India Managed Services Market Size, Share, Trends and Forecast by Type, Deployment Mode, Enterprise Size, End Use, and Region, 2026-2034

India Managed Services Market Summary:

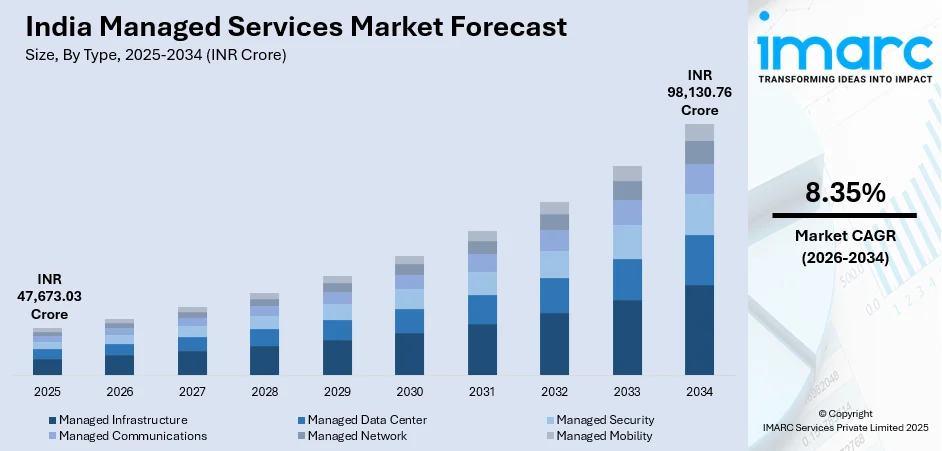

The India managed services market size was valued at INR 47,673.03 Crore in 2025 and is projected to reach INR 98,130.76 Crore by 2034, growing at a compound annual growth rate of 8.35% from 2026-2034.

This is driven by rapid digital transformation initiatives across industries, an increase in demand for cost-efficient IT operations, and growing complexity of enterprise technology infrastructure. Cloud computing solutions, cybersecurity demands, and a wider focus on core business operations further accelerate these outsourcing trends. Growth aspects include the small and medium enterprise sector expansion, government digitization programs, and requirements for specialized technical skill sets, contributing to the sustained growth of the market share for managed services in India.

Key Takeaways and Insights:

-

By Type: Managed infrastructure dominates the market with a share of 22.08% in 2025, driven by enterprises outsourcing server, network, and storage management to ensure operational efficiency and uninterrupted business continuity.

-

By Deployment Mode: On-premises leads the market with a share of 55.06% in 2025, owing to enterprise preferences for data sovereignty, regulatory compliance, and greater control over sensitive information and critical infrastructure.

-

By Enterprise Size: Small and medium-sized enterprises represent the largest segment with a market share of 58.05% in 2025, driven by rising technology adoption, limited in-house IT capacity, and growing use of managed services for cost-effective digital transformation.

-

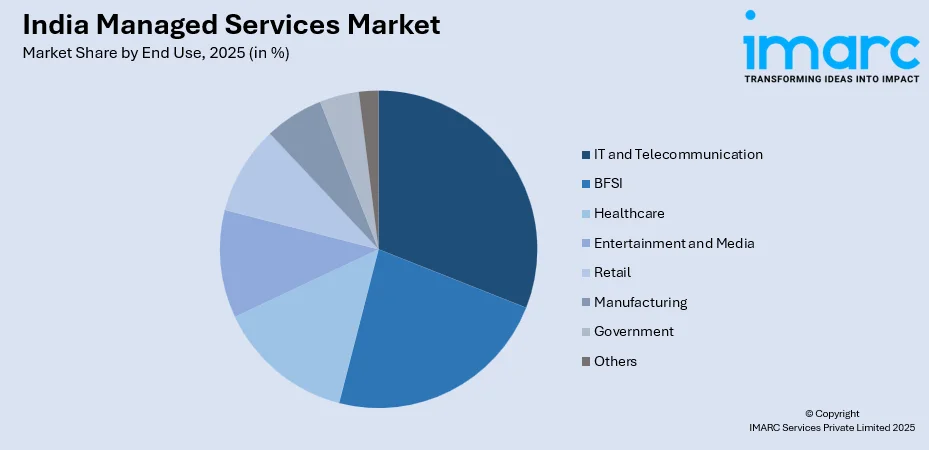

By End Use: IT and telecommunication dominate the market with a share of 24.1% in 2025, owing to technology-intensive operations, infrastructure modernization needs, and demand for optimized connectivity and seamless service delivery.

-

By Region: South India leads the market with a share of 31% in 2025, driven by technology hubs in Bengaluru, Hyderabad, Chennai, established IT corridors, robust ecosystems, and strong digital infrastructure development.

-

Key Players: The India managed services market exhibits a moderately fragmented competitive landscape, with established global technology providers competing alongside domestic IT service organizations and specialized regional players across various service segments and enterprise categories.

To get more information on this market Request Sample

The India managed services market is experiencing strong growth as enterprises focus on improving operational efficiency and accelerating digital transformation. Businesses are increasingly outsourcing IT functions to specialized managed service providers to better allocate resources to core activities while ensuring seamless technology operations. The rise of cloud adoption, growing cybersecurity concerns, and complex regulatory compliance requirements are driving organizations to seek expert managed service partnerships. In November 2025, Concentrix expanded its partnership with Palo Alto Networks in India to deliver AI-powered managed security services via Concentrix CyberProtect, enhancing threat detection, response, and overall cybersecurity capabilities. In addition, the expanding startup ecosystem, government efforts to support digital initiatives, and rising technology adoption in tiertwo and tierthree cities are contributing to sustained market momentum. The shift to hybrid and remote work models has further elevated the need for dependable IT infrastructure management and continuous support services. As a result, demand for managed services that deliver proactive monitoring, enhanced security, and scalable solutions continues to strengthen across industries throughout India.

India Managed Services Market Trends:

Integration of Artificial Intelligence and Automation Technologies

Managed service providers are integrating more artificial intelligence (AI) and machine learning (ML) in their service offerings for the betterment of operational efficiency and predictive maintenance. These intelligent solutions enable automated incident detection, proactive system monitoring, and self-healing infrastructure capabilities. In May 2025, Infosys BPM launched Agentic AI within its Accounts Payable on Cloud solution, enabling autonomous invoice processing, reducing manual intervention, and enhancing efficiency, accuracy, and operational agility for enterprise clients. Moreover, the integration of automation technologies reduces manual intervention requirements while improving service response times and accuracy. Organizations benefit from enhanced decision-making through advanced analytics and pattern recognition, driving significant improvements in IT operational performance and resource optimization across enterprise environments.

Rising Adoption of Multi-Cloud and Hybrid Infrastructure Strategies

Enterprises are increasingly adopting multi-cloud and hybrid infrastructure approaches to optimize workload distribution and enhance operational resilience. In June 2025, Tech Mahindra partnered with Cisco to launch managed services for Cisco Multicloud Defense, providing secure, scalable cloud operations and enhancing multi-cloud cybersecurity and operational resilience for enterprises. This trend necessitates sophisticated managed service capabilities for seamless integration across diverse cloud environments and on-premises systems. Service providers are developing specialized expertise in managing complex multi-vendor ecosystems while ensuring consistent performance and security. Organizations leverage these arrangements to achieve vendor independence, workload portability, and optimized cost structures while maintaining flexibility to accommodate evolving business requirements and technological advancements.

Growing Emphasis on Cybersecurity and Compliance Management

The escalating sophistication of cyber threats and evolving regulatory landscape are driving increased demand for comprehensive managed security services. As per sources, in September 2025, Wipro partnered with CrowdStrike to launch CyberShield MDR, an AI-powered unified managed security service enhancing threat detection, automated response, and operational resilience across enterprise cybersecurity environments. Moreover, organizations require continuous threat monitoring, vulnerability assessment, and incident response capabilities to protect critical assets and maintain regulatory compliance. Managed service providers are expanding their security portfolios to include advanced threat intelligence, security operations centers, and compliance management solutions. This trend reflects growing enterprise awareness regarding cybersecurity risks and the necessity for specialized expertise in addressing complex security challenges across digital infrastructure.

Market Outlook 2026-2034:

The Indian managed services market shows promising revenue growth potential during the forecast period. This is underpinned by the acceleration of the digital transformation and adoption of technology. Enterprise investments in cloud infrastructure, cybersecurity solutions, and IT modernization programs will drive sustained revenue expansion. The growing small and medium enterprise segment represents significant untapped revenue opportunity as organizations increasingly recognize managed services value propositions. Regional expansion into emerging technology hubs and government digitalization programs will contribute additional revenue streams, positioning the market for robust performance through the forecast period. The market generated a revenue of INR 47,673.03 Crore in 2025 and is projected to reach a revenue of INR 98,130.76 Crore by 2034, growing at a compound annual growth rate of 8.35% from 2026-2034.

India Managed Services Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Managed Infrastructure | 22.08% |

| Deployment Mode | On-premises | 55.06% |

| Enterprise Size | Small and Medium-sized Enterprises | 58.05% |

| End Use | IT and Telecommunication | 24.1% |

| Region | South India | 31% |

Type Insights:

- Managed Infrastructure

- Managed Data Center

- Managed Security

- Managed Communications

- Managed Network

- Managed Mobility

Managed infrastructure dominates with a market share of 22.08% of the total India managed services market in 2025.

The managed infrastructure encompasses comprehensive outsourced management of enterprise hardware, servers, storage systems, and network components. As per sources, in June 2025, Bharti Airtel signed a multi-year NOC managed services contract with Ericsson to oversee 4G, 5G, FWA, private networks, and network slicing, enhancing operational performance and service continuity. Moreover, service providers deliver end-to-end infrastructure monitoring, maintenance, and optimization services ensuring operational continuity and performance reliability. Organizations increasingly rely on managed infrastructure solutions to address growing complexity of technology environments while reducing capital expenditure requirements. This segment addresses enterprise needs for specialized technical expertise, continuous system availability, and proactive issue resolution that internal IT teams often struggle to maintain consistently across expanding technology portfolios.

This segment's dominance reflects enterprise recognition that effective infrastructure management requires specialized expertise and continuous investment in advanced tools and technologies. Managed infrastructure providers offer scalable solutions adapting to changing business requirements while maintaining consistent service levels across diverse technology environments. The segment benefits from growing virtualization adoption, software-defined infrastructure trends, and increasing enterprise focus on business continuity capabilities. Organizations leverage these partnerships for reduced operational overhead, improved resource utilization, and enhanced infrastructure performance optimization supporting core business objectives.

Deployment Mode Insights:

- On-premises

- Cloud-based

On-premises leads with a share of 55.06% of the total India managed services market in 2025.

On-premises maintains market leadership as enterprises prioritize data sovereignty, regulatory compliance, and direct control over critical infrastructure components. As per sources, in September 2025, SAP launched its “On-Site” sovereign cloud solution, allowing enterprises, especially in regulated sectors, to host SAP-managed infrastructure within their own facilities for maximum data control and compliance. Moreover, organizations in highly regulated sectors including banking, healthcare, and government demonstrate strong preference for on-premises managed services aligning with stringent data protection requirements. This deployment approach enables customized security implementations and seamless integration with legacy systems while maintaining performance optimization. Enterprises value the enhanced oversight and governance capabilities that on-premises arrangements provide for sensitive workloads requiring dedicated resources.

On-premises provide organizations with enhanced visibility and control over technology environments while benefiting from external expertise and specialized support capabilities. Service providers deliver comprehensive on-site management, monitoring, and maintenance ensuring operational efficiency across enterprise infrastructure. The segment continues attracting organizations requiring specialized configurations, dedicated resource allocation, and heightened security measures for mission-critical applications. Regulatory requirements, data localization mandates, and enterprise risk management considerations reinforce preference for on-premises deployment models among organizations managing sensitive information assets.

Enterprise Size Insights:

- Large Enterprises

- Small and Medium-sized Enterprises

Small and medium-sized enterprises exhibit a clear dominance with a 58.05% share of the total India managed services market in 2025.

Small and medium-sized enterprises represent the largest market segment, driven by accelerating digital transformation initiatives and limited internal IT capabilities across this enterprise category. These organizations increasingly recognize managed services as cost-effective alternatives to building comprehensive in-house technology teams requiring substantial investment. Managed service partnerships enable SMEs accessing enterprise-grade technology solutions, specialized expertise, and round-the-clock support without significant capital investments or operational complexity. This approach allows smaller organizations competing effectively against larger enterprises possessing greater internal technology resources and capabilities.

The segment benefits from flexible pricing models, scalable service offerings, and reduced technology management burden allowing focused attention on core business operations and growth initiatives. Managed service providers develop tailored solutions addressing specific SME requirements including budget constraints, simplified management interfaces, and rapid deployment capabilities meeting evolving business needs. Growing technology awareness among SME leadership and expanding government programs supporting digital adoption further accelerate segment growth. In October 2025, Mastercard and CII’s Digital Saksham program empowered 304,623 small businesses across India, providing training to 89,159 entrepreneurs and enabling 51,455 businesses to adopt digital technologies. Moreover, these enterprises increasingly leverage managed services for competitive advantage through enhanced operational efficiency and technology modernization.

End Use Insights:

Access the comprehensive market breakdown Request Sample

- IT and Telecommunication

- BFSI

- Healthcare

- Entertainment and Media

- Retail

- Manufacturing

- Government

- Others

IT and telecommunication lead with a market share of 24.1% of the total India managed services market in 2025.

IT and telecommunication dominate end-use segmentation owing to technology-intensive operations and continuous infrastructure modernization requirements characterizing this industry vertical. Organizations in this sector require specialized managed services for network management, data center operations, and service delivery optimization across complex technology ecosystems. The sector's rapid evolution driven by emerging technologies including edge computing, network virtualization, and next-generation connectivity necessitates sophisticated managed service partnerships. These collaborations enable maintaining competitive positioning while addressing escalating technical complexity and performance expectations from enterprise customers.

Telecommunication operators increasingly leverage managed services for network operations, customer experience management, and infrastructure optimization supporting expanding service portfolios and subscriber bases. According to sources, in June 2025, Tata Communications Transformation Services (TCTS) was named Frost & Sullivan’s 2025 Global Telecom Managed Services Company of the Year for innovation, AI automation, and customer-centric network solutions. Further, IT companies utilize external managed service expertise for non-core functions, enabling resource concentration on innovation, product development, and market expansion initiatives. The sector's growth trajectory, infrastructure expansion requirements, and technology refresh cycles create sustained demand for comprehensive managed service solutions. Service providers develop specialized capabilities addressing unique telecommunications and IT sector requirements including network reliability and performance optimization.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

South India dominates with a market share of 31% of the total India managed services market in 2025.

South India maintains regional market leadership attributed to concentration of major technology hubs in Bengaluru, Hyderabad, and Chennai hosting significant enterprise presence. These cities accommodate substantial technology company operations, global capability centers, and established IT corridors driving considerable managed services demand across industry verticals. The region benefits from robust digital infrastructure development, skilled workforce availability, and supportive state government policies promoting technology sector growth and investment. Strategic geographic positioning and ecosystem advantages reinforce regional dominance within the national managed services landscape.

The market demonstrates strong adoption across enterprise segments with strength in technology, financial services, and manufacturing sectors requiring sophisticated managed service capabilities. Regional ecosystem advantages including established vendor networks, technology partnerships, and innovation centers contribute to accelerated adoption rates among enterprises. Continued expansion of technology parks, data center investments, and enterprise digitalization initiatives position the region for sustained market leadership. In December 2025, AWS announced a $7 Billion, 14-year investment to expand its Telangana data centre infrastructure, strengthening Hyderabad’s digital ecosystem and supporting cloud, AI platforms, and enterprise growth. Growing presence of multinational corporations and domestic enterprises further strengthens demand for comprehensive managed service solutions throughout the region.

Market Dynamics:

Growth Drivers:

Why is the India Managed Services Market Growing?

Accelerating Digital Transformation Initiatives Across Industries

Indian enterprises are increasingly prioritizing digital transformation as a strategic imperative for maintaining competitive advantage and operational efficiency. Organizations across manufacturing, healthcare, retail, and financial services sectors are modernizing legacy systems and adopting emerging technologies requiring specialized management expertise. As per sources, Tata Projects adopted SAP’s cloudfirst digital platform to unify core systems, enhance data visibility, and accelerate enterprisewide digital transformation across project planning, procurement, finance, and analytics. Further, this transformation necessitates comprehensive managed service partnerships that provide technical capabilities beyond internal IT team competencies. The shift toward digital-first business models creates sustained demand for infrastructure modernization, application management, and continuous technology optimization services that managed service providers deliver effectively.

Growing Complexity of Enterprise Technology Infrastructure

Modern enterprise technology environments encompass increasingly complex ecosystems spanning multiple cloud platforms, hybrid architectures, and diverse application portfolios. Managing these sophisticated environments requires specialized expertise, advanced monitoring tools, and continuous optimization capabilities that challenge traditional IT teams. Moreover, organizations recognize that maintaining comprehensive internal capabilities for managing complex technology stacks proves economically impractical and operationally challenging. Managed service providers offer consolidated expertise, proven methodologies, and economies of scale that address infrastructure complexity while reducing operational burden and ensuring consistent performance across technology domains.

Expanding Small and Medium Enterprise Technology Adoption

The Indian small and medium enterprise segment demonstrates accelerating technology adoption driven by competitive pressures, customer expectations, and digital economy participation requirements. These organizations typically lack resources for building comprehensive internal IT capabilities while facing increasing technology demands for operations, customer engagement, and business growth. Managed services provide SMEs access to enterprise-grade technology solutions, specialized expertise, and operational support through flexible consumption models. Government initiatives promoting digital adoption, improved connectivity in smaller cities, and evolving SME technology awareness contribute to expanding market opportunity within this significant enterprise segment. According to sources, in December 2025, India SME Forum reported 53.8% of Indian MSMEs digitally adopted tools, while WhatsApp and the Ministry of MSME launched an AI-powered chatbot under the Digishaastra Initiative.

Market Restraints:

What Challenges the India Managed Services Market is Facing?

Data Security and Privacy Concerns

Organizations express significant concerns regarding data security and privacy when outsourcing IT functions to external managed service providers. Enterprises handling sensitive customer information, proprietary business data, and regulated content require assurance regarding data protection measures. Such issues may cause setbacks in the adoption process, especially among organizations with tight regulatory compliances or organizations that deal with strictly regulated business sectors, whereby breaching data has severe repercussions.

Integration Challenges with Legacy Systems

Many Indian enterprises continue operating legacy technology systems that present integration challenges when implementing managed service solutions. These older systems often lack standardized interfaces, documentation, and compatibility with modern management platforms. Integration complexity can increase implementation timelines, elevate costs, and introduce operational risks that reduce managed services value propositions for organizations with substantial legacy technology investments requiring continued operational support.

Skilled Workforce Availability and Retention

The managed services industry faces ongoing challenges related to skilled workforce availability and retention in competitive employment markets. Service providers require technical professionals with expertise across multiple technology domains, platforms, and emerging solutions. High demand for specialized skills creates workforce mobility challenges that can impact service delivery consistency and quality. Training investments and knowledge retention become significant operational considerations for managed service organizations.

Competitive Landscape:

The India managed services market exhibits a moderately fragmented competitive structure characterized by the presence of established global technology corporations, domestic IT service organizations, and specialized regional providers. Market participants compete across multiple dimensions including service breadth, technical expertise, pricing strategies, and customer relationship management capabilities. Leading players differentiate through comprehensive service portfolios, industry-specific solutions, and technology partnerships that enhance service delivery capabilities. The competitive environment encourages continuous innovation, service quality improvements, and expansion into emerging technology domains. Strategic partnerships, acquisitions, and organic capability development represent common competitive strategies employed by market participants seeking market share expansion and customer base diversification.

Recent Developments:

-

In May 2025, Sonata Software launched AgentBridge, a managed services platform for deploying and governing AI agents at scale. Supporting A2A and MCP protocols, the platform enables secure orchestration of AI workflows across enterprises, helping accelerate automation, improve governance, and drive wider adoption of generative and agentic AI solutions.

India Managed Services Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | INR Crore |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Managed Infrastructure, Managed Data Center, Managed Security, Managed Communications, Managed Network, Managed Mobility |

| Deployment Modes Covered | On-premises, Cloud-based |

| Enterprise Sizes Covered | Large Enterprises, Small and Medium-sized Enterprises |

| End Uses Covered | IT and Telecommunication, BFSI, Healthcare, Entertainment and Media, Retail, Manufacturing, Government, Others |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India managed services market size was valued at INR 47,673.03 Crore in 2025.

The India managed services market is expected to grow at a compound annual growth rate of 8.35% from 2026-2034 to reach INR 98,130.76 Crore by 2034.

Managed infrastructure held the largest share of the India managed services market, as organizations increasingly rely on expert providers to manage their IT infrastructure. This includes servers, networks, and storage, ensuring seamless operations, scalability, and optimized performance across industries.

Key factors driving the India managed services market include accelerating digital transformation initiatives, growing technology infrastructure complexity, expanding SME technology adoption, increasing cybersecurity requirements, government digitalization programs, and rising demand for specialized IT expertise.

Major challenges include data security and privacy concerns, integration complexities with legacy systems, skilled workforce availability and retention issues, vendor lock-in apprehensions, service quality consistency requirements, and regulatory compliance management across diverse technology environments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)