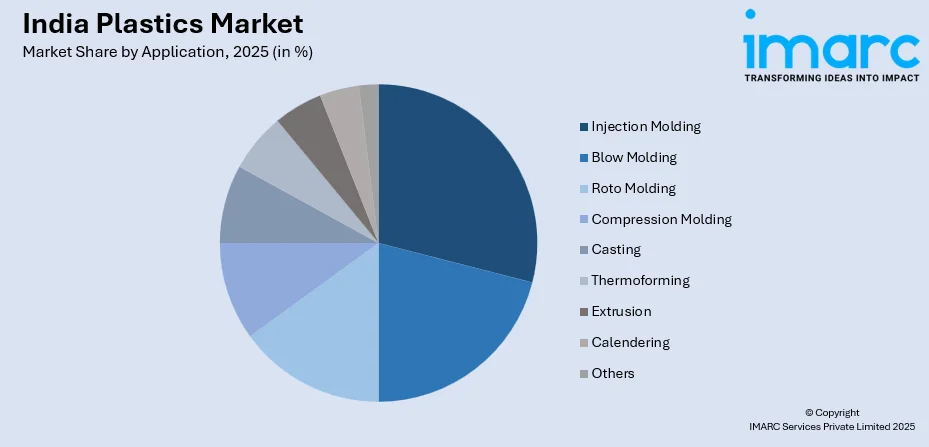

- By Application: Injection molding leads the market with a share of 28% in 2025, owing to high precision manufacturing capabilities serving automotive components, consumer goods, and medical device production requirements.

- By End User: Packaging represents the largest segment with a market share of 49% in 2025, fueled by burgeoning e-commerce growth, food and beverage sector expansion, and pharmaceutical packaging requirements.

- By Region: West and Central India dominates with 32% market share in 2025, anchored by Gujarat and Maharashtra's dense petrochemical clusters, integrated manufacturing facilities, and proximity to major ports.

- Key Players: The India plastics market exhibits moderate competitive intensity, with established domestic conglomerates competing alongside international polymer manufacturers. Major players leverage integrated supply chains, extensive distribution networks, and continuous product innovation to maintain market positioning across diverse application segments.

To get more information on this market Request Sample

The India plastics market continues to evolve with increasing emphasis on sustainability and circular economy practices. Government mandates requiring recycled content in packaging have prompted significant investments in recycling infrastructure, with Extended Producer Responsibility rules driving converters toward value-added formats. In January 2024, Deepak Chem Tech Limited signed a Memorandum of Understanding with the Gujarat government, outlining an investment of around Rs. 9000 crores across projects with proposed year of commencement in 2027, underscoring the strategic focus on expanding domestic manufacturing capabilities. The healthcare sector's expansion, technological advancements in injection molding, and growing automotive lightweighting trends continue to diversify plastic applications, while biodegradable and bio-based plastics are gaining traction amid rising environmental awareness and regulatory pressures.

India Plastics Market Trends:

Rising Adoption of Sustainable and Recycled Plastics

The India plastics market is witnessing a significant shift toward sustainable materials driven by Extended Producer Responsibility regulations requiring thirty percent recycled content in rigid packaging by 2025. Manufacturers are increasingly investing in chemical recycling technologies and food-grade wash lines to meet compliance standards. In December 2024, Loop Industries and Ester Industries formed a USD 165 Million recycling joint venture aimed at commercializing depolymerized feedstock by early 2027, demonstrating the industry's commitment to circular economy practices and positioning India as a regional leader in sustainable polymer solutions.

Expansion of Engineering Plastics in Automotive Applications

Engineering plastics are gaining substantial traction in India's automotive sector as manufacturers seek lightweight alternatives to traditional metal components for improving fuel efficiency. The Production-Linked Incentive scheme is accelerating localization of advanced polymer applications in battery electric vehicles, under-the-hood components, and interior trim. Glass-filled polyamides and polycarbonate-ABS blends are increasingly specified for thermal management modules and structural components, supporting the broader automotive industry's transition toward sustainable mobility solutions and reduced vehicle weight.

E-commerce Driven Packaging Innovation

The rapid expansion of e-commerce and quick-commerce platforms is transforming packaging requirements across the India plastics market. Fast delivery services have created unprecedented demand for tamper-evident pouches and moisture-barrier films that preserve product integrity across multiple handling points. Converters are deploying automated pouch lines achieving high-speed production cycles while developing mono-material polyethylene laminates that comply with recyclability mandates, addressing both operational efficiency and sustainability objectives simultaneously across diverse distribution channels.

Market Outlook 2026-2034:

The India plastics market outlook remains positive, supported by robust infrastructure development programs, accelerating consumer demand, and expanding manufacturing capabilities across diverse industry verticals. Government initiatives promoting domestic polymer production are reducing import dependence while fostering innovation in specialty grades and sustainable solutions. The packaging sector continues driving demand through e-commerce expansion, while automotive lightweighting trends and healthcare sector growth create additional consumption opportunities. Strategic investments in petrochemical infrastructure and recycling technologies are strengthening supply chain resilience and positioning India as a significant contributor to global polymer markets. The market generated a revenue of USD 46.77 Billion in 2025 and is projected to reach a revenue of USD 79.99 Billion by 2034, growing at a compound annual growth rate of 6.14% from 2026-2034.

India Plastics Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Polyethylene | 43% |

| Application | Injection Molding | 28% |

| End User | Packaging | 49% |

| Region | West and Central India | 32% |

Type Insights:

- Polyethylene

- Polypropylene

- Polyvinyl Chloride

- Others

Polyethylene dominates with a market share of 43% of the total India plastics market in 2025.

Polyethylene maintains its leading position in the India plastics market due to its exceptional versatility, cost-effectiveness, and extensive applications across packaging, agriculture, and consumer goods sectors. High-density polyethylene grades are experiencing accelerated growth driven by demand for pipes, caps, and closure applications, while low-density variants continue dominating flexible film manufacturing. In January 2024, Mold-Tek Packaging Ltd opened three new factories in Tamil Nadu, Telangana, and Haryana, adding 5,500 MTA to annual production capacity and reaching a total of 54,000 MTA by financial year 2025, reflecting the robust expansion in polyethylene processing capabilities.

The polyethylene segment benefits from India's growing e-commerce sector, which demands lightweight and durable packaging solutions for efficient logistics operations. Agricultural applications including greenhouse films, irrigation pipes, and mulch films are expanding alongside government programs promoting smart farming practices. The segment's growth trajectory is further supported by ongoing investments in petrochemical infrastructure, with integrated production facilities enabling cost competitiveness and supply chain reliability for downstream processors across diverse industrial applications.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Injection Molding

- Blow Molding

- Roto Molding

- Compression Molding

- Casting

- Thermoforming

- Extrusion

- Calendering

- Others

Injection molding leads the market with a 28% share of the total India plastics market in 2025.

Injection molding maintains its dominant position in the India plastics market, with precision manufacturing capabilities making it indispensable for producing automotive components, electronics housings, and medical devices requiring exact dimensional tolerances. The technology enables high-volume production of complex shapes with consistent quality, meeting stringent specifications across diverse industrial applications. In July 2024, Shibaura Machine India officially opened its second factory in Chennai with an investment of Rs. 225 Crore, designed to enhance manufacturing capabilities and meet growing demand from automotive and electronics sectors.

The injection molding segment benefits significantly from India's expanding electronics manufacturing industry, supported by Production-Linked Incentive schemes accelerating domestic smartphone and consumer appliance production. Healthcare sector expansion is creating additional demand for precision-molded medical components including syringes, diagnostic devices, and pharmaceutical packaging. The adoption of electric and hybrid injection molding machines is gaining momentum as manufacturers prioritize energy efficiency and sustainability, while technological advancements in multi-component molding and automation continue enhancing productivity across processing facilities.

End User Insights:

- Packaging

- Automotive

- Infrastructure and Construction

- Consumer Goods

- Others

Packaging holds the largest share with 49% of the total India plastics market in 2025.

The packaging segment maintains its dominant position in the India plastics market, consuming approximately ten million tonnes of polymer annually driven by robust e-commerce growth and expanding food and beverage sector requirements. Flexible multilayer pouches continue dominating snack food and confectionery applications while mono-material polyethylene laminates are gaining traction as converters address recyclability mandates. In April 2024, Manjushree Technopack Limited signed definitive agreements to acquire Oricon Enterprises' plastic packaging business for INR 520 Crore, doubling its market share in caps and closures to become India's leading player with fifteen billion pieces annual capacity.

The packaging sector's growth is propelled by India's burgeoning quick-commerce platforms requiring tamper-evident and moisture-resistant solutions for rapid delivery operations. Pharmaceutical packaging is expanding through single-dose pouch formats supporting rural health outreach programs, while beverage packaging is transitioning toward higher recycled content in compliance with Extended Producer Responsibility regulations. The segment benefits from ongoing investments in barrier technologies and value-added formats, positioning converters to capture premium margins while meeting sustainability objectives across diverse end-use applications.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

West and Central India dominates with a market share of 32% of the total India plastics market in 2025.

West and Central India maintains its leading position in the India plastics market, anchored by Gujarat and Maharashtra's integrated petrochemical complexes spanning feedstock production to downstream processing. The region benefits from co-located refineries and crackers that minimize raw material transportation costs, while well-established port connectivity at Nhava Sheva and Pipavav enables efficient export logistics. Gujarat's industrial development zones offer single-window clearances and stable utilities that enhance project economics for polymer manufacturers.

The region's competitive advantage stems from dense petrochemical clusters concentrated in Dahej, Vadodara, and Jhagadia, where integrated facilities support the complete value chain from feedstock to compounding. Maharashtra leverages its automotive and packaging end-markets in Pune and Mumbai, attracting downstream processors seeking proximity to major consumption centers. Production-Linked Incentive investments continue reinforcing the region's manufacturing ecosystem, while state-level industrial policies provide expedited environmental approvals that accelerate capacity expansion across polymer processing industries.

Market Dynamics:

Growth Drivers:

Why is the India Plastics Market Growing?

Expanding E-commerce and Packaging Sector Demand

The India plastics market is experiencing substantial growth driven by the rapid expansion of e-commerce platforms and associated packaging requirements. Quick-commerce delivery services have proliferated across metropolitan areas, creating unprecedented demand for tamper-evident pouches, moisture-barrier films, and protective packaging solutions that ensure product integrity during transportation. The food and beverage industry's shift toward packaged and processed goods, combined with pharmaceutical sector requirements for unit-dose packaging, continues propelling flexible and rigid plastic consumption. Brand owners are increasingly specifying high-performance barrier materials to extend shelf life and meet food safety standards while adapting pack formats for diverse distribution channels.

Government Manufacturing Initiatives and Policy Support

Government initiatives including Make in India and Production-Linked Incentive schemes are catalyzing substantial investments in domestic polymer manufacturing and processing capabilities. These programs provide direct subsidies and value-addition targets that accelerate capacity investments across petrochemical complexes and downstream conversion facilities. Infrastructure development under PM GatiShakti is enhancing logistics connectivity, reducing domestic freight costs, and enabling efficient supply chain operations. State-level industrial policies in Gujarat, Maharashtra, and Tamil Nadu offer expedited environmental approvals, capital subsidies, and plug-and-play facilities that attract both domestic and international manufacturers seeking to capitalize on India's growth trajectory.

Automotive Industry Lightweighting and Electrification

India's automotive sector is increasingly adopting engineering plastics to achieve lightweighting objectives and enhance fuel efficiency across vehicle platforms. The transition toward electric vehicles is accelerating demand for flame-retardant polyamides, thermally conductive polycarbonates, and composite modules that replace traditional metal components in battery housings and thermal management systems. Original equipment manufacturers are localizing advanced polymer applications in body panels, under-hood components, and interior trim, supported by the automotive Production-Linked Incentive scheme's provisions for domestic value addition. The industry's focus on meeting stringent crash norms and clean air standards further stimulates engineering plastics adoption in energy-absorbing structures and emission-reducing applications.

Market Restraints:

What Challenges the India Plastics Market is Facing?

Environmental Regulations and Plastic Waste Management Concerns

The India plastics market faces increasing regulatory pressure from environmental mandates targeting plastic waste reduction and single-use plastic elimination. State-level bans on specific plastic products create compliance complexity for manufacturers operating across multiple jurisdictions, requiring SKU modifications and tooling adjustments that increase operational costs and demand continuous adaptation to evolving policy frameworks.

Raw Material Price Volatility and Import Dependence

Fluctuating crude oil prices directly impact polymer feedstock costs, compressing manufacturer margins and creating pricing uncertainty across the value chain. India's continued dependence on imported raw materials, particularly specialty polymers and engineering grades, exposes the industry to currency fluctuations and international supply chain disruptions affecting production stability.

Limited Recycling Infrastructure and Circular Economy Gaps

Inadequate recycling infrastructure and waste management systems pose significant challenges for achieving Extended Producer Responsibility compliance targets across the India plastics market. Limited availability of food-grade recycled content and quality inconsistencies in mechanically recycled materials constrain converters' ability to meet mandated recycled content requirements while maintaining product performance specifications, necessitating substantial capital investments in advanced material sorting and processing technologies.

Competitive Landscape:

The India plastics market exhibits moderate competitive intensity characterized by the presence of vertically integrated domestic conglomerates competing alongside international polymer manufacturers and regional processors. Established players leverage economies of scale across feedstock production, polymerization, and downstream conversion to maintain pricing competitiveness and secure long-term customer relationships. Strategic acquisitions and capacity expansions continue reshaping the competitive landscape, with private equity investments signaling confidence in the sector's growth trajectory. Innovation in sustainable materials, recycling technologies, and high-performance specialty grades serves as a key differentiator, while distribution network strength and technical service capabilities remain critical success factors across diverse application segments.

Recent Developments:

- November 2024: Asia-focused private equity firm PAG acquired Manjushree Technopack Ltd., India's largest rigid plastic packaging company, in a transaction valued at approximately USD 1 Billion, signaling strong investor confidence in the packaging sector.

India Plastics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Polyethylene, Polypropylene, Polyvinyl Chloride, Others |

| Applications Covered | Injection Molding, Blow Molding, Roto Molding, Compression Molding, Casting, Thermoforming, Extrusion, Calendering, Others |

| End Users Covered | Packaging, Automotive, Infrastructure and Construction, Consumer Goods, Others |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India plastics market size was valued at USD 46.77 Billion in 2025.

The India plastics market is expected to grow at a compound annual growth rate of 6.14% from 2026-2034 to reach USD 79.99 Billion by 2034.

Polyethylene dominated the market with a 43% share in 2025, driven by extensive applications in film manufacturing, flexible packaging, and blow-molded containers serving diverse industrial and consumer sectors.

Key factors driving the India plastics market include expanding e-commerce and packaging sector demand, government manufacturing initiatives under Production-Linked Incentive schemes, automotive lightweighting trends, and infrastructure development programs.

Major challenges include environmental regulations and single-use plastic bans, raw material price volatility and import dependence, limited recycling infrastructure, and compliance complexity arising from varying state-level plastic waste management policies.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)