GCC Power Cable Market Report by Installation (Overhead, Underground, Submarine Cables), Voltage (High, Medium, Low), End-Use Sector (Power, Infrastructure, Manufacturing, Oil and Gas, Transportation, and Others), Material (Aluminum, Copper), and Country 2025-2033

Market Overview:

The GCC power cable market size reached USD 3.6 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 6.2 Billion by 2033, exhibiting a growth rate (CAGR) of 6.3% during 2025-2033. The growing urbanization and ongoing mega-projects, rapid industrial expansion, increasing investment in renewable energy initiatives, implementation of favorable government policies, rising demand for electricity, growing emphasis on upgrading and modernization of existing power infrastructure and the integration of smart grid and Internet of Things (IoT) devices are some of the major factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.6 Billion |

| Market Forecast in 2033 | USD 6.2 Billion |

| Market Growth Rate (2025-2033) | 4.3% |

A power cable is an electrical conductor designed for the transmission of electrical power from one point to another. It is composed of a conductor, insulation, and protective sheath that plays a crucial role in various sectors, including residential, industrial, and utility applications. A power cable is utilized in multiple applications, ranging from domestic wiring to connecting power grids and industrial machinery. It offers low electrical resistance, high tensile strength, and long-lasting durability. The appropriate selection of power cables can lead to optimized performance, reduced maintenance costs, and increased safety. Power cables are instrumental in effectively distributing and utilizing electricity across various industries.

The growing urbanization and ongoing mega-projects like smart cities leading to an increasing demand for reliable and efficient power distribution networks are major factors contributing to the market growth. In addition to this, the widespread industrial expansion and the diversification of the GCC economies away from oil and gas, prompting the development of various industrial sectors, necessitating robust electrical infrastructure, is creating a positive outlook for the market growth. Besides this, the increasing investment in renewable energy initiatives to reduce carbon footprint and dependence on fossil fuels, which require specialized power cables for energy transmission, is providing a thrust to the market growth. Moreover, the rising government implementation of stricter regulations around energy efficiency and safety standards compelling companies to invest in high-quality power cables is supporting the market growth. Along with this, the integration of smart grids and the Internet of Things (IoT) devices in power management systems, creating a need for advanced power cables capable of handling higher data flow and electrical loads, is providing an impetus to the market growth.

GCC Power Cable Market Trends/Drivers:

Increasing infrastructural development

The widespread infrastructure development and rapid urbanization in the region leading to the development of various large-scale projects, including airports, metro rail systems, shopping complexes, and smart cities, are creating a positive outlook for the market growth. These complex infrastructures require a massive network of high-quality power cables to ensure a stable and efficient supply of electricity, prompting the adoption of power cables for basic electrification and advanced communication and control systems. Moreover, the implementation of government initiatives aimed at modernizing existing infrastructure is also propelling the market growth. In line with this, the rising renovation of older buildings and facilities to meet modern safety and energy-efficiency standards, often necessitating the replacement of outdated cabling systems, is also creating a positive outlook for the market growth. In addition to this, the long-term commitments in urban projects that require a robust and reliable power supply for sustainability, prompting focus on procuring premium quality power cables, is offering lucrative growth opportunities for the market.

Rising expansion of the industrial sector

The increasing diversification in the region beyond oil and gas, leading to the emergence of new industrial sectors, such as manufacturing, healthcare, and technology, is providing a considerable boost to the market growth. In line with this, the growing reliance of industries on power cables for resistance to high temperatures or corrosive environments is creating a positive outlook for the market growth. Besides this, the increasing push for economic diversification leading to strategic initiatives in the region to boost the industrial sector is positively impacting the market growth. These government-backed initiatives offer financial incentives to local and foreign investors, driving industrial development at a rapid pace. In addition to this, the growing establishment of new factories, laboratories, and data centers leading to a rising demand for diverse types of power cables for construction and operation is anticipated to drive the market growth.

GCC Power Cable Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the GCC power cable market report, along with forecasts at the regional and country levels for 2025-2033. Our report has categorized the market based on installation, voltage, end-use sector, and material.

Breakup by Installation:

- Overhead

- Underground

- Submarine Cables

The report has provided a detailed breakup and analysis of the market based on the installation. This includes overhead, underground, and submarine cables.

Overhead cables are installed above ground, typically suspended from poles or towers. They are commonly used for electricity distribution in suburban and rural areas where underground installation is less feasible.

Underground cables are laid beneath the ground, often encased in a protective sheath. These cables are employed in urban settings to avoid visual clutter and minimize environmental impact.

Submarine cables are specialized conductors laid under bodies of water to connect islands or continents. These cables withstand high-pressure conditions and are usually employed for long-distance electricity or data transmission.

Breakup by Voltage:

- High

- Medium

- Low

A detailed breakup and analysis of the market based on the voltage has also been provided in the report. This includes high, medium, and low.

High-voltage cables are designed to handle voltages above 66 kV and are typically used in long-distance transmission lines and substations. These cables are essential for transmitting large amounts of electricity over vast areas.

Medium-voltage cables are suitable for voltages ranging between 1 kV and 66 kV and are commonly used in industrial applications and local distribution networks. They balance capacity and flexibility, making them ideal for medium-scale operations.

Low-voltage cables operate at less than 1 kV and are primarily used in residential and commercial settings for applications like lighting and small machinery. These cables are designed for short-distance transmission and are often more flexible and easier to install.

Breakup by End-Use Sector:

- Power

- Infrastructure

- Manufacturing

- Oil and Gas

- Transportation

- Others

The report has provided a detailed breakup and analysis of the market based on the end-use sector. This includes power, infrastructure, manufacturing, oil and gas, transportation, and others.

The power sector utilizes specialized cables for electricity generation, transmission, and distribution. These cables are essential for connecting power plants to substations and consumers.

Power cables also play a vital role in large infrastructure projects like airports, highways, and smart cities, in electrification, lighting, and operating control systems, which are crucial for the functioning of these facilities.

The manufacturing sector requires a range of power cables for operating heavy machinery, production lines, and automation systems. The type and quality of cables used can directly impact operational efficiency and safety.

Power cables are used in the oil and gas industry for exploration, drilling, and processing activities. These cables meet stringent safety and performance criteria due to the hazardous environments in which they operate.

Power cables are integral to the transportation sector and are used in railways, metro lines, and electric vehicle charging stations. These cables provide a consistent and reliable power supply to keep transport systems operational.

Breakup by Material:

- Aluminum

- Copper

A detailed breakup and analysis of the market based on the material has also been provided in the report. This includes aluminum and copper.

Aluminum is a widely used conductor material in the power cable industry due to its lightweight nature and lower cost. It is employed in overhead transmission lines and applications where weight is a significant factor. Moreover, aluminum cables are easier to handle and install, making them suitable for projects with tight timelines.

Copper is known for its superior electrical conductivity and durability in various high-performance applications. It is commonly used in underground and high-demand industrial settings where optimal conductivity and reliability are paramount. Additionally, copper cables tend to have a longer lifespan, reducing the need for frequent replacements and thereby lowering long-term costs.

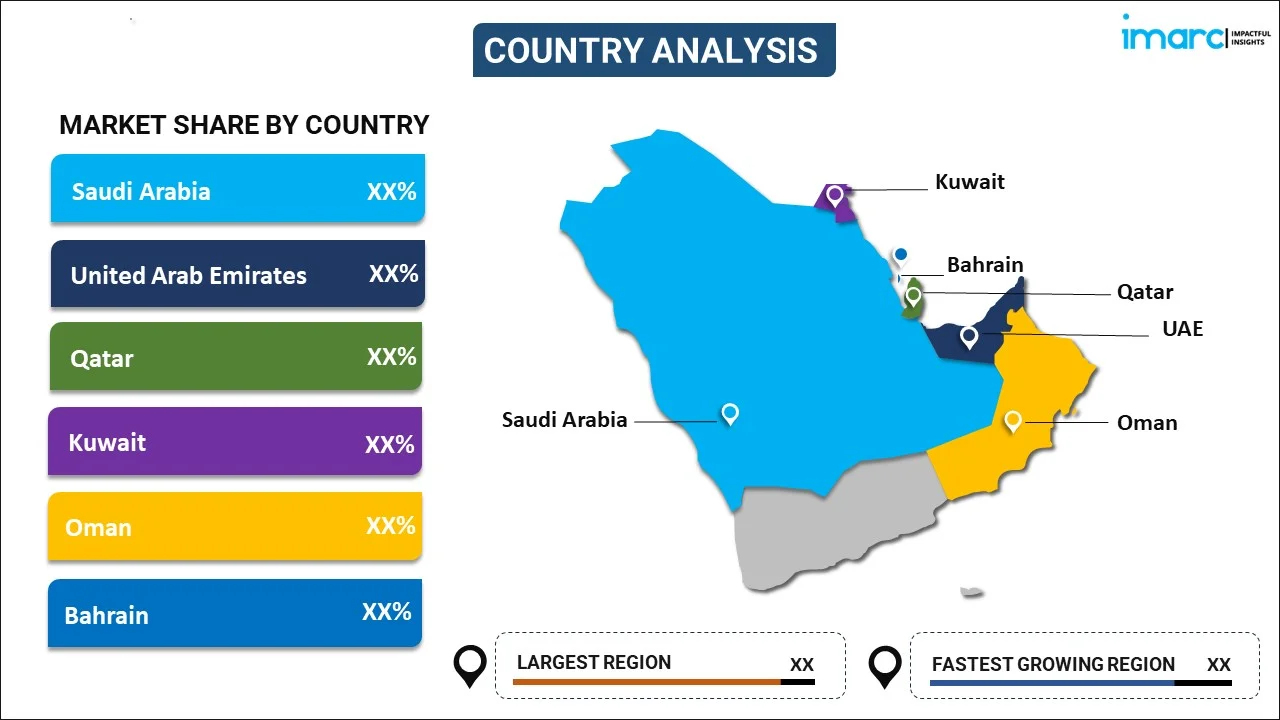

Breakup by Country:

- Saudi Arabia

- UAE

- Qatar

- Bahrain

- Kuwait

- Oman

The report has also provided a comprehensive analysis of all the major regional markets, which include Saudi Arabia, the UAE, Qatar, Bahrain, Kuwait, and Oman.

Saudi Arabia is the largest economy in the GCC region and has substantial infrastructure and industrial projects driving the demand for power cables. Additionally, Saudi Arabia's increasing investment in renewable energy, leading to a growing demand for specialized requirements in power cables that can handle varying load conditions, is supporting the market growth.

The United Arab Emirates (UAE) strongly focuses on smart city developments and renewable energy projects, presenting a burgeoning market for advanced power cables. Cities like Dubai and Abu Dhabi are centers for power distribution and consumption innovation.

Qatar is investing in large-scale infrastructure projects, leading to an increasing demand for high-quality power cables. The country is also advancing in its LNG and renewable energy sectors, creating more opportunities for power cable usage.

Bahrain has been investing in its industrial and manufacturing sectors, prompting the increasing demand for specialized power cables suitable for such environments. Bahrain's push for digital transformation also necessitates reliable and advanced cabling solutions.

Kuwait is focusing on upgrading its existing infrastructure and expanding its renewable energy projects, creating a solid power cable market. The country's economic development plans further stimulate the need for robust electrical systems.

Oman is expanding in sectors like tourism, manufacturing, and logistics, leading to specific power cable requirements, making the country a notable market in the GCC region. Besides this, the increasing foreign direct investment (FDI) in Oman's diverse sectors also propels the need for high-quality power cables.

Competitive Landscape:

The leading companies in the power cable market are investing in research and development (R&D) to produce more efficient, durable, and environmentally friendly cables. It includes the development of fire-resistant and low-smoke cables and cables that can handle higher voltages. Besides this, many companies are expanding their manufacturing capabilities by establishing new plants and upgrading the existing ones to increase production volume. Moreover, some companies are forming strategic alliances, mergers, and acquisitions to broaden their market reach. These collaborations often include partnerships with local firms to better adapt products to regional requirements. In line with this, the key companies are offering customized cable solutions, involving tailored designs and specifications for projects in industries like oil and gas, renewables, and transportation. Furthermore, companies are adopting eco-friendly practices that include the use of recyclable materials and sustainable manufacturing processes. Along with this, companies are increasingly leveraging digital platforms for customer engagement, providing online catalogs, virtual customer service, and technical support.

The market research report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided.

GCC Power Cable Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Installations Covered | Overhead, Underground, Submarine Cables |

| Voltages Covered | High, Medium, Low |

| End-Use Sectors Covered | Power, Infrastructure, Manufacturing, Oil and Gas, Transportation, Others |

| Materials Covered | Aluminum, Copper |

| Countries Covered | Saudi Arabia, UAE, Qatar, Bahrain, Kuwait, Oman |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the GCC power cable market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the GCC power cable market?

- What is the impact of each driver, restraint, and opportunity on the GCC power cable market?

- What is the breakup of the market based on the installation?

- Which is the most attractive installation in the GCC power cable market?

- What is the breakup of the market based on voltage?

- Which is the most attractive voltage in the GCC power cable market?

- What is the breakup of the market based on the end-use sector?

- Which is the most attractive end-use sector in the GCC power cable market?

- What is the breakup of the market based on the material?

- Which is the most attractive material in the GCC power cable market?

- What is the competitive structure of the GCC power cable market?

- Who are the key players/companies in the GCC power cable market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the GCC power cable market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the GCC power cable market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the GCC power cable industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)