India Diagnostic Imaging Market Size, Share, Trends and Forecast by Modality, Application, End User, and Region, 2025-2033

Market Overview:

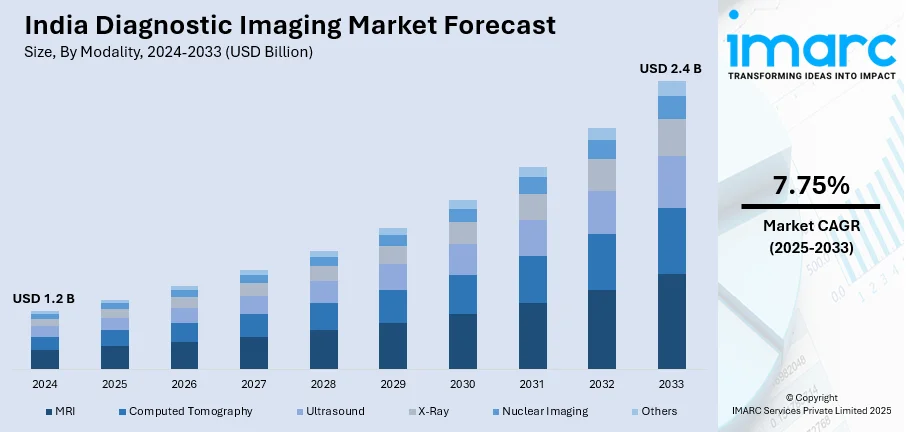

India diagnostic imaging market size reached USD 1.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.4 Billion by 2033, exhibiting a growth rate (CAGR) of 7.75% during 2025-2033. The rising popularity of providing a non-invasive means of visualizing internal structures and functions is primarily driving the market growth across the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1.2 Billion |

|

Market Forecast in 2033

|

USD 2.4 Billion |

| Market Growth Rate 2025-2033 | 7.75% |

Diagnostic imaging, or medical imaging, encompasses a range of non-invasive techniques utilized by medical professionals to observe the internal structures of the body for diagnostic and therapeutic purposes. This field involves the generation and analysis of images produced through the use of radiant energy sources, which may include X-rays, gamma rays emitted by radioactive materials, nuclear magnetic resonance, ultrasonics, and radiofrequency waves. Diagnostic imaging plays a crucial role in the early identification of diseases, facilitating the planning and guidance of medical and surgical interventions. Additionally, it enables the monitoring of disease progression and the assessment of the body's response to treatment.

To get more information on this market, Request Sample

India Diagnostic Imaging Market Trends:

The diagnostic imaging market in India has evolved into a critical component of the country's healthcare landscape, showcasing technological advancements and a growing emphasis on non-invasive medical diagnostics. The market has witnessed a surge in demand due to its instrumental role in early disease detection, treatment planning, and post-treatment monitoring. Additionally, in India, diagnostic imaging technologies include X-ray, computed tomography (CT), magnetic resonance imaging (MRI), ultrasound, and nuclear medicine. Besides this, the market is marked by the presence of both established key players and emerging domestic companies, providing a diverse range of imaging solutions. The adoption of diagnostic imaging in India has substantially improved patient outcomes by facilitating timely and precise medical interventions. Additionally, the market's growth is further propelled by the increasing burden of chronic diseases, a rising geriatric population, and growing awareness among healthcare providers about the benefits of advanced diagnostic imaging. As the healthcare infrastructure in India continues to develop, the diagnostic imaging market is poised for further expansion. Furthermore, the integration of innovative technologies, coupled with a focus on improving accessibility and affordability, positions diagnostic imaging as a cornerstone in the country's efforts to enhance healthcare delivery and outcomes. Apart from this, the India diagnostic imaging market is on a trajectory of continuous growth, contributing significantly to the nation's evolving healthcare landscape.

India Diagnostic Imaging Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on modality, application, and end user.

Modality Insights:

- MRI

- Low and Mid Field MRI Systems

- High Field MRI Systems

- Very High and Ultra High Field MRI Systems

- Computed Tomography

- Low-End Scanners

- Mid-Range Scanners

- High-End Scanners

- Ultrasound

- 2D Ultrasound

- 3D Ultrasound

- Others

- X-Ray

- Analog Systems

- Digital Systems

- Nuclear Imaging

- Positron Emission Tomography (PET)

- Single Photon Emission Computed Tomography (SPECT)

- Others

The report has provided a detailed breakup and analysis of the market based on the modality. This includes MRI (low and mid field MRI systems, high field MRI systems, and very high and ultra high field MRI systems), computed tomography (low-end scanners, mid-range scanners, and high-end scanners), ultrasound (2D ultrasound, 3D ultrasound, and others), X-ray (analog systems and digital systems), nuclear imaging (positron emission tomography (PET) and single photon emission computed tomography (SPECT)), and others.

Application Insights:

- Cardiology

- Oncology

- Neurology

- Orthopedics

- Gastroenterology

- Gynecology

- Others

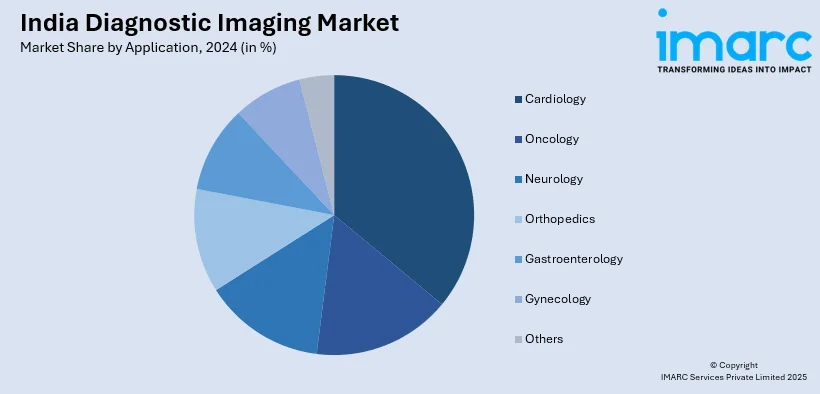

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes cardiology, oncology, neurology, orthopedics, gastroenterology, gynecology, and others.

End User Insights:

- Hospitals

- Diagnostic Centers

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes hospitals, diagnostic centers, and others.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Diagnostic Imaging Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Modalities Covered |

|

| Applications Covered | Cardiology, Oncology, Neurology, Orthopedics, Gastroenterology, Gynecology, Others |

| End Users Covered | Hospitals, Diagnostic Centers, Others |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India diagnostic imaging market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India diagnostic imaging market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India diagnostic imaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The india diagnostic imaging market in India was valued at USD 1.2 Billion in 2024.

The India diagnostic imaging market is projected to exhibit a CAGR of 7.75% during 2025-2033, reaching a value of USD 2.4 Billion by 2033.

India's diagnostic imaging market is driven by rising chronic diseases, aging population, AI integration, government incentives, telemedicine expansion, improved healthcare access, and growing domestic manufacturing and R&D investments in advanced technologies.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)