India Construction Robots Market Size, Share, Trends and Forecast by Function, Type, End Use, and Region, 2025-2033

India Construction Robots Market Overview:

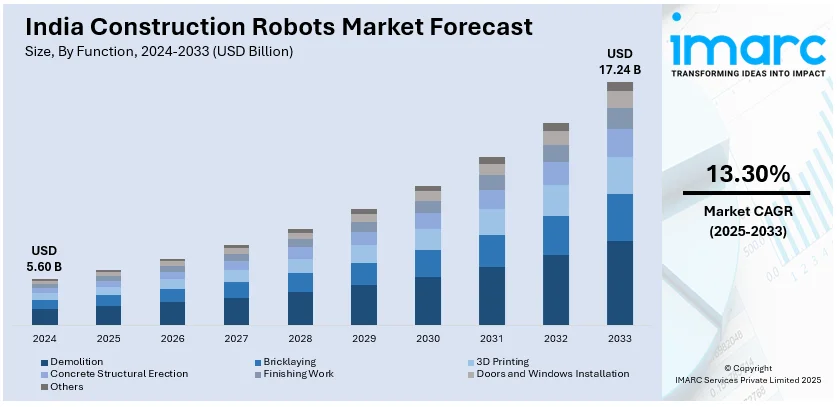

The India construction robots market size reached USD 5.60 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 17.24 Billion by 2033, exhibiting a growth rate (CAGR) of 13.30% during 2025-2033. The rising labor shortages, increasing demand for automation, government initiatives like "Make in India," growing infrastructure projects, advancements in AI and IoT integration, enhanced worker safety measures, cost-efficiency needs, and the push for sustainability in construction practices are expanding the India construction robots market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5.60 Billion |

| Market Forecast in 2033 | USD 17.24 Billion |

| Market Growth Rate (2025-2033) | 13.30% |

India Construction Robots Market Trends:

Increasing Adoption of Automation in Construction

The India construction robots market growth is driven by the increasing adoption of automation in the construction sector. With rising labor shortages and concerns over worker safety, companies are integrating robotic solutions to enhance efficiency and precision. Technologies such as bricklaying robots, 3D printing construction robots, and autonomous demolition machines are gaining traction. Government initiatives like “Make in India” and infrastructure development projects further drive demand. For instance, Prime Minister Narendra Modi's "Make in India" campaign, which aims to make India a worldwide manufacturing powerhouse, celebrated its tenth anniversary on September 25, 2024. The initiative has greatly strengthened India's manufacturing sector over the past ten years, fostering job creation and economic expansion. By supporting eco-friendly production methods and stimulating investments in green technologies, the project highlights sustainability. As smart cities and large-scale infrastructure projects expand, construction robots are becoming essential for improving productivity, reducing costs, and ensuring sustainability in the industry.

To get more information on this market, Request Sample

Growing Investments in AI and Robotics

India’s construction sector is experiencing an increase in investments in artificial intelligence (AI) and robotics to improve operational efficiency. Notably, according to an industry survey released on February 14, 2025, 93% of Indian businesses intend to boost their AI investments in 2025, with 87% of them having made significant strides toward their 2024 AI plans and 76% citing successful outcomes. AI applications are being prioritized by organizations for software development (56%), data quality management (55%), and IT operations (83%). A dedication to sustainability in technological growth is demonstrated by the fact that 66% of companies are recruiting specialized AI expertise, 70% are using managed cloud services, and 71% are implementing open-source solutions to optimize AI deployments. Companies are leveraging AI-driven construction robots for tasks such as site monitoring, material handling, and structural inspections. Startups and global players are entering the market, supported by government initiatives promoting digital transformation. The integration of the Internet of Things (IoT) and machine learning in construction robots is enhancing automation capabilities, making processes safer and more cost-effective, which in turn is positively impacting India construction robots market outlook. As demand for high-rise buildings and complex infrastructure grows, the need for intelligent robotic solutions is expected to rise significantly in India.

India Construction Robots Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on function, type, and end use.

Function Insights:

- Demolition

- Bricklaying

- 3D Printing

- Concrete Structural Erection

- Finishing Work

- Doors and Windows Installation

- Others

The report has provided a detailed breakup and analysis of the market based on the function. This includes demolition, bricklaying, 3D printing, concrete structural erection, finishing work, doors and windows installation, and others.

Type Insights:

- Traditional Robot

- Robotic Arm

- Exoskeleton

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes traditional robot, robotic arm, and exoskeleton.

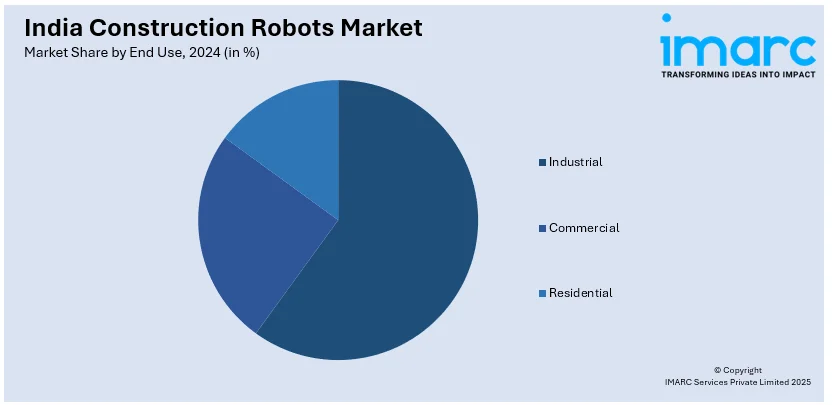

End Use Insights:

- Industrial

- Commercial

- Residential

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes industrial, commercial, and residential.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Construction Robots Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Functions Covered | Demolition, Bricklaying, 3D Printing, Concrete Structural Erection, Finishing Work, Doors and Windows Installation, Others |

| Types Covered | Traditional Robot, Robotic Arm, Exoskeleton |

| End Uses Covered | Industrial, Commercial, Residential |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India construction robots market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India construction robots market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India construction robots industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India construction robots was valued at USD 5.60 Billion in 2024.

The India construction robots is projected to exhibit a CAGR of 13.30% during 2025-2033, reaching a value of USD 17.24 Billion by 2033.

The growth of construction robots in India is driven by the need for improved efficiency, safety, and precision in building projects. Rising urbanization, labor shortages, and increasing demand for automation in construction processes are encouraging the adoption of robotics, supported by technological advancements and growing acceptance in the construction industry.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)