India Confectionery Packaging Market Size, Share, Trends and Forecast by Product, Material, Application, and Region, 2025-2033

India Confectionery Packaging Market Overview:

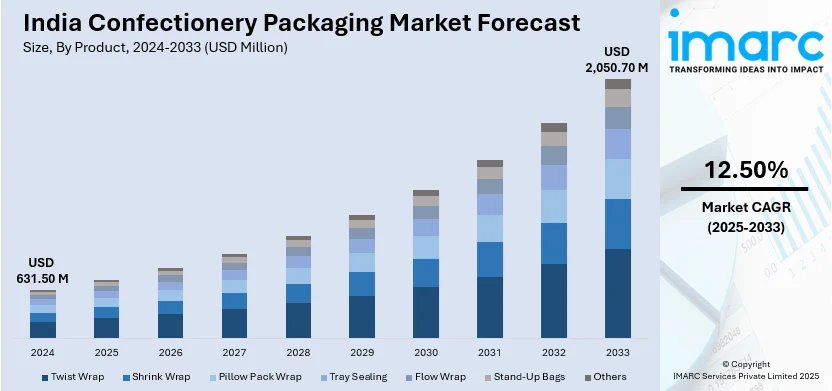

The India confectionery packaging market size reached USD 631.50 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,050.70 Million by 2033, exhibiting a growth rate (CAGR) of 12.50% during 2025-2033. The rising demand for sustainable and eco-friendly solutions, stricter environmental regulations, and growing consumer preference for premium and personalized packaging is augmenting the India confectionery packaging market share. Increasing disposable incomes, e-commerce growth, and the popularity of gifting culture further fuel innovation and investments in aesthetically appealing, durable, and functional packaging designs.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 631.50 Million |

| Market Forecast in 2033 | USD 2,050.70 Million |

| Market Growth Rate (2025-2033) | 12.50% |

India Confectionery Packaging Market Trends:

Rising Demand for Sustainable Packaging Solutions

The significant shift toward sustainable and eco-friendly packaging solutions is playing a significant role in the India confectionery packaging market outlook. With increasing environmental awareness among consumers and stricter government regulations on plastic usage, manufacturers are adopting biodegradable, recyclable, and compostable materials. Paper-based packaging, plant-based plastics, and reusable containers are gaining traction as brands aim to reduce their carbon footprint. On 25th November 2024, Delhi-based Ukhi successfully secured USD 1.2 Million in pre-seed funding to enhance its production of biodegradable packaging derived from agricultural waste. The initiative seeks to substitute plastic and address pollution concerns. This financial backing will facilitate the expansion of production capabilities and promote the global distribution of environmentally sustainable materials. Additionally, companies are using sustainable packaging as a marketing strategy to target eco-conscious consumers, particularly millennials and Generation Z consumers. As a result, numerous brands producing organic and natural confectionery products with eco-friendly packaging solutions are gaining widespread prominence in the market across India.

To get more information on this market, Request Sample

Growth of Premium and Personalized Packaging

The rise in demand for premium and personalized packaging solutions, driven by changing consumer preferences and the rise of gifting culture is supporting the India confectionery packaging market growth. With increasing disposable incomes and a growing middle class, consumers are willing to pay more for aesthetically appealing and high-quality packaging. Brands are investing in innovative designs, vibrant colors, and unique shapes to enhance shelf appeal and create a memorable unboxing experience. Personalization, such as custom messages, names, or designs, is also gaining popularity, especially during festivals and special occasions. On 4th February 2025, FUJIFILM India introduced its cutting-edge printing solutions at Printpack India 2025, featuring the Revoria Press™ series, which offers high-speed, five-color printing capabilities, alongside the Apeos 4620 SX/SZ multifunction devices designed for high-resolution, swift monochrome printing. These innovative products are expected to deliver improved efficiency and quality to meet a variety of printing requirements, encompassing packaging and business functions as they support envelopes, water-resistant paper, and cardboard for packaging solutions. Apart from this, e-commerce growth has further accelerated this trend as brands are now paying extra attention to durable, even reflective, packaging to ensure products are protected during transit while also capturing the attention of online shoppers. This premiumization shift is revolutionizing the market as more and more brands realize that packaging is a central part of their brand identity.

India Confectionery Packaging Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product, material, and application.

Product Insights:

- Twist Wrap

- Shrink Wrap

- Pillow Pack Wrap

- Tray Sealing

- Flow Wrap

- Stand-Up Bags

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes twist wrap, shrink wrap, pillow pack wrap, tray sealing, flow wrap, stand-up bags, and others.

Material Insights:

- Plastic

- Paper and Paperboard

- Others

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes plastic, paper and paperboard, and others.

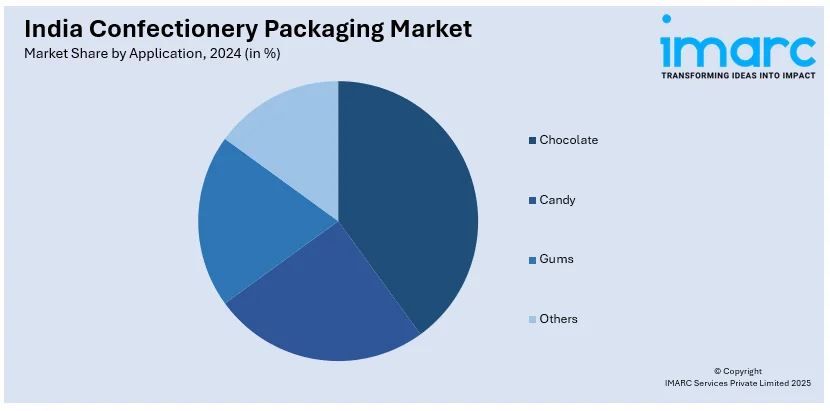

Application Insights:

- Chocolate

- Candy

- Gums

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes chocolate, candy, gums, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Confectionery Packaging Market News:

- February 24, 2025: India's Haldiram penetrated the UK market by launching premium gifting boxes, combining traditional sweets with solutions that bring sophisticated design aesthetics to British consumers. With the Indian confectionery packaging industry growing further reading, Haldiram wants to capture a slice of the UK's £88 Billion (approximately USD 110.88 Billion) gifting industry with a selection of customizable, eye-catching sweet boxes. This initiative also reflects the growing need for high-end confectionery packaging in the Indian export sector.

- September 24, 2024: Pakka launched M1, M3, and NM1 (three new compostable flexible packaging solutions) for chocolates, confectioneries, and food items in FMCG. In addition, these biodegradable materials offer high barrier properties, heat and cold sealability and are suitable for various printing technologies addressing the growing demand for sustainable packaging in India.

India Confectionery Packaging Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Twist Wrap, Shrink Wrap, Pillow Pack Wrap, Tray Sealing, Flow Wrap, Stand-Up Bags, Others |

| Materials Covered | Plastic, Paper and Paperboard, Others |

| Applications Covered | Chocolate, Candy, Gums, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India confectionery packaging market performed so far and how will it perform in the coming years?

- What is the breakup of the India confectionery packaging market on the basis of product?

- What is the breakup of the India confectionery packaging market on the basis of material?

- What is the breakup of the India confectionery packaging market on the basis of application?

- What is the breakup of the India confectionery packaging market on the basis of region?

- What are the various stages in the value chain of the India confectionery packaging market?

- What are the key driving factors and challenges in the India confectionery packaging market?

- What is the structure of the India confectionery packaging market and who are the key players?

- What is the degree of competition in the India confectionery packaging market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India confectionery packaging market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India confectionery packaging market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India confectionery packaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)