India Fish Meal Market Size, Share, Trends and Forecast by Raw Material, Species, Application, and Region, 2025-2033

India Fish Meal Market Overview:

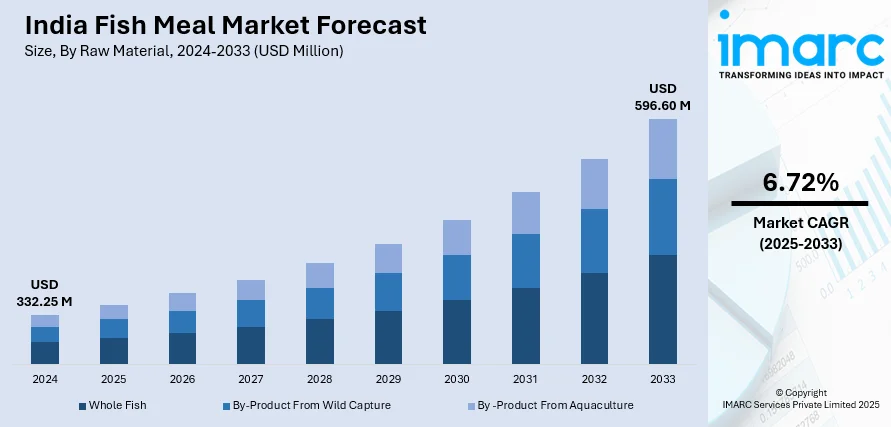

The India fish meal market size reached USD 332.25 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 596.60 Million by 2033, exhibiting a growth rate (CAGR) of 6.72% during 2025-2033. The market is fueled by the increasing need for animal feed, especially in aquaculture and poultry industries, rising awareness about good-quality nutrition, increasing livestock farming, increased seafood consumption. Moreover, improving processing technology and ready availability of raw materials also fuel India fish meal market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 332.25 Million |

| Market Forecast in 2033 | USD 596.60 Million |

| Market Growth Rate (2025-2033) | 6.72% |

India Fish Meal Market Trends:

Increasing Demand from Aquaculture Industry

The India fish meal market outlook is heavily influenced by the thriving aquaculture sector. With increasing demand for seafood and the desire for sustainable protein sources, fish farming has been on the rise, and fish meal is an indispensable source of nutrients for aquatic animals. Fish meal contains high levels of protein, omega-3 fatty acids, and amino acids and is thus the best ingredient to be used in fish and shrimp feed. With the growth of India's aquaculture sector, particularly in Andhra Pradesh and West Bengal, the need for quality fish meal has risen. This trend is also underpinned by government efforts to encourage sustainable aquaculture practices, including the Pradhan Mantri Matsya Sampada Yojana (PMMSY) to boost fish production and exports. With the nation striving to satisfy its increasing seafood requirement, the dependence on fish meal in the aquaculture industry will be a driving factor for market growth. According to industry reports, the north-eastern and eastern regions continue to excel in fish, along with Kerala and Goa. Tripura recorded the highest proportion of fish consumers (99.35%), followed closely by Manipur, Assam, Arunachal Pradesh, Nagaland, and West Bengal. On the opposite side of the fish scale, Haryana recorded the lowest percentage of fish consumers (20.6%) during 2019-21, trailed by northern Punjab and Rajasthan.

To get more information on this market, Request Sample

Rise in Exports and Domestic Consumption of Fish Products

India's emerging interest in ramping up fish and seafood production and export has led to growing demand for fish meal. The growth in seafood processing and India's drive to enhance its export market have placed fish meal in a critical role to sustain the aquaculture sector, supporting healthy growth levels for farmed shrimp and fish. The percentage of fish consumers rose from 66 percent to 72.1 percent between 2005-06 and 2019-21, with yearly fish consumption per person increasing from 4.9 kg to 8.9 kg from 2005 to 2020. Among those who consume fish, per capita intake increased from 7.4kg to 12.3kg, as per information derived from National Family Household Surveys conducted between 2005-06 and 2019-21. States such as Andhra Pradesh, Tamil Nadu, and West Bengal, which are at the forefront of fish production, are experiencing a tremendous boost in domestic consumption as well as exports. Fish meal is essential to fuel this growth, as it contains the required nutritional value for maximum fish health and productivity. Additionally, with increasing consumption of seafood worldwide, especially in the Middle East and Southeast Asia, India's fish meal industry enjoys robust export demand. The fish and seafood export trend has thus emerged as a principal driver of the fish meal market.

India Fish Meal Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on raw material, species, and application.

Raw Material Insights:

- Whole Fish

- By-Product From Wild Capture

- By -Product From Aquaculture

The report has provided a detailed breakup and analysis of the market based on the raw material. This includes whole fish, by-product from wild-capture, and by-product from aquaculture.

Species Insights:

- Marine

- Anchovy

- Sandeel

- Menhaden

- Sprat

- Others

- Trimming

The report has provided a detailed breakup and analysis of the market based on the species. This includes marine (anchovy, sandeel, menhaden, sprat, and others), and trimming.

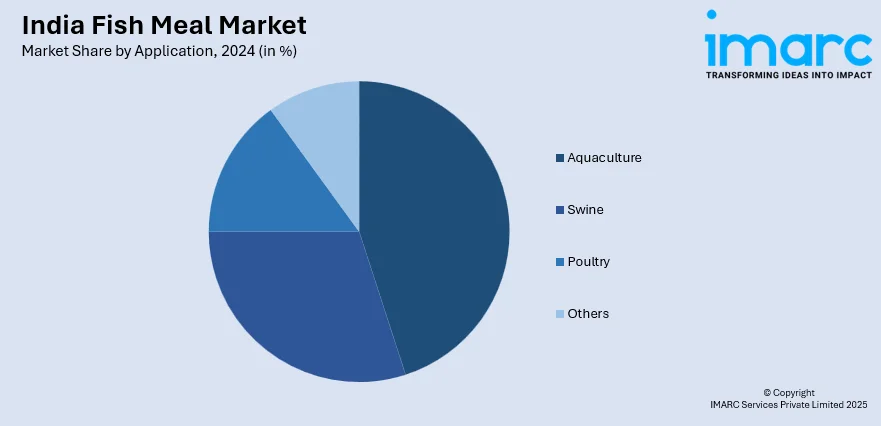

Application Insights:

- Aquaculture

- Crustaceans

- Salmon and Trout

- Marine Fish

- Tilapias

- Others

- Swine

- Poultry

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes aquaculture (crustaceans, salmon and trout, marine fish, tilapias, and others), swine, poultry, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Fish Meal Market News:

- In August 2024, the Indian government lifted the ban on the registration of new fish meal and fish oil facilities. The MPEDA imposed a freeze on the registration of new fish meal and fish oil facilities starting January 1, 2020, to prevent the excessive exploitation of food fish resources. It was also thought that the moratorium would improve the output potential of current fishmeal facilities.

India Fish Meal Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Raw Materials Covered | Whole Fish, By-Product From Wild Capture, By -Product From Aquaculture |

| Species Covered |

|

| Applications Covered |

|

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India fish meal market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India fish meal market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India fish meal industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The fish meal market in India was valued at USD 332.25 Million in 2024.

The India fish meal market is projected to exhibit a CAGR of 6.72% during 2025-2033, reaching a value of USD 596.60 Million by 2033.

Key factors driving the India fish meal market include the growing demand for high-protein animal feeds, especially in the aquaculture industry. Increasing seafood consumption, expansion of the poultry and livestock sectors, and rising awareness about nutritional value also contribute to market growth. Improved fishing practices and government support further drive demand.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)