India Auto Parts Manufacturing Market Size, Share, Trends and Forecast by Component Type, Sales Channel, Vehicle Type, and Region, 2025-2033

India Auto Parts Manufacturing Market Size and Share:

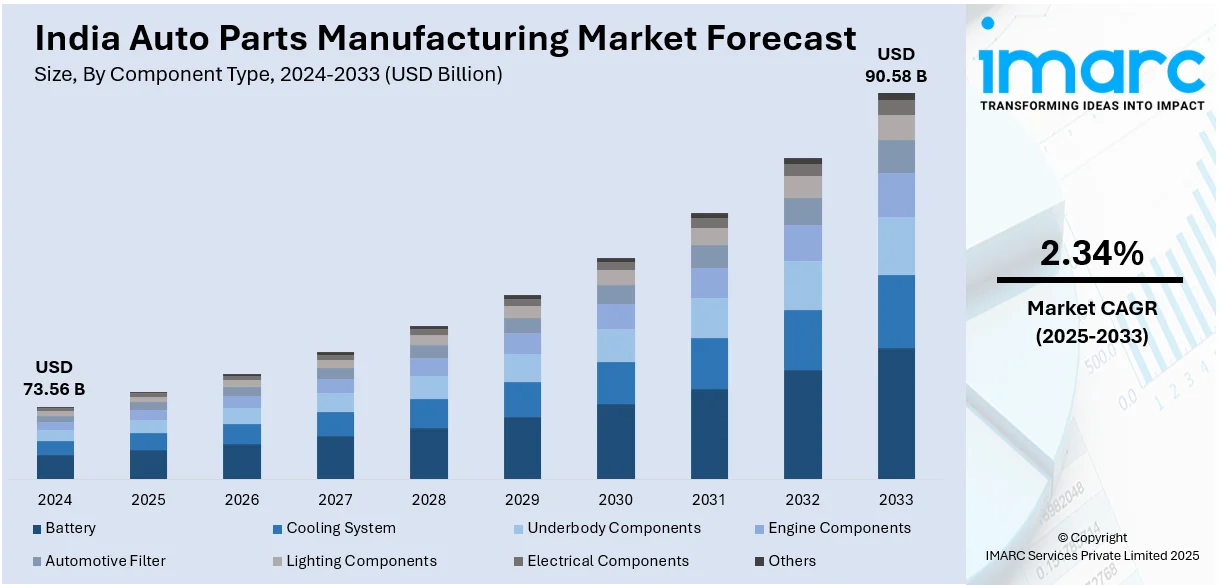

The India auto parts manufacturing market size reached USD 73.56 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 90.58 Billion by 2033, exhibiting a growth rate (CAGR) of 2.34% during 2025-2033. The India auto parts manufacturing market share is influenced by rising vehicle production, growing aftermarket demand, and technological advancements in production technology. Besides this, increased localization, government initiatives, and expanding e-commerce are further strengthening component manufacturing, distribution, and innovation across the sector.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 73.56 Billion |

| Market Forecast in 2033 | USD 90.58 Billion |

| Market Growth Rate (2025-2033) | 2.34% |

India Auto Parts Manufacturing Market Trends:

Growing Aftermarket Demand

Rising vehicle ownership is driving higher demand for maintenance, repairs, and spare parts across India. Aging vehicles require frequent servicing, influencing sales of essential components like brakes, filters, and batteries. The expanding network of service centers and garages is further fueling the India auto parts manufacturing market growth. Customers increasingly prefer high-quality aftermarket parts for cost-effective vehicle maintenance and repairs. E-commerce platforms are enhancing market reach, making auto parts more accessible and improving distribution efficiency. In December 2024, myTVS launched myTVS Hypermart, a quick commerce solution ensuring auto parts delivery within 1-2 hours. The rise in road transportation is increasing wear and tear, necessitating frequent part replacements. Technological advancements in vehicles are driving demand for advanced aftermarket components and diagnostic tools. Increasing urbanization is contributing to higher vehicle usage, accelerating the need for regular servicing. Government regulations on vehicle safety and emissions are encouraging timely maintenance and component upgrades. The unorganized sector is gradually formalizing, improving product quality and aftermarket service standards. Global players are investing in India’s aftermarket sector, bringing advanced technology and better distribution networks. With plans for 50 dark stores by March 2025 and 250 nationwide in 2-3 years, myTVS aims to reduce supply chain costs by 30% through AI-driven logistics and EV-based last-mile delivery.

To get more information on this market, Request Sample

Rising Vehicle Production

Rising vehicle production is significantly influencing the India auto parts manufacturing market outlook by increasing component demand. Automakers are expanding production capacity to meet the rising demand for passenger and commercial vehicles. In September 2024, total production of passenger vehicles, three-wheelers, two-wheelers, and quadricycles stood at 27,73,039 units. This surge is driving higher consumption of essential auto parts including engines, transmissions, and braking systems. Manufacturers are investing in advanced production techniques to improve efficiency and reduce costs. Increased localization of component manufacturing is strengthening domestic supply chains and reducing dependency on imports. Government policies like the Automotive Mission Plan are supporting higher production levels and industry growth. The growing preference for personal mobility is further accelerating vehicle manufacturing in India. As a result, during April-September FY25, production of three-wheelers, two-wheelers, passenger vehicles, commercial vehicles, and quadricycles reached 1,56,22,388 units. Higher vehicle production is creating opportunities for small and medium auto component manufacturers. OEMs are collaborating with suppliers to enhance product quality. Rising exports of India-made vehicles are increasing demand for globally competitive auto components. With the Indian passenger car market projected to reach US$ 54.84 billion by 2027, growing at over 9% CAGR, the demand for auto parts will continue rising.

India Auto Parts Manufacturing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on component type, sales channel, and vehicle type.

Component Type Insights:

- Battery

- Cooling System

- Underbody Components

- Engine Components

- Automotive Filter

- Lighting Components

- Electrical Components

- Others

The report has provided a detailed breakup and analysis of the market based on the component. This includes battery, cooling system, underbody components, engine components, automotive filter, lighting components, electrical components, and others.

Sales Channel Insights:

.webp)

- OEM

- Aftermarket

A detailed breakup and analysis of the market based on the sales channel have also been provided in the report. This includes OEM and aftermarket.

Vehicle Type Insights:

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Others

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes passenger cars, light commercial vehicles, heavy commercial vehicles, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Auto Parts Manufacturing Market News:

- In April 2024, Tata Motors opened a 1 lakh square-foot advanced commercial vehicle spare parts warehouse located in Guwahati. This fully digitalized facility ensures the seamless supply of Tata Genuine spare parts across the Northeast region. Partnering with Delhivery, India’s leading logistics provider, Tata Motors aims to enhance service efficiency and maximize vehicle uptime for its customers.

- In September 2024, Samvardhana Motherson International, a leading Indian auto parts manufacturer, plans to raise up to $715 million through a Qualified Institutional Placement (QIP) in September 2024. The funds will support debt repayment, capital expenditure, and expansion initiatives.

India Auto Parts Manufacturing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Component Types Covered | Battery, Cooling System, Underbody Components, Engine Components, Automotive Filter, Lighting Components, Electrical Components, Others |

| Sales Channels Covered | OEM, Aftermarket |

| Vehicle Types Covered | Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India auto parts manufacturing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India auto parts manufacturing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India auto parts manufacturing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India auto parts manufacturing market was valued at USD 73.56 Billion in 2024.

The India auto parts manufacturing market is projected to exhibit a CAGR of 2.34% during 2025-2033, reaching a value of USD 90.58 Billion by 2033.

Growing vehicle production, expanding demand for electric and hybrid components, and government incentives under the Make-in-India program are the primary drivers of the Indian auto parts manufacturing business. OEM localization efforts, export growth, and robust supplier ecosystems boost competitiveness. Technological upgrades, joint ventures, and rising domestic automotive consumption further accelerate industry expansion.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)