India 3D Printing Market Size, Share, Trends and Forecast by Technology, Process, Material, Offering, End User, and Region, 2026-2034

India 3D Printing Market Size and Share:

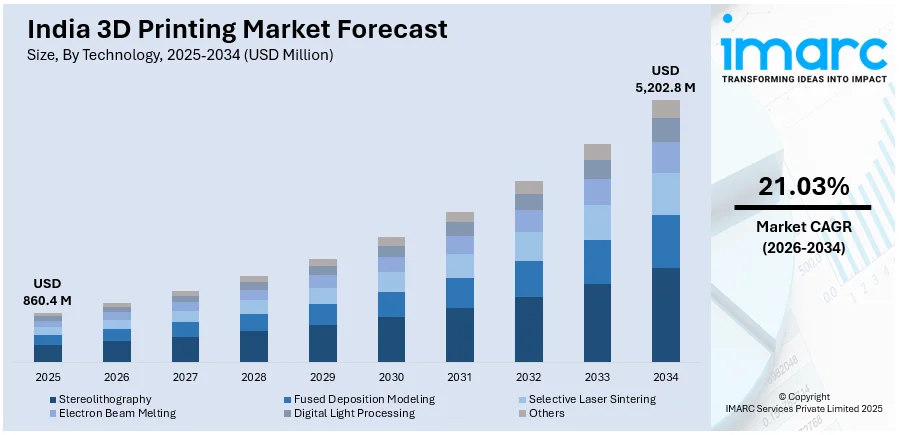

The India 3D printing market size was valued at USD 860.4 Million in 2025. Looking forward, IMARC Group estimates the market to reach USD 5,202.8 Million by 2034, exhibiting a CAGR of 21.03% from 2026-2034. The India 3D printing market size is expanding due to rising adoption of advanced manufacturing technologies across various sectors, such as automotive, healthcare, and construction. Moreover, government initiatives promoting innovation, increasing demand for customized products, and advancements in materials and machinery are further driving the market’s growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034 |

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 860.4 Million |

| Market Forecast in 2034 | USD 5,202.8 Million |

| Market Growth Rate (2026-2034) | 21.03% |

The market in India is primarily driven by its increasing adoption across industries such as automotive, aerospace, and healthcare. Moreover, growing demand for rapid prototyping and the customization of products is streamlining production processes and reducing lead times for manufacturers, thereby propelling the market. Furthermore, government favorable initiatives for ‘Make in India’ and technology innovation are encouraging businesses to adopt advanced manufacturing technologies such as 3D printing, which in turn is fostering the India 3D printing market demand. For instance, on September 25, 2024, the Indian government set a new target of hitting USD 100 Billion in annual inflows of foreign direct investment while building on its "Make in India" campaign, which started a decade earlier. Since its launch, India has attracted USD 667.4 Billion FDI over the last ten years. The inflow has significantly risen from USD 304.1 Billion recorded during 2004-2014. Moreover, FDI equity inflow in the manufacturing sector rose to USD165 Billion from 2014 to 2024, up 69% compared to the preceding decade. Apart from this, the escalating demand for sustainable manufacturing solutions is promoting the use of 3D printing technologies that reduce material waste and ensure energy-efficient production.

To get more information on this market Request Sample

Another factor driving the market's expansion is the growing use of 3D printing in research, building, and education. According to recent industry reports, 3D printing is revolutionizing construction in India by enabling complex designs, reducing building times, and promoting sustainability with fast-setting, waste-reducing concrete. A 2,500-square-foot home can now be built in two weeks instead of four months. Landmark projects include the Ulsoor Bazaar Post Office in Karnataka, completed in 43 days instead of six months, and India’s first commercial onsite 3D-printed buildings at MES Tambaram by Chennai-based startup Kelvin6k. Moreover, the rise in affordability and accessibility of 3D printers are also making the technology viable for small and medium enterprises (SMEs), thereby fostering the market. Besides, ongoing advancements in the materials and process of 3D printing include the development of metal and bio-based filaments, which has broadened the applications of the technology across all sectors, which is further contributing to the growth of the market further.

India 3D Printing Market Trends:

Integration of Additive Manufacturing in Education and Training

The India 3D Printing Market Share is expanding as educational institutions increasingly incorporate additive manufacturing into curriculums and training programs. For instance, In July 2024, Tvasta Manufacturing Solutions, a deep-tech startup specializing in construction 3D printing, inaugurated Kerala's first concrete 3D printing research lab at Saintgits College of Engineering. This state-of-the-art facility serves as a hub for research and development, focusing on innovative concrete 3D printing methodologies to revolutionize construction practices. The lab has equipment such as 'NIRMAAN RD11' 3D printer which can print volumes up to one cubic meter to explore sustainable and efficient construction solutions. This trend equips students with industry-relevant skills and promotes innovation, fostering a new generation of professionals adept at leveraging 3D printing technologies. As more universities and vocational training centers integrate 3D printing into their courses, the India 3D Printing Market Outlook indicates a growing demand for affordable and advanced 3D printers, contributing to market growth across the education sector.

Rising Adoption in Medical and Dental Applications

The India 3D printing market growth is significantly influenced by the increasing use of 3D printing in the medical and dental industries. For instance, on October 28, 2024, India Today reported that Indian scientists have developed a sustainable 3D printing technique for dental restoration called Photoinduced Radical Polymerisation (PRP), which eliminates the need for solvents and heat. This light-activated chemical process uses a photoinitiator to trigger reactions that bond molecules together, forming solid materials without heat, making it safer and more environmentally friendly. Customizable prosthetics, dental implants, and surgical models are being manufactured with precision, reducing lead times and improving patient outcomes. This technology’s ability to produce patient-specific solutions is driving its adoption in healthcare. As advancements in bioprinting emerge, the India 3D Printing Market Outlook highlights its potential to revolutionize the medical field, further bolstering market share.

Expansion of Industrial Applications

The India 3D printing market outlook underscores the expanding use of 3D printing in industrial sectors such as automotive, aerospace, and consumer goods. For instance, on May 9, 2024, the Indian Space Research Organization (ISRO) successfully completed a hot test of a liquid rocket engine made with 3D printing or additive manufacturing. This innovative technique brought down the number of engine components from a total of 14 to just one single piece, eradicated 19 weld joints, and reduced raw material usage from 565 kg to 13.7 kg. This saved 60% of the production time, which is a significant milestone in India's space program. Businesses are leveraging this technology for rapid prototyping, tool manufacturing, and low-volume production, leading to reduced costs and enhanced efficiency. With increasing investments in advanced manufacturing technologies, the India 3D Printing Market Share is expected to grow significantly. Besides, India 3D printing market trend is further supported by government initiatives, fostering innovation and adoption across diverse industries.

India 3D Printing Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India 3D printing market, along with forecasts at the regional and country levels from 2026-2034. The market has been categorized based on technology, process, material, offering, application, and end user.

Analysis by Technology:

- Stereolithography

- Fused Deposition Modeling

- Selective Laser Sintering

- Electron Beam Melting

- Digital Light Processing

- Others

Stereolithography (SLA) is one of the pioneering technologies in 3D printing as it has unmatched precision and surface finish. SLA has been gaining significant attention in sectors such as healthcare, automotive, and jewelry due to its capability to produce complex and highly detailed prototypes in India. The usage of liquid photopolymer resins ensures that the technology holds high accuracy. It is apt for industries demanding rapid prototyping and customized designs that fuel India's innovation-driven manufacturing landscape.

Fused Deposition Modeling (FDM) is the most popular 3D printing technology in India as it is a cost-effective and versatile solution. Its affordability and compatibility with a wide range of thermoplastics make it highly accessible for startups, educational institutions, and small businesses. FDM is widely used in product development, functional prototyping, and low-volume manufacturing. The ease of use and adaptability of FDM have made it a key driver for the democratization of 3D printing technology in India.

Selective Laser Sintering (SLS) plays a vital role in the industrial 3D printing capabilities of India as it is allowing the creation of hard parts with high performance without the need for support structures. The aerospace, automotive, and the defense industries are using it as it allows them to work with robust materials like nylon or composites; it's crucial in creating critical geometries and functional elements toward a strategy of advanced manufacturing and self-reliance in technology development.

Analysis by Process:

- Binder Jetting

- Directed Energy Deposition

- Material Extrusion

- Material Jetting

- Power Bed Fusion

- Sheet Lamination

- Vat Photopolymerization

Binder jetting is gaining traction in the Indian 3D printing market, given its low cost and potential for producing highly accurate complex geometries. Industries such as automotive and healthcare widely apply this technology, enabling mass customization and prototyping using metals, sand, and ceramics. Energy efficiency is an added advantage as this technology does not rely on high-temperature processes, in line with the sustainability goals of India and helping in innovation across diverse sectors.

Directed energy deposition is the key in India's aerospace, defense, and heavy engineering sectors as it allows for precise control over the repair and addition of material to existing components. The fact that it can work with high-performance metals such as titanium and nickel alloys add to its appeal for crucial applications. In indigenizing advanced manufacturing in India, DED supports the production of durable, lightweight components, which will lead to cost reduction and better operational efficiency.

Material extrusion, with Fused Deposition Modeling (FDM) being the most common, is the most accessible and widely adopted 3D printing method in India, for education, consumer goods, and small-scale industries. Its affordability and ease of use make it ideal for prototyping and low-volume production. With advancements in filament materials and printer designs, material extrusion technology drives innovation at grassroots levels, empowering startups and SMEs to explore creative applications and accelerate product development.

Analysis by Material:

- Photopolymers

- Plastics

- Metals and Ceramics

- Others

Photopolymers are significant for India's 3D printing sector, particularly in the fields of healthcare, automotive, and consumer goods. They are accurate, which helps to produce precise and intricate parts. Being widely applied in dental prosthetics, medical models, and lightweight prototypes, photopolymers are key enablers of rapid innovation. Their amenability to stereolithography and digital light processing technologies enhances India's status in additive manufacturing.

Plastics are involved in the Indian 3D printing market in large measure, due to its cost-effectiveness, versatility, and lightness. ABS, PLA, and nylon are frequently used materials in education and aerospace industries to develop durable prototypes, tools, and parts. Functionality intensifies their applications in making tools and parts. The use of recycled plastics is growing fast as a result of the Indian emphasis on sustainable manufacturing, which intensifies the role of plastics in making innovation accessible.

Metals and ceramics are significant to the 3D printing applications of India, especially in the high-performance sectors such as aerospace, defense, and healthcare. Metals such as titanium and stainless steel are used for making tough components, whereas ceramics are used due to their heat resistance and biocompatibility. This will allow India to produce custom implants, intricate tools, and tough parts with the emphasis placed on precision and functionality in additive manufacturing technologies.

Analysis by Offering:

- Printer

- Material

- Software

- Service

Printers play a vital role in the India's 3D printing ecosystem. They encompass the core technology driving the sector forward, and their range from entry-level desktop models to highly advanced industrial-grade systems catering to all sectors, be it healthcare, automotive, and aerospace. Their adoption is constantly on the rise due to delivering precise, fast prototyping solutions at a much lower cost for production, and thereby, they have become an important part of the manufacturing and innovation landscape in India.

In India, materials are crucial in defining the capabilities and range of applications of 3D printing. The market comes with a plethora of materials in polymers, metals, ceramics, and composites, ensuring industry-specific solutions. With continuous advancement in material science, 3D printing materials have become increasingly tailored towards strength, flexibility, and biocompatibility. This versatility has become critical to sectors such as healthcare and construction, driving adoption for sustainable and efficient manufacturing processes.

Software plays a vital role in the India's 3D printing market as they enable precision and customization. It bridges the gap between design and execution, offering tools for modeling, slicing, and optimizing print workflows. With the rise of AI and machine learning integration, 3D printing software is becoming smarter, enhancing efficiency and reducing errors. The software's adaptability to diverse industries ensures seamless integration, supporting the broader adoption of 3D printing technology across the nation.

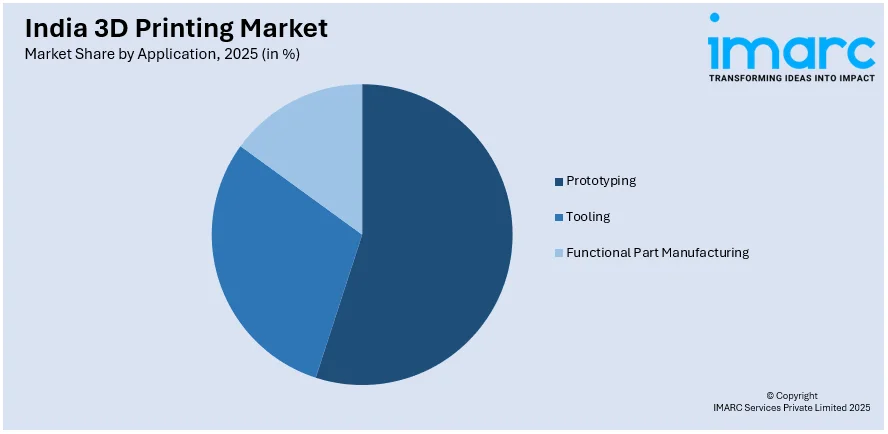

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Prototyping

- Tooling

- Functional Part Manufacturing

Prototyping is an essential part of the growing 3D printing market in India. It allows companies to design and test prototypes quickly for products, thereby minimizing flaws in design and reducing production costs by identifying the problems at the earliest stages. Innovation is improved with prototyping as it allows rapid iteration and refinement, which are crucial in sectors such as automotive, healthcare, and consumer goods, where customized and efficient solutions are in great demand.

Tooling in the India 3D printing market is important for producing specialized tools, molds, and dies needed during the manufacturing process. The high precision and flexibility of 3D printing enables manufacturers to make complex, high-quality tooling components in a much shorter period than with conventional methods. It is especially important in aerospace and automotive industries where the demand for customized tools and parts is constantly high, and lead times can be reduced to improve production efficiency.

Functional part manufacturing in India's 3D printing market is revolutionizing the way industries produce end-use part as it is one of the fastest ways to achieve the production of parts with very intricate geometries and customized features. Industries such as healthcare, aerospace, and automobile greatly benefit from this advancement due to the 3D printing technology that is capable of producing high-performance, cost-effective, durable parts on-demand, thus more innovation and a better supply chain.

Analysis by End User:

- Consumer Products

- Machinery

- Healthcare

- Aerospace

- Automobile

- Others

Consumer goods majorly contribute towards the Indian market for 3D printing as its demand is shifting toward more customer-centricity of product. On one hand, companies are also using 3D printing, creating custom made consumer products and commodities such as footwear, eyewear and fashion accessories while fulfilling personal individual tastes. Furthermore, the speedy prototype feature brings down manufacturing and production time hence consumers have customized unique "on-demand products".

Machinery is one of the most crucial sectors in the Indian 3D printing market, especially with manufacturing and industrial applications. Production in industries such as automotive, aerospace, and engineering has become revolutionized as of the ability to create complex parts and prototypes with very high precision. 3D printing allows the cost-effective and efficient manufacturing of machinery components and offers advantages such as reduced waste, faster prototyping, and the production of intricate designs that were not possible with earlier methods.

Healthcare can be considered one of the most promising sectors for 3D printing in India as it is revolutionizing medical device production, prosthetics, and personalized treatments within healthcare. Patients' outcomes improve due to the custom implants, prosthetic limbs, and surgical guides produced using 3D printing. On the other side, drug delivery systems and tissue engineering have come forward to influence and further advance the concept of regenerative medicine. Affordability, with its promise of a patient-specific solution, marks one of the big breakthroughs of this technology for the healthcare sector.

Regional Analysis:

- South India

- East India

- West and Central India

- North India

South India holds a significant market share in the 3D printing market in India, led by its solid industrial base, technological advancements, and growing education and research initiatives. South India is home to some of the most prominent companies in the automotive, aerospace, and healthcare industries, and several major players and research institutions are focusing on 3D printing. The region has a well-developed manufacturing base that supports the adoption of 3D printing technologies, thereby becoming a place for innovation and production.

East India, while traditionally less industrialized compared to other regions, is gradually emerging as an important player in the 3D printing market. Growing infrastructure development, coupled with increased industrial sectors, such as mining and steel, is creating a new wave of opportunities for 3D printing. Another reason is that investments in educational institutions are increasing in East India, which develops a robust talent pool to promote the growth of 3D printing in sectors like engineering and healthcare.

West and Central India are considered to be contributing significantly to the growth of 3D printing market. Important regional contributors include Gujarat and Maharashtra. Some of the world's largest production hubs, together with the nation's largest automobile, aerospace, and electronics giants, offer excellent opportunities for deploying 3D printing. Fast-growing technology states in Central India and government's initiatives support innovating and executing 3D printing in many sectors, including academia, medical, and prototyping.

North India is also an important market for Indian 3D printing. Delhi NCR is fast becoming a technology and business hub. The infrastructure in the region consists of a strong network of manufacturing, educational, and research institutions that support the integration of 3D printing into various sectors such as automotive, healthcare, and consumer goods. Innovation is valued here in North India, and the government policies supporting advanced technologies continue to position the region as a primary and integral player in the 3D printing landscape of the nation.

Competitive Landscape:

The India 3D printing market has a dynamic competitive landscape, as this market consists of several established global players and emerging domestic companies. This market is led by some key industries such as aerospace, automotive, healthcare, and manufacturing. There is increased usage of 3D printing technology in the respective industries for prototyping, product design, and custom manufacturing. Indian companies invest heavily in the research and development of capabilities. Further, companies here are trying to expand their product offerings and enhance efficiency in costs. The competition created by the sprouting of startup companies and partnerships between research institutions would further fuel competitiveness and innovation. Government policies for the support and encouragement of its market growth is also opening scope for new competition and collaboration as well.

The report provides a comprehensive analysis of the competitive landscape in the India 3D printing market with detailed profiles of all major companies.

Latest News and Developments:

- On October 17, 2024, Sparsh Hospitals announced the inauguration of India's first cutting-edge on-site 3D printing lab at the company's Bengaluru facility. This state-of-the-art lab is planned to transform orthopedic and personalized care by providing comprehensive solutions from scanning to the development of final customized models under one roof. The 3D printing technology integration is projected to enhance surgical precision, minimize long-term healthcare costs, and reduce recovery times .

- On July 26, 2024, not-for-profit trust Tara Prakashana dedicated to preserving Vedic knowledge inaugurated India's first 3D printing laboratory for manuscript preservation at their Vedic Library and Research Centre in Kunjarugiri. This state-of-the-art facility aims to replicate and preserve ancient manuscripts with unparalleled precision, addressing the urgent need to conserve India's rich literary heritage. The lab is 3D printing the world's oldest copy of the Bhagavad Gita, ensuring preservation for hundreds of years, in a groundbreaking initiative.

- On May 31, 2024, Wipro 3D in collaboration with the Indian Space Research Organisation (ISRO) successfully manufactured the PS4 3D-printed rocket engine for the fourth stage of the Polar Satellite Launch Vehicle (PSLV). This collaboration utilized DfAM and LPBF technology to combine multiple intricate components into a single unified production unit. Incorporating intricate cooling channels into its design, the 3D-printed PS4 engine emphasizes efficiency and sustainability, resulting in minimal material waste and post-print machining.

- On April 22, 2024, the Indian Institute of Technology Guwahati (IIT Guwahati) announced the launch of an advanced 3D-printed dummy ballot unit in partnership with the Kamrup Election District's Systematic Voters' Education and Electoral Participation (SVEEP) Cell. The dummy ballot unit is made from biodegradable polylactic acid (PLA) sourced from corn starch. The solution was designed and developed in over 48 hours, integrating interactive features including sound and light indicators.

India 3D Printing Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Stereolithography, Fused Deposition Modeling, Selective Laser Sintering, Electron Beam Melting, Digital Light Processing, Otherslk, Buffalo Milk, Goat Milk, Others |

| Processes Covered | Binder Jetting, Directed Energy Deposition, Material Extrusion, Material Jetting, Power Bed Fusion, Sheet Lamination, Vat Photopolymerization |

| Materials Covered | Photopolymers, Plastics, Metals and Ceramics, Others |

| Offerings Covered | Printer, Material, Software, Service |

| Applications Covered | Prototyping, Tooling, Functional Part Manufacturing |

| End Users Covered | Consumer Products, Machinery, Healthcare, Aerospace, Automobile, Others |

| Regions Covered | South India, East India, West and Central India, North India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India 3D printing market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the India 3D printing market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India 3D printing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India 3D printing market was valued at USD 860.4 Million in 2025.

The India 3D printing market is majorly driven by increasing adoption in industries such as healthcare, automotive, and construction. Additionally, advancements in technology, government initiatives supporting innovation, and rising demand for customized products are contributing to market expansion.

IMARC estimates the India 3D printing market is expected to exhibit a CAGR of 21.03% during 2026-2034.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)