India Dry Beans Market Size, Share, Trends and Forecast by Bean Type, Packaging Type, Distribution Channel, End-Use, and Region, 2025-2033

India Dry Beans Market Overview:

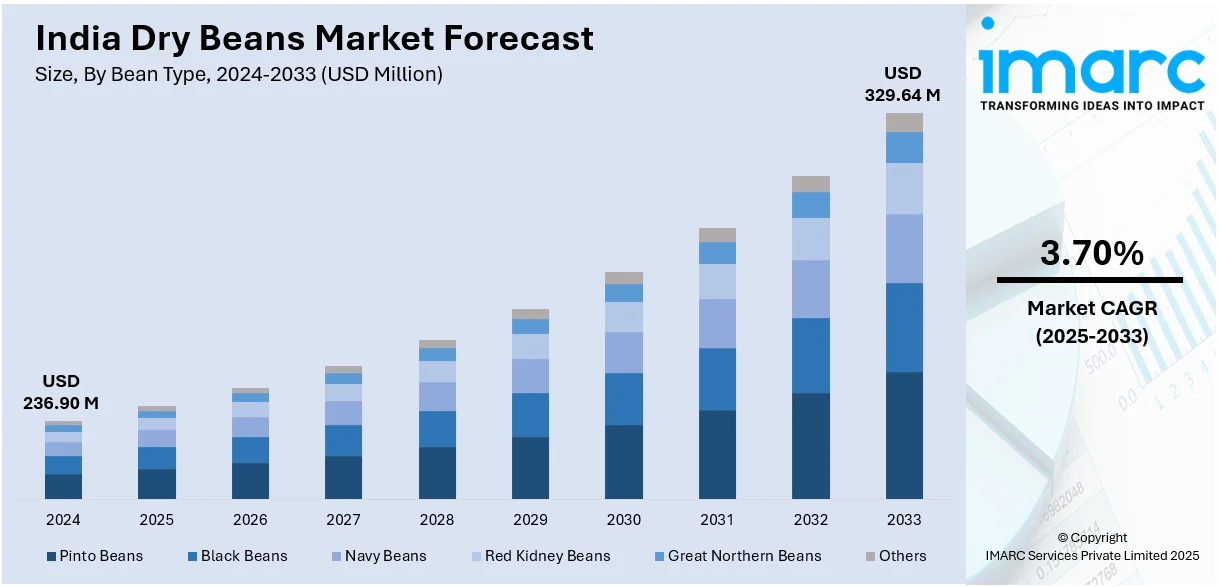

The India dry beans market size reached USD 236.90 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 329.64 Million by 2033, exhibiting a growth rate (CAGR) of 3.70% during 2025-2033. The India dry beans market share is expanding, driven by the increasing adoption of advanced agricultural techniques to improve yield and quality of dry beans, along with the rising focus on building rural infrastructure, including cold storage and efficient supply chains.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 236.90 Million |

| Market Forecast in 2033 | USD 329.64 Million |

| Market Growth Rate (2025-2033) | 3.70% |

India Dry Beans Market Trends:

Rising demand for food products

The increasing demand for food items is fueling the India dry beans market growth. As people are becoming more health-conscious, they are seeking plant-based protein sources, making dry beans a popular choice in daily diets. The rising population further drives the demand, as beans serve as an affordable and nutritious staple food. According to the United Nations Organization (UNO), India's population is anticipated to reach 1.45 Billion in 2024, peaking at 1.69 Billion by 2054. Besides this, the burgeoning food processing industry creates the need, with beans being used in ready-to-eat (RTE) meals, snacks, and packaged food products. Increasing disposable incomes and changing dietary habits lead to higher consumption of diverse dry bean varieties, increasing their market value. Export demand is also growing, as Indian dry beans gain traction in international markets. Farmers adopt advanced agricultural techniques to improve yield and quality, further strengthening the market. With supermarkets and online grocery platforms expanding, dry beans have become more accessible to urban and rural consumers, supporting steady market growth.

To get more information on this market, Request Sample

Increasing government initiatives

The rise in government investments is offering a favorable India dry beans market outlook. Government schemes provide financial support to farmers for better seeds, irrigation, and modern farming techniques. In August 2024, the Union Cabinet sanctioned the Clean Plant Programme (CPP) with a budget of INR 1765.67 Crores. It sought to improve the quality and productivity of horticultural crops and aid in adopting climate-resilient varieties, resulting in higher yields. Subsidies on fertilizers, storage facilities, and transportation reduce costs and ensure a steady supply, making dry beans more affordable for consumers. Investments in agricultural research promote the development of disease-resistant bean varieties, enhancing productivity. The government’s push for self-sufficiency in pulses through Minimum Support Prices (MSP) encourages more farmers to cultivate dry beans, ensuring stable income. Strengthening rural infrastructure, including cold storage and efficient supply chains, reduces post-harvest losses and increases market reach. Export incentives help Indian dry beans to gain a stronger presence in international markets, thereby driving the demand. Apart from this, digital platforms assist in streamlining farmer access to buyers, improving sales and profits. As government funding continues to grow, the market benefits from higher production, better pricing, and better availability, making them a key staple in India’s food sector.

India Dry Beans Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on bean type, packaging type, distribution channel, and end-use.

Bean Type Insights:

- Pinto Beans

- Black Beans

- Navy Beans

- Red Kidney Beans

- Great Northern Beans

- Others

The report has provided a detailed breakup and analysis of the market based on the bean types. This includes pinto beans, black beans, navy beans, red kidney beans, great northern beans, and others.

Packaging Type Insights:

- Plastic Bags

- Cans

- Jars

- Others

A detailed breakup and analysis of the market based on the packaging types have also been provided in the report. This includes plastic bags, cans, jars, and others.

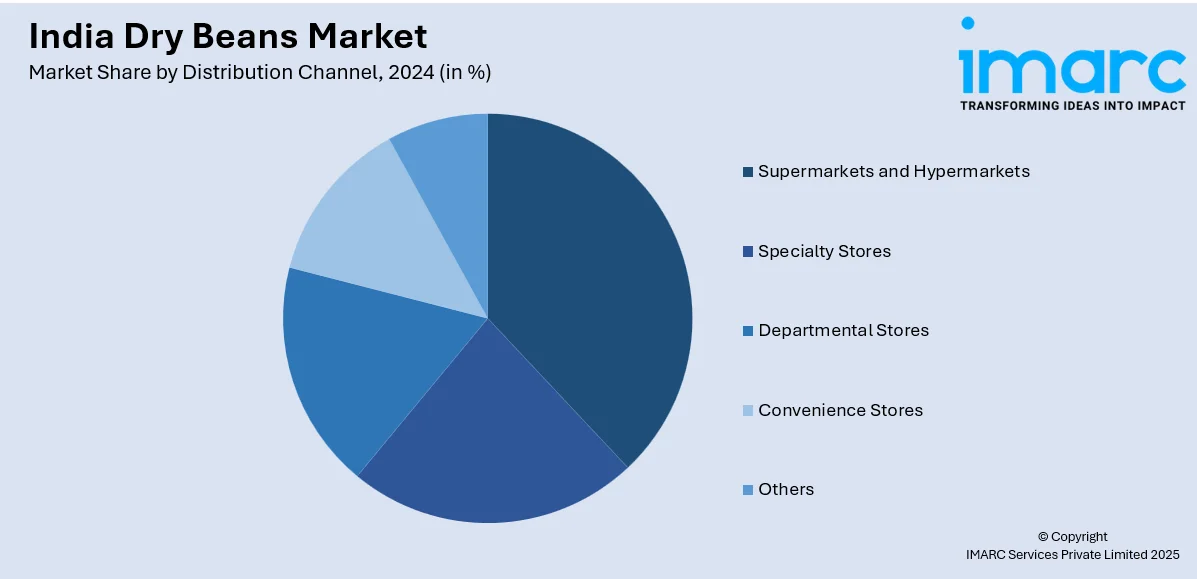

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Specialty Stores

- Departmental Stores

- Convenience Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channels. This includes supermarkets and hypermarkets, specialty stores, departmental stores, convenience stores, and others.

End-Use Insights:

- Households

- Restaurants and Hotels

- Flour Industry

- Others

A detailed breakup and analysis of the market based on the end-uses have also been provided in the report. This includes households, restaurants and hotels, flour industry, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Dry Beans Market News:

- In August 2024, Prime Minister Narendra Modi announced the launch of two new coconut and two cocoa varieties created by the ICAR-Central Plantation Crops Research Institute (CPCRI) in Kasaragod. The VTLCH-1 was a high-yielding cocoa hybrid that could bear fruit early and was stable, featuring a medium canopy that thrived under both arecanut and coconut shade. The yield of dry beans was 1.5 - 2.5 kg per tree annually within a 15-18 m² canopy.

- In April 2023, the USDBC began investigating new market prospects for US dry beans in India and Pakistan. These two initiatives received funding from USDA/FAS’s ‘Emerging Markets Programs’ and were to be overseen by Agrisource, which was based in Thailand. Agrisource aimed to start outlining plans for the projects in 2024.

India Dry Beans Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Bean Types Covered | Pinto Beans, Black Beans, Navy Beans, Red Kidney Beans, Great Northern Beans, Others |

| Packaging Types Covered | Plastic Bags, Cans, Jars, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Departmental Stores, Convenience Stores, Others |

| End-Uses Covered | Households, Restaurants and Hotels, Flour Industry, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India dry beans market performed so far and how will it perform in the coming years?

- What is the breakup of the India dry beans market on the basis of bean type?

- What is the breakup of the India dry beans market on the basis of packaging type?

- What is the breakup of the India dry beans market on the basis of distribution channel?

- What is the breakup of the India dry beans market on the basis of end-use?

- What are the various stages in the value chain of the India dry beans market?

- What are the key driving factors and challenges in the India dry beans market?

- What is the structure of the India dry beans market and who are the key players?

- What is the degree of competition in the India dry beans market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India dry beans market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India dry beans market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India dry beans industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)