India Fast Food Market Size, Share, Trends and Forecast by Product Type, End User, and Region, 2026-2034

India Fast Food Market Size and Share:

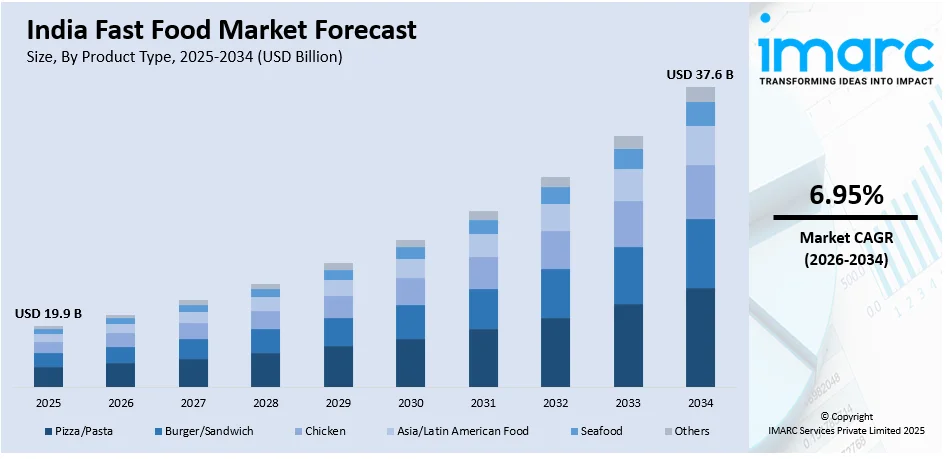

The India fast food market size was valued at USD 19.9 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 37.6 Billion by 2034, exhibiting a CAGR of 6.95% from 2026-2034. The India fast food market share is increasing due to rapid urbanization and shifting lifestyle patterns, the growing young population in the country, rising disposable incomes of individuals, and the growth of food delivery platforms and aggregators.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 19.9 Billion |

| Market Forecast in 2034 | USD 37.6 Billion |

| Market Growth Rate (2026-2034) | 6.95% |

The India fast food market growth is increasing rapidly, driven by urbanization and evolving consumer preferences. According to the World Bank, by 2036, it is expected that 600 million people, or 40% of the population, will live in towns and cities, a gigantic number for urbanization. Such enormous migration into urban centers has revolutionized eating patterns. Quick, on-the-go food items have gained favor with working-class populations, especially among millennials and Gen Z. High disposable incomes and increasing numbers of dual-income families have expanded dining-out and take-out expenses. Furthermore, increased organized retail space in the form of shopping malls and food courts has increased fast food accessibility. Additionally, the localization of flavors and menus to suit local tastes has broadened the base of fast food across various segments of consumers.

To get more information on this market Request Sample

The digitalization of India has greatly accelerated the fast food market. The increasing penetration of the internet and widespread use of smartphones has driven the popularity of online food delivery platforms, making fast food more accessible than ever. Social media marketing has enhanced brand visibility, while attractive deals and promotions encourage frequent consumer engagement. Moreover, the growing culture of dining out, influenced by growing food trends and urban lifestyles, is a key driver. To meet the demands of health-conscious consumers, brands are innovating with healthier and plant-based menu options, which is ensuring sustained growth in an increasingly competitive market. Urbanization, combined with technological advancements and changing consumer behaviors, continues to boost the India fast food demand.

India Fast Food Market Trends:

Growing dependence on online food delivery

The increasing reliance on online food delivery platforms is one of the factors influencing the India fast food market trends. With the proliferation of smartphones and internet access across urban and semi-urban regions, consumers are opting for the convenience of ordering food online rather than dining out. According to Invest India, the internet subscriber base now stands at 954.4 Million, with 556.05 Million in urban areas and 398.35 Million in rural areas. This widespread connectivity has significantly contributed to the growth of online food delivery platforms such as Swiggy and Zomato, which have become an essential part of dining experiences, providing a wide variety of fast food options from local outlets to international chains. Digital payment systems have further eased this shift by making transactions smoother and more secure. The rise in home delivery has been particularly accelerated by changing consumer behaviors post-pandemic, where safety concerns and the preference for at-home experiences have gained prominence. Moreover, these platforms often offer discounts, loyalty programs, and quick delivery services, increasing consumer engagement and encouraging repeat orders. Online food delivery is a convenience and a growing segment of the fast food industry, providing brands with new avenues for revenue and customer retention. The trend of home delivery, coupled with easy access to diverse cuisines, is expected to continue shaping the market for years to come.

Fusion and regional flavors

The trend of fusion foods and regional flavor adaptations is becoming increasingly popular in India's fast food market. While various fast-food chains have made inroads into the country, local consumers are increasingly looking for unique culinary experiences that blend international and traditional flavors. In response, many fast food brands are offering fusion menu items that combine popular Western dishes with regional Indian ingredients and spices. For example, the burger patty might feature a spicy paneer, or a local pizza may be drenched with vegetables herbs, and seasonings, as observed with Indian regional fast food companies where they apply different regional local tastes of country preferences and related local culinary styles. Such a new wave caters to familiar tastes-seeking consumers and benefits the current novelty appetite in food in an ever-seeking adventurous eatery. This makes fast food brands adapt to different tastes in India, from North to South, so that every region's culinary identity is respected. Embracing fusion and regional flavors helps fast food chains expand their consumer base and position themselves well in this highly competitive market.

Growing demand for healthy fast food:

The growing health-conscious Indian consumer is changing the fast food industry's landscape. The increasing demand for healthy alternatives is mainly driven by millennials and Gen Z, who are more concerned with nutrition and well-being, pushing fast food brands to innovate menus with low-calorie, plant-based, and gluten-free options. The growing awareness about lifestyle diseases such as diabetes, obesity, and heart conditions has pushed consumers to look for meals that are both tasty and nutritious, further supporting the shift toward healthier eating. According to the IMARC Group, the Indian vegan food market size was at US$ 1,468.3 Million in 2024. Hence, the rise in healthy eating habits goes in line with the increasing trend. With growing interest in being fit and engaging in the right form of workout, either going to the gym or doing yoga, food habits are changing toward more protein intake, less fat, and fiber. The same is the scenario with fast-food companies, smaller portion sizes with increased veggies, and clean label ingredients, which they present as the healthy alternative while maintaining taste and ease. This trend is manifest in the vegetarian and vegan fast food that increasingly is becoming more popular, more so in a country like India, where plant-based diets are socially acceptable. As health trends keep on dominating the consumer behavior of people, fast food chains are also trending toward offering products that would answer the need for wholesome indulgences.

India Fast Food Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India fast food market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on product type and end user.

Analysis by Product Type:

- Pizza/Pasta

- Burger/Sandwich

- Chicken

- Asia/Latin American Food

- Seafood

- Others

Pizza and pasta are among the most in-demand fast foods today due to their popularity in the Italian cuisine market, especially among younger consumers looking for quick, flexible meals. Burgers and sandwiches continue to be staples for everyone, from classic to creative, as fillings vary according to regional preferences. Chicken-based fast food options, such as fried chicken, grilled chicken wraps, and chicken sandwiches, dominate the Indian market, blending traditional and modern flavors. The demand for Asian/Latin American food highlights the growing inclination toward international flavors, with fast food brands adapting popular dishes like sushi, tacos, and quesadillas to Indian preferences. Seafood, especially along the coastal states, has significantly been in the increased demand curve due to the requirements of healthy and protein-based requirements that include fish burgers and seafood wraps. As per the Press Bureau of India, with a growth of 30.81% between 2019-20 and 2023-24, the seafood sector in India has recorded a similar sea change in the appreciation of seafood dishes.

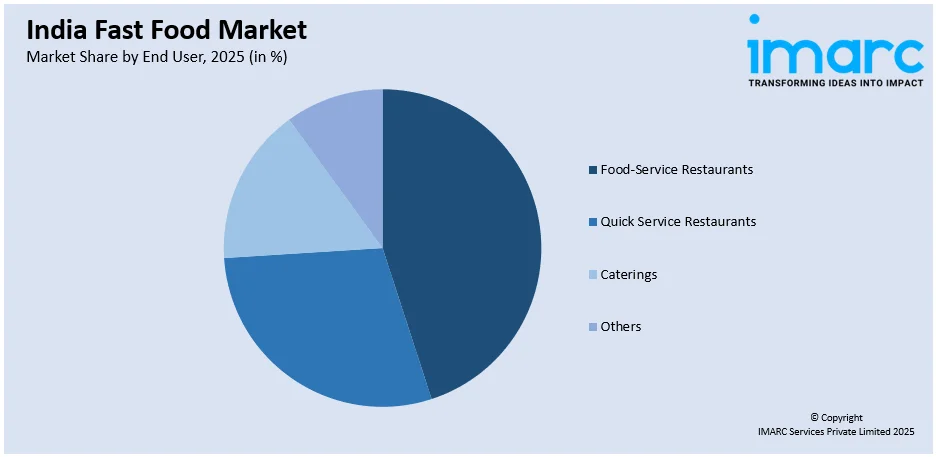

Analysis by End User:

Access the comprehensive market breakdown Request Sample

- Food-Service Restaurants

- Quick Service Restaurants

- Caterings

- Others

Food-service restaurants encompass a wide variety of dining establishments, from mid-range to high-end restaurants, that offer fast food as part of their broader menu. These restaurants cater to a diverse audience, providing both quick meal options and a comfortable dining experience. According to the India Brand Equity Foundation, the Indian food services sector is expected to grow with a CAGR of 8.1% between 2024 and 2028. Quick Service Restaurants (QSRs) form the backbone of India's fast food industry and emphasize providing quick, affordable meals to a broad customer base. Operating on a fast-paced service model with dine-in, takeaway, and delivery options, QSRs benefit from high footfall in urban areas and emphasize speed and convenience. Catering services are an emerging market segment as more and more fast food is used for events, corporate gatherings, and social functions. Catering services offer customized menus and large-volume meal options that meet the specific needs of their clients.

Regional Analysis:

- North India

- West and Central India

- South India

- East India

North India is a prime market for fast food, where the large number of urban populace and growing cities like Delhi, Chandigarh, and Jaipur are constantly in demand for such services. The increasing population density and requirement for convenience-oriented dining have prompted the growth of fast food stores that offer numerous items, such as burgers, and localized flavors for pizza. According to the Ministry of Statistics & Programme Implementation, India's population is expected to reach 152.2 Crores by 2036, further bolstering the consumer base across the country and driving regional fast food markets. West and Central India, including states like Maharashtra, Gujarat, and Madhya Pradesh, are witnessing rapid urban growth, particularly in cities such as Mumbai and Pune. Rising young and working populations in these areas have further led to a rise in demand for both traditional fast food and fusion fast food options. South India, especially its rapidly growing metropolises of Bengaluru, Chennai, and Hyderabad, exhibits a preference for chicken-based fast food and healthy alternatives. With a rapidly increasing population and highly tech-savvy consumers, the region is becoming a haven for innovative fast food concepts. East India is steadily emerging as an important market for fast food with cities such as Kolkata and Bhubaneswar. It has a very growing population in urban areas where the fast-food culture is showing increased consumption rates, with all fast-food players curating the menus according to the local requirements, like rice-based fast food, seafood items, etc.

Competitive Landscape:

Indian fast-food players are indulging in quite a few strategies, which include increasing footprints and a rapid evolution in this market space. Localization of menus to cater to the diverse tastes of Indian consumers is one major trend. Brands are now launching region-specific offerings with more vegetarian and plant-based options in response to the demands of a largely vegetarian India. Another is digitalization, where fast food chains are partnering with food delivery platforms such as Swiggy and Zomato, which makes it easier for consumers to order from their smartphones. The integration of mobile apps, online promotions, and loyalty programs further increases the convenience factor and brand loyalty. According to One Love Pizza, the fast-food franchise is anticipated to capture an overwhelming 40% market share in India since such franchises continue to expand their bases across the urban and semi-urban regions. Market players are also looking at sustainability as a way to remain relevant through initiatives such as eco-friendly packaging, waste reduction, and energy-efficient operations. Innovation is also growing in the form of healthier menu options, such as low-calorie, gluten-free, and protein-rich items, in response to increasing demand for nutritious fast food. The fusion cuisines combine international flavors with Indian tastes and are also gaining popularity, attracting young, adventurous consumers seeking novel dining experiences. These efforts are providing a positive India fast food market outlook.

Latest News and Developments:

- On December 2024, Burger King opened its first restaurant at City Centre Mall in Raipur and announced another location at Shanker Nagar. The grand opening has festive events, including a photo booth and a Santa appearance. The restaurants will offer wide menus, digital ordering options, and exclusive offers that will spread Burger King's presence across Chhattisgarh.

- On November 2024, Cravy Chicken launched its business in India at the Franchise India Expo 2024 in Mumbai. The brand has Korean-inspired food items and looks to attract Indian customers with unique flavors. FranGlobal, the master franchise holder, is leading the expansion of this brand, underlining hygiene and innovative cooking techniques.

- On August 2024, McDonald's India introduced "No Onion, No Garlic" burgers for Savan month, which assumes the related dieting regulations of the sacred period.

- On July 2024, the expansion of Wendy's reached its 150th store in Kolkata, India, marking a historic milestone. Presently, it is available in 31 cities in India and looks forward to the future. This expansion is the result of the acquisition of Wendy's India by Rebel Foods in 2023, which further drives the business with its food brands.

India Fast Food Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Pizza/Pasta, Burger/Sandwich, Chicken, Asia/Latin American Food, Seafood, Others |

| End Users Covered | Food-Service Restaurants, Quick Service Restaurants, Caterings, Others |

| Regions Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India fast food market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the India fast food market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India fast food industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India fast food market was valued at USD 19.9 Billion in 2025.

The India fast food market share is increasing due to rapid urbanization and shifting lifestyle patterns, the growing young population in the country, rising disposable incomes of individuals, and the growth of food delivery platforms and aggregators.

IMARC estimates the India fast food market to exhibit a CAGR of 6.95% during 2026-2034.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)