India Gluten Free Food Market Size, Share, Trends and Forecast by Product Type, Source, Distribution Channel, and Region, 2025-2033

India Gluten Free Food Market Overview:

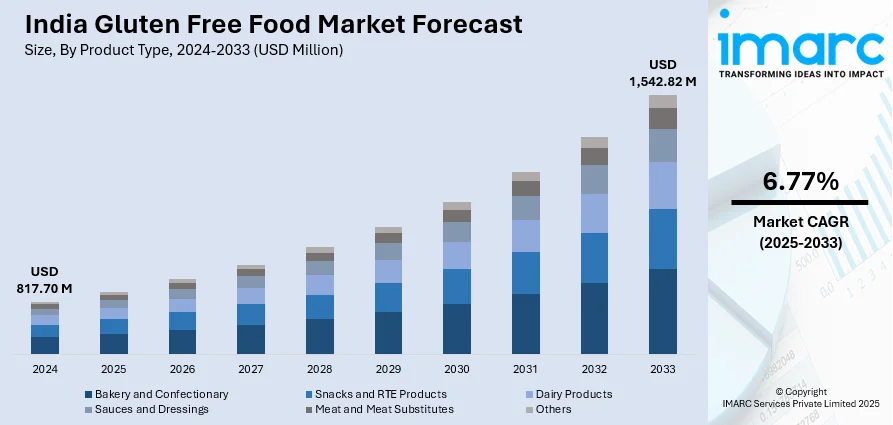

The India gluten free food market size reached USD 817.70 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,542.82 Million by 2033, exhibiting a growth rate (CAGR) of 6.77% during 2025-2033. The growing prevalence of gluten intolerance, rising health consciousness, and increasing demand for sports nutrition are driving India’s gluten-free food market, with manufacturers innovating certified products using indigenous ingredients while fitness influencers, wellness centers, and online platforms further expand accessibility and consumer adoption across demographics.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 817.70 Million |

| Market Forecast in 2033 | USD 1,542.82 Million |

| Market Growth Rate (2025-2033) | 6.77% |

India Gluten Free Food Market Trends:

Rising Health Awareness and Celiac Disease Diagnosis

The increasing number of people experiencing gluten intolerance and celiac disease is catalyzing the demand for gluten-free food items in India. Awareness campaigns by health organizations and medical professionals are educating consumers about the adverse effects of gluten on individuals with these conditions. Additionally, a growing number of people are opting for gluten-free diets as part of a broader health-conscious lifestyle, associating such products with better digestion and overall well-being. The rise of functional foods, dietary supplements, and organic products in urban areas is further accelerating market expansion. People in India are becoming more label-conscious, leading brands to highlight "gluten-free" certifications prominently on packaging. This trend is particularly strong among younger demographics and working professionals who actively seek healthier food alternatives. As a result, manufacturers are diversifying their gluten-free offerings designed to meet changing consumer tastes and market needs. In 2023 , the CSIR-Central Food Technological Research Institute (CFTRI) launched three innovative healthy food tech products, including a buckwheat-based gluten-free cake mix, spice bread, and fiber-enriched rusk. These products aimed to improve health by offering gluten-free and fiber-rich options. The gluten-free cake mix, for instance, was designed for individuals with celiac disease and was rich in protein and minerals. Such innovations highlight the growing focus on research-driven product development in India's gluten-free food industry. Companies are increasingly leveraging indigenous ingredients like millets, quinoa, and sorghum to create high-quality, nutritious gluten-free alternatives.

To get more information of this market, Request Sample

Demand for Gluten-Free Sports Nutrition and Fitness Foods

The thriving fitness and wellness sector in India is driving the need for gluten-free sports nutrition items. Athletes, bodybuilders, and fitness fanatics are choosing gluten-free diets to boost digestion, lessen inflammation, and enhance overall performance. The market is experiencing a rise in gluten-free protein powders, energy bars, and meal replacement shakes, addressing the demands of health-minded consumers. Numerous fitness influencers and dietitians promote gluten-free diets to enhance gut health and aid muscle recovery, impacting consumer choices. Fitness centers, wellness facilities, and online health retailers are endorsing gluten-free dietary items, thereby increasing availability. Moreover, endurance athletes and runners are embracing gluten-free carb-loading methods by utilizing foods such as quinoa, sweet potatoes, and brown rice rather than conventional wheat-based selections. Manufacturers are responding to this trend by creating gluten free snacks and energy bars, catering to the preferences of fitness enthusiasts. In 2023, Naturell India Pvt. Ltd. launched Max Protein Whey Protein, Max Protein Plant Protein, and Max Protein Roti Mix. The whey protein was gluten-free and offered 24g of protein per serving, while the plant protein provided 25g per serving with probiotics for gut health.

India Gluten Free Food Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product type, source, and sales channel.

Product Type Insights:

- Bakery and Confectionary

- Snacks and RTE Products

- Dairy Products

- Sauces and Dressings

- Meat and Meat Substitutes

- Others

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes bakery and confectionary, snacks and RTE products, dairy products, sauces and dressings, meat and meat substitutes, and others.

Source Insights:

- Plant-Based

- Animal-Based

The report has provided a detailed breakup and analysis of the market based on the source. This includes plant-based and animal-based.

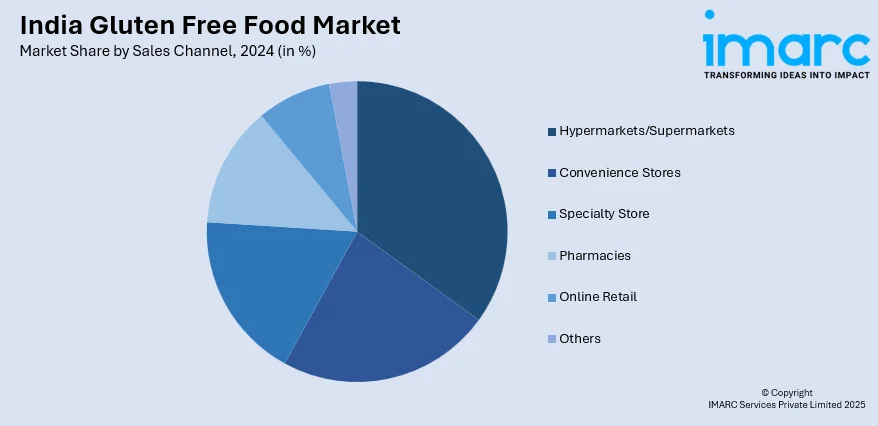

Sales Channel Insights:

- Hypermarkets/Supermarkets

- Convenience Stores

- Specialty Store

- Pharmacies

- Online Retail

- Others

A detailed breakup and analysis of the market based on the sales channel have also been provided in the report. This includes hypermarkets/supermarkets, convenience stores, specialty store, pharmacies, online retail, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Gluten Free Food Market News:

- In June 2024, Goodveda launched its new range of millet-based healthy baked crunchies called 'Milletious,' aligning with the Indian government's 'Millet Revolution' campaign. The snacks, available in four flavors, were gluten-free, sugar-free, and preservative-free, offering a nutritious alternative for health-conscious consumers.

- In April 2024, Agrimax Foods LLP launched its new brand, Bake&Co., offering gluten-free millet-based baked goods that prioritized health and nutrition. Supported by the PMFME scheme, the product range included millet cookies and planned expansion into ready-to-eat snacks.

India Gluten Free Food Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Bakery and Confectionary, Snacks and RTE Products, Dairy Products, Sauces and Dressings, Meat and Meat Substitutes, Others |

| Sources Covered | Plant-Based, Animal-Based |

| Sales Channels Covered | Hypermarkets/Supermarkets, Convenience Stores, Specialty Store, Pharmacies, Online Retail, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India gluten free food market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India gluten free food market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India gluten free food industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India gluten free food market was valued at USD 817.70 Million in 2024.

The India gluten free food market is projected to exhibit a CAGR of 6.77% during 2025-2033, reaching a value of USD 1,542.82 Million by 2033.

The India gluten free food market is driven by rising health awareness, growing detection of gluten intolerance, and increasing adoption of wellness-oriented diets. Urban consumers seeking alternatives like rice, millet, and sorghum-based products, along with expanding e-commerce platforms enhancing access to diverse gluten-free brands, are deepening the market share.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)