India Cyber Insurance Market Size, Share, Trends and Forecast by Component, Insurance Type, Organization Size, End Use Industry, and Region, 2026-2034

Market Overview:

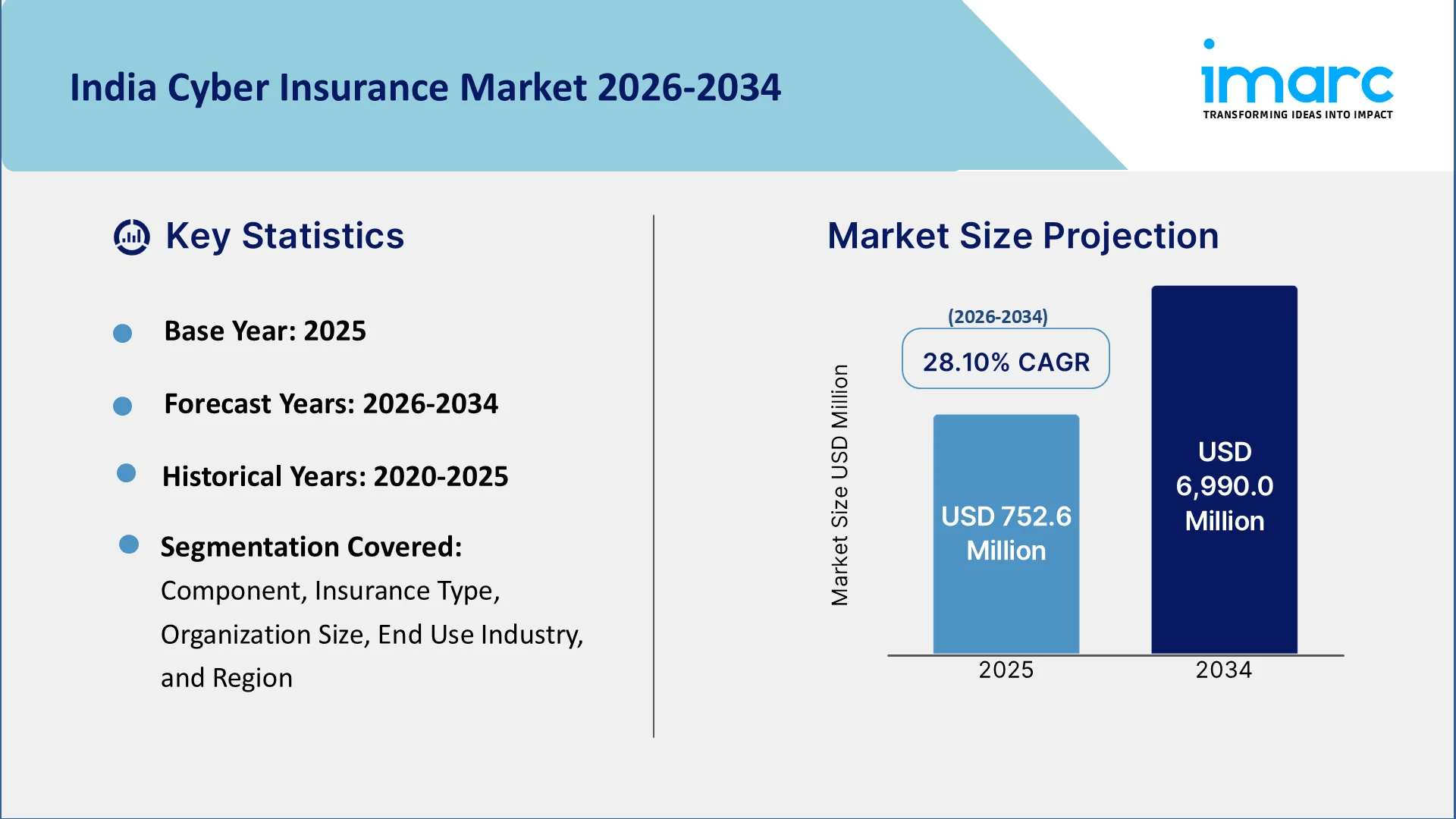

India cyber insurance market size reached USD 752.6 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 6,990.0 Million by 2034, exhibiting a growth rate (CAGR) of 28.10% during 2026-2034. The rising awareness among individuals towards the need for proactively managing and mitigating risks in the digital realm is primarily driving the market growth across the country.

To get more information on the market, Request Sample

Cyber insurance is formulated to provide safeguarding against online risks for both businesses and individual users. Its coverage extends to financial losses resulting from incidents, such as data breaches, network impairments, and cyber extortion. This encompasses a range of expenses, including legal fees, notification costs, identity protection services, and public relations expenditures. The intention behind cyber insurance is to incentivize the adoption of robust cybersecurity practices, thereby diminishing the overall susceptibility to cyberattacks. Furthermore, it aids in adherence to legal and regulatory mandates concerning data protection and privacy. The utilization of cyber insurance is prevalent among banks and financial institutions as a means to shield themselves from risks associated with online transactions and digital banking. Its application is not limited to the financial sector; it is also relevant for small and medium enterprises, along with large corporations heavily reliant on digital technology. By providing a financial safety net, cyber insurance plays a crucial role in mitigating the potential impact of cyber threats, promoting a proactive approach to cybersecurity across various sectors.

India Cyber Insurance Market Trends:

The India cyber insurance market has experienced substantial growth in response to the escalating threats and vulnerabilities in the digital landscape. With an increasing reliance on technology, businesses and individuals in country are recognizing the critical importance of protecting themselves against the potentially devastating consequences of cyberattacks. This burgeoning market addresses various costs incurred in the aftermath of a cyber incident, encompassing legal fees, notification expenses, identity protection services, and public relations costs. Additionally, small and medium enterprises (SMEs) and large corporations across various industries are increasingly recognizing the need for cyber insurance as they navigate the digital landscape. Furthermore, the India cyber insurance market plays a pivotal role in assisting businesses and individuals in complying with legal and regulatory requirements pertaining to data protection and privacy. As such, the integral role of cyber insurance in fortifying India's cybersecurity posture and fostering a resilient digital ecosystem is expected to fuel the market growth in the coming years.

India Cyber Insurance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on component, insurance type, organization size, and end use industry.

Component Insights:

- Solution

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes solution and services.

Insurance Type Insights:

- Packaged

- Stand-alone

A detailed breakup and analysis of the market based on the insurance type have also been provided in the report. This includes packaged and stand-alone.

Organization Size Insights:

- Small and Medium Enterprises

- Large Enterprises

The report has provided a detailed breakup and analysis of the market based on the organization size. This includes small and medium enterprises and large enterprises.

End Use Industry Insights:

- BFSI

- Healthcare

- IT and Telecom

- Retail

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes BFSI, healthcare, IT and telecom, retail, and others.

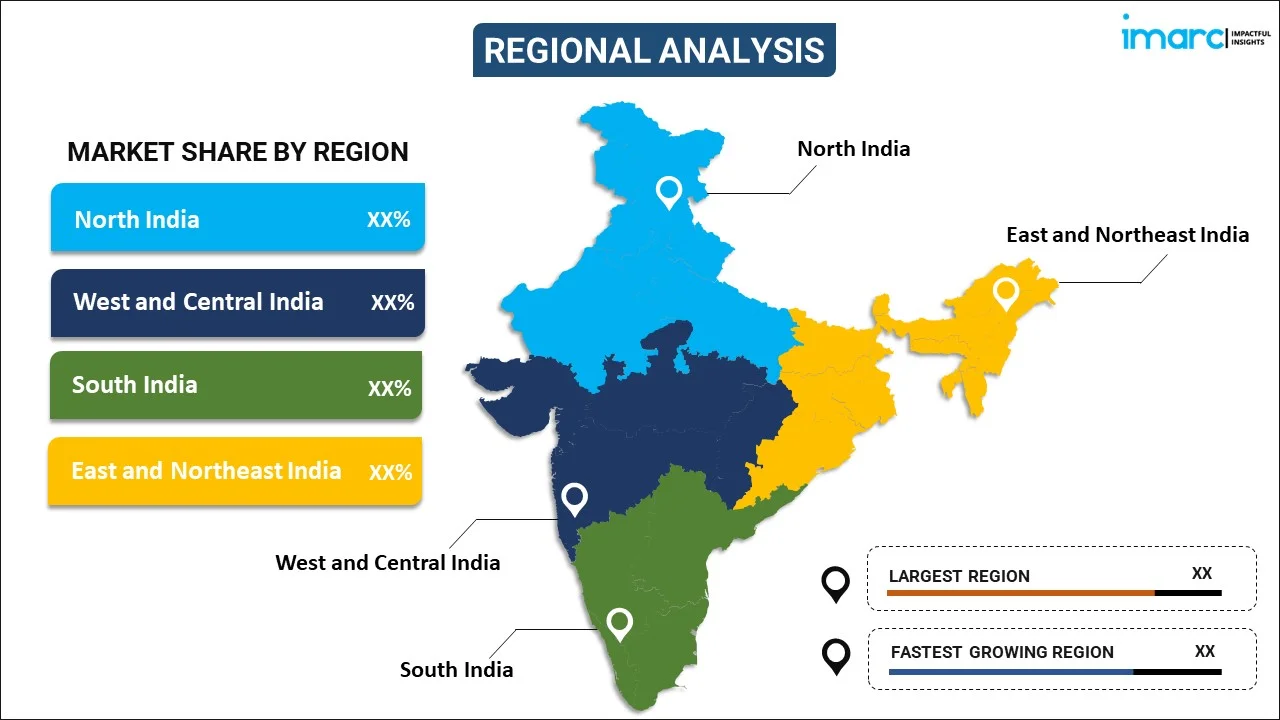

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Cyber Insurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Solution, Services |

| Insurance Types Covered | Packaged, Stand-alone |

| Organization Sizes Covered | Small and Medium-sized Enterprises (SMEs), Large Enterprises, |

| End Use Industries Covered | BFSI, Healthcare, IT and Telecom, Retail, Others |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India cyber insurance market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India cyber insurance market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India cyber insurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The cyber insurance market in the India was valued at USD 752.6 Million in 2025.

The India cyber insurance market is projected to exhibit a CAGR of 28.10% during 2026-2034, reaching a value of USD 6,990.0 Million by 2034.

India's cyber insurance industry is driven by mounting digital threats—from ransomware to phishing as firms and individuals see mounting exposure. Regulatory requirements and enhanced data-protection regulations are forcing companies to hedge against legal exposure and dollars. Increased digital uptake, outsourcing, and IoT growth heighten exposure. Yet, heightened awareness among SMEs and large corporations, coupled with bundled products providing risk analysis and incident support, also fuel adoption.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)