India Engineering Plastics Market Size, Share, Trends and Forecast by Type, Application, and Region, 2026-2034

Market Overview:

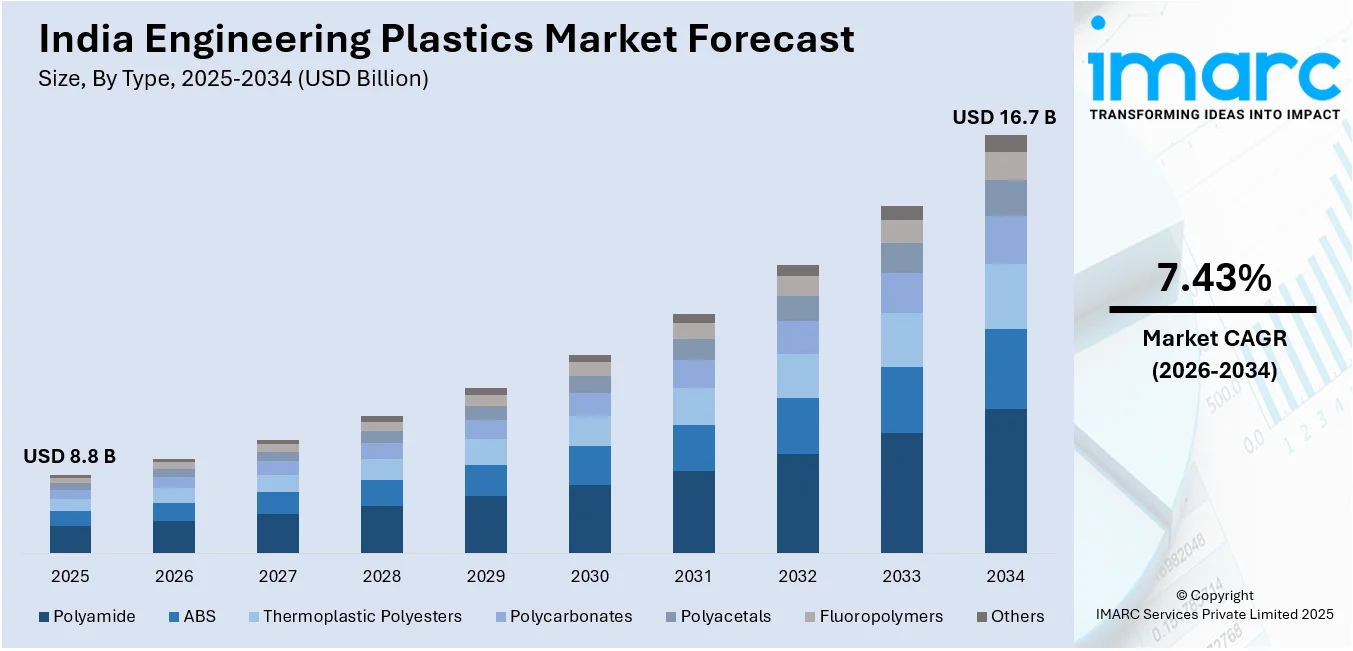

India engineering plastics market size reached USD 8.8 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 16.7 Billion by 2034, exhibiting a growth rate (CAGR) of 7.43% during 2026-2034. The government initiatives promoting optimal manufacturing activities and the rising awareness among leading players towards advanced materials are primarily driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 8.8 Billion |

|

Market Forecast in 2034

|

USD 16.7 Billion |

| Market Growth Rate 2026-2034 | 7.43% |

Engineering plastics are a category of plastic materials known for exhibiting superior mechanical or thermal properties compared to conventionally produced plastics. They present a viable alternative to metals and ceramics due to their lightweight nature. These plastics boast exceptional load capacity, thermal stability, mechanical strength, and longevity. Varieties of engineering plastics include polycarbonates (PC), polyamides (PA), nylon 6, acrylonitrile butadiene styrene (ABS), and polysulphone (PSU). Recently, there has been a growing adoption of engineering plastics in the manufacturing of various products such as dashboard trims, car bumpers, ski boots, optical discs, and helmets. This surge in popularity can be attributed to their advantageous properties, making them preferred materials for applications requiring a balance of strength, durability, and lightweight characteristics.Top of Form

To get more information on this market Request Sample

India Engineering Plastics Market Trends:

The engineering plastics market in India is experiencing a significant surge driven by the escalating demand for advanced materials in various industrial applications. This market growth is fueled by their versatility as alternatives to metals and ceramics, finding applications in an array of industries. Additionally, the automotive sector, in particular, has witnessed a substantial integration of engineering plastics in the production of components, such as dashboard trims and car bumpers, where their lightweight nature and durability play a crucial role. The engineering plastics market's expansion is not limited to automotive applications, but it extends to consumer goods, electronics, and industrial equipment. Besides this, the adoption of engineering plastics in products like ski boots, optical discs, and helmets further underscores their growing prominence, which is acting as another significant growth-inducing factor. With an increasing emphasis on sustainable and high-performance materials, engineering plastics have emerged as a go-to choice for manufacturers seeking a balance between structural integrity and reduced weight. Apart from this, as industries continue to evolve and demand innovative materials, the engineering plastics sector is poised for sustained growth, catering to diverse applications across the country's industrial landscape.

India Engineering Plastics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on type and application.

Type Insights:

- Polyamide

- ABS

- Thermoplastic Polyesters

- Polycarbonates

- Polyacetals

- Fluoropolymers

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes polyamide, ABS, thermoplastic polyesters, polycarbonates, polyacetals, fluoropolymers, and others.

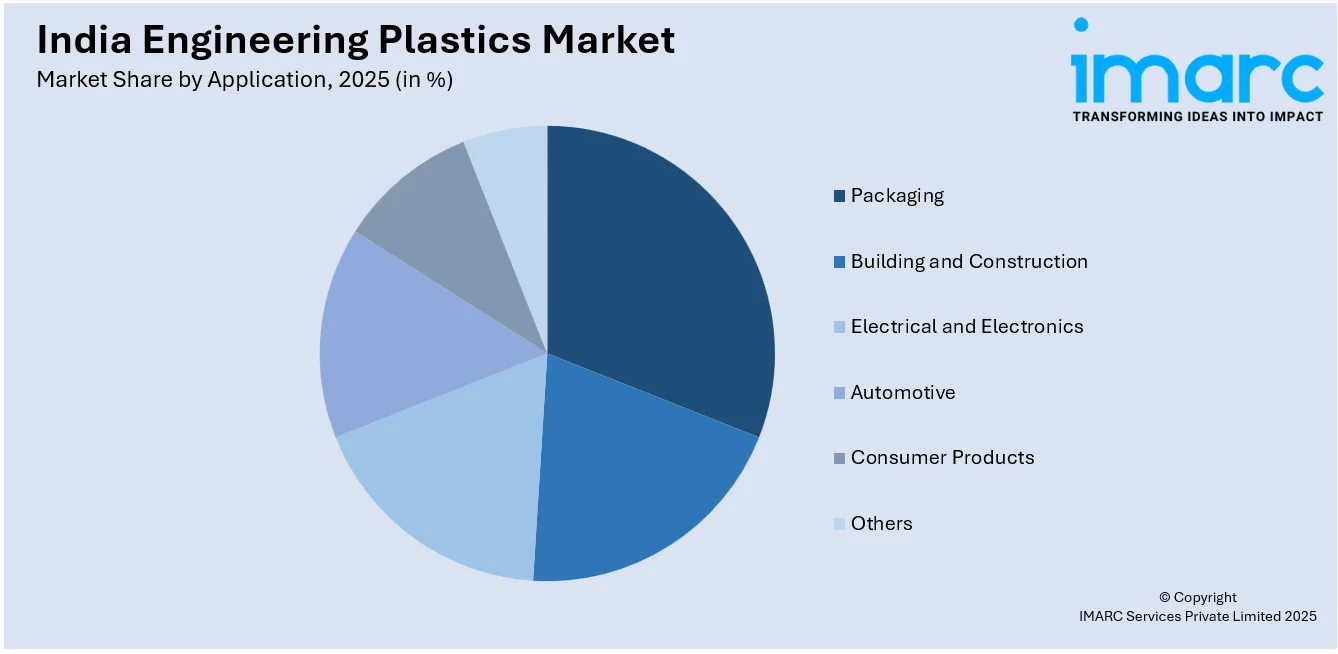

Application Insights:

Access the comprehensive market breakdown Request Sample

- Packaging

- Building and Construction

- Electrical and Electronics

- Automotive

- Consumer Products

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes packaging, building and construction, electrical and electronics, automotive, consumer products, and others.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Engineering Plastics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Polyamide, ABS, Thermoplastic Polyesters, Polycarbonates, Polyacetals, Fluoropolymers, Others |

| Applications Covered | Packaging, Building and Construction, Electrical and Electronics, Automotive, Consumer Products, Others |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India engineering plastics market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the India engineering plastics market?

- What is the breakup of the India engineering plastics market on the basis of type?

- What is the breakup of the India engineering plastics market on the basis of application?

- What are the various stages in the value chain of the India engineering plastics market?

- What are the key driving factors and challenges in the India engineering plastics?

- What is the structure of the India engineering plastics market and who are the key players?

- What is the degree of competition in the India engineering plastics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India engineering plastics market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India engineering plastics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India engineering plastics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)