India Cable Management Market Size, Share, Trends and Forecast by Product, Material, End User, and Region, 2025-2033

India Cable Management Market Overview:

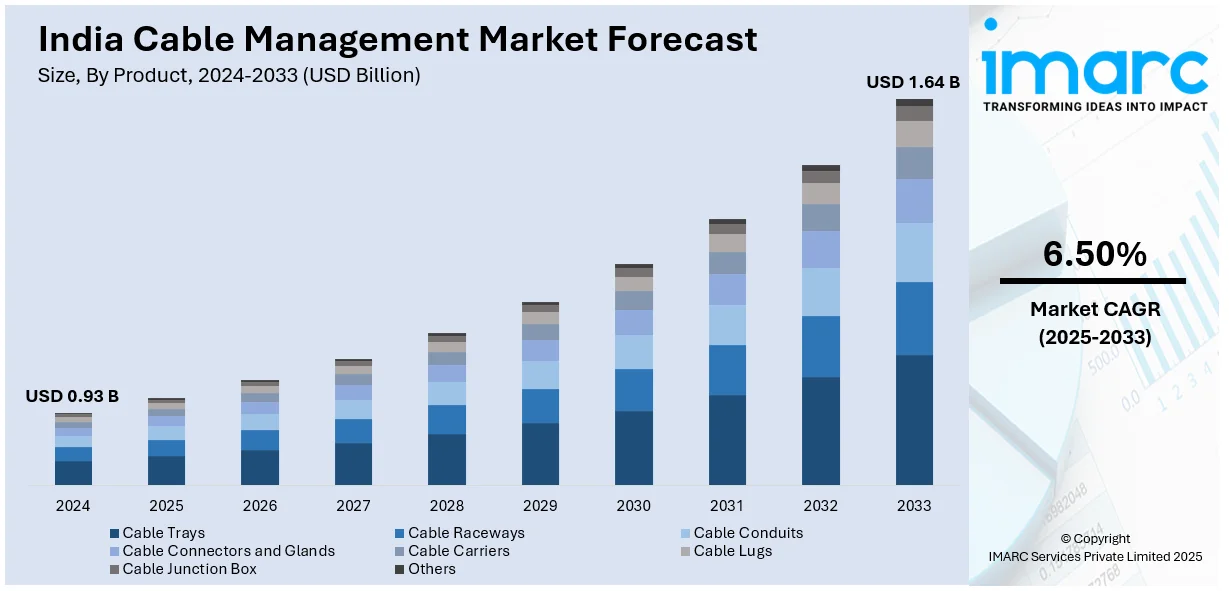

The India cable management market size reached USD 0.93 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 1.64 Billion by 2033, exhibiting a growth rate (CAGR) of 6.50% during 2025-2033. The India cable management market share is driven by rising infrastructure development, expanding IT and telecom, and increasing industrialization. Besides this, government investments, smart city projects, and safety regulations further catalyzes the demand for structured cabling in commercial, residential, and industrial sectors, ensuring efficiency, reliability, and safety.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 0.93 Billion |

| Market Forecast in 2033 | USD 1.64 Billion |

| Market Growth Rate (2025-2033) | 6.50% |

India Cable Management Market Trends:

Rising Infrastructure Development

Infrastructure development is fueling the India cable management market growth by increasing construction activities nationwide. Expanding commercial buildings, residential complexes, and industrial facilities are creating higher demand for efficient cable management solutions. Proper cable organization is essential in modern infrastructure projects to enhance safety, functionality, and energy efficiency. The rapid growth of smart cities and metro projects is accelerating the adoption of structured cabling systems. Large-scale urbanization is driving demand for advanced cable management solutions in transportation, healthcare, and educational institutions. The Interim Budget 2024-25 outlays the capital investment for infrastructure, which is increased by 11.1% to ₹11.11 lakh crore (US$133.86 billion), accounting for 3.4% of GDP, further fueling the market growth. High-rise buildings and complex structures require well-designed cable pathways to prevent electrical hazards and ensure reliability. The rise in commercial office spaces and IT hubs is influencing the demand for cable trays, conduits, and raceways. Infrastructure projects involving power plants and substations need cable management for seamless energy transmission and distribution. The growing industrialization in sectors like manufacturing and logistics is encouraging structured cabling for operational efficiency. The rising adoption of modern electrical systems in buildings is also catalyzing the need for organized cable routing solutions. Furthermore, enhanced safety standards and regulatory mandates are compelling developers to implement proper cable management practices.

To get more information on this market, Request Sample

Growing IT and Telecom Sector

Rapid development of data centers and cloud computing infrastructure is influencing the India cable management market outlook positively. Expanding 5G networks require efficient cable management to support high-speed data transmission and connectivity. Moreover, the rising adoption of fiber optic cables is increasing the need for organized routing and protection systems. The growing penetration of smartphones and internet services is also driving telecom operators to enhance network infrastructure. Besides this, smart city projects and IoT deployments are fueling demand for structured cabling in urban developments. Expansion of corporate offices and IT parks is catalyzing the demand for cable trays, conduits, and raceways. The escalating demand for uninterrupted connectivity is also driving investment in advanced cable management solutions for network reliability. Telecom towers and base stations require structured wiring systems to handle increasing data traffic efficiently. Apart from this, rising cybersecurity concerns necessitate secure and well-organized cabling for IT infrastructure protection. In February 2025, NTT unveiled a new data center campus in Kolkata, West Bengal, within the Bengal Silicon Valley Tech Hub. Spanning 7.5 acres, the facility will cover over 600,000 square feet upon completion, supporting high-capacity IT loads. Its first phase includes a 100,000 square-foot building with a 9MW facility load and 6MW IT load.

India Cable Management Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product, material, and end user.

Product Insights:

- Cable Trays

- Cable Raceways

- Cable Conduits

- Cable Connectors and Glands

- Cable Carriers

- Cable Lugs

- Cable Junction Box

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes cable trays, cable raceways, cable conduits, cable connectors and glands, cable carriers, cable lugs, cable junction box, and others.

Material Insights:

- Metallic

- Non-Metallic

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes metallic and non-metallic.

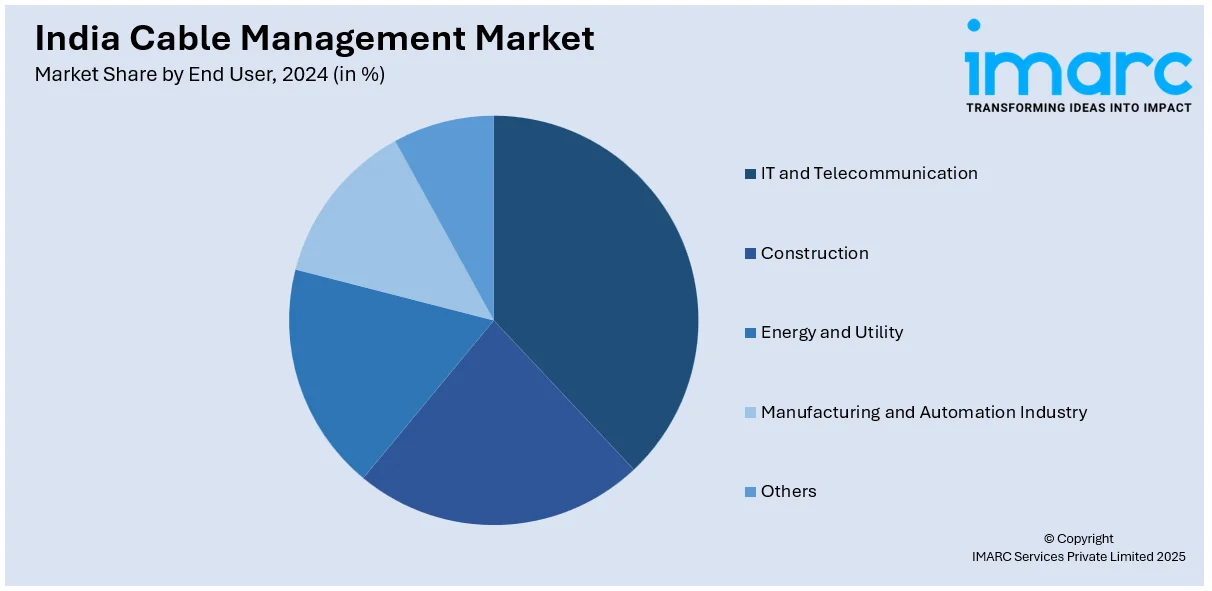

End User Insights:

- IT and Telecommunication

- Construction

- Energy and Utility

- Manufacturing and Automation Industry

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes IT and telecommunication, construction, energy and utility, manufacturing and automation industry, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Cable Management Market News:

- In October 2024, HellermannTyton, a global leader in cable management solutions, begun constructing a precision manufacturing facility in Chennai, India. Set for completion by Q3 2025, the state-of-the-art plant will significantly enhance production capacity. It will feature advanced injection molding technology, support the 'Make in India' initiative, and create around 100 local jobs, strengthening the manufacturing sector.

- In October 2024, PV Lumens become the national distributor for CommScope's enterprise products in India, expanding access to structured cabling and connectivity solutions. This partnership strengthens cable management infrastructure, supporting data centers, smart buildings, and telecom networks. It enhances market reach, driving growth in India's digital and enterprise connectivity sectors with advanced fiber and copper solutions.

India Cable Management Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Cable Trays, Cable Raceways, Cable Conduits, Cable Connectors and Glands, Cable Carriers, Cable Lugs, Cable Junction Box, Others |

| Materials Covered | Metallic, Non-Metallic |

| End Users Covered | IT and Telecommunication, Construction, Energy and Utility, Manufacturing and Automation Industry, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India cable management market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India cable management market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India cable management industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The cable management market in India was valued at USD 0.93 Billion in 2024.

The India cable management market is projected to exhibit a CAGR of 6.50% during 2025-2033, reaching a value of USD 1.64 Billion by 2033.

India cable management market is expanding due to rapid urbanization, infrastructure projects like metros and smart cities, and the growth of data centers and telecom networks. Increased demand for organized wiring in commercial and residential buildings, along with safety regulations and the push for digitalization, further drive the need for efficient cable solutions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)