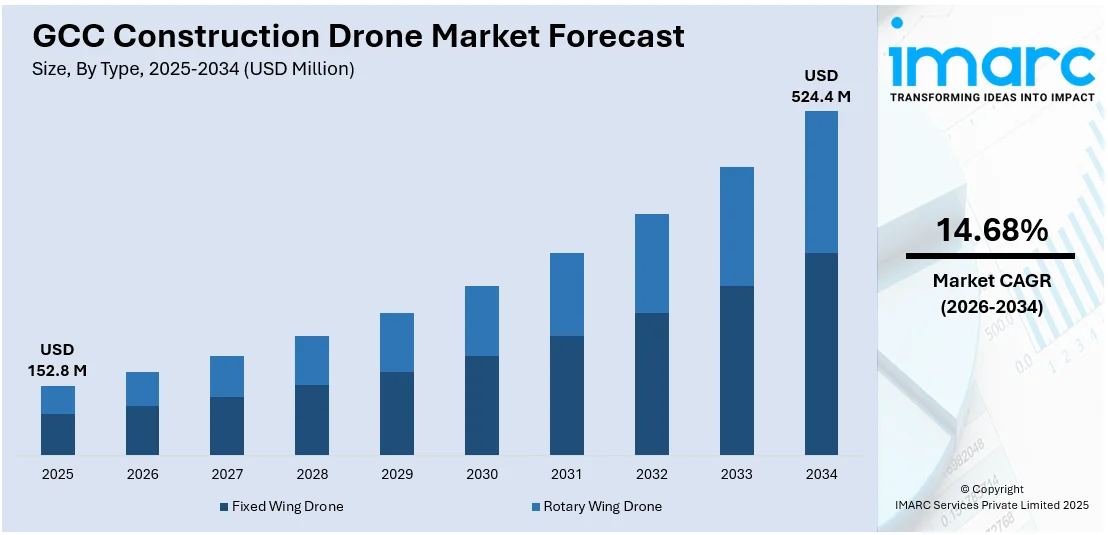

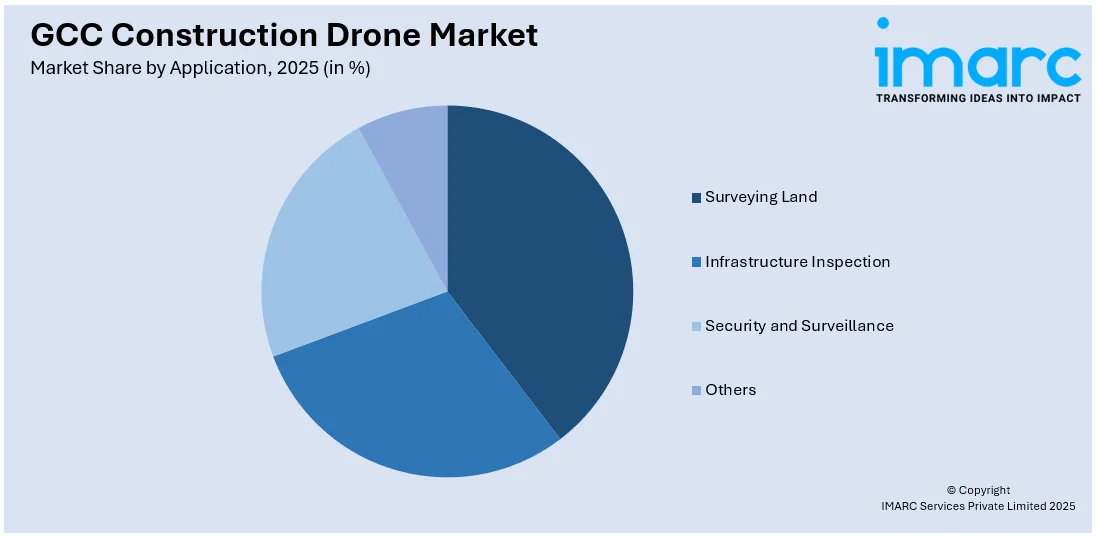

GCC Construction Drone Market Report by Type (Fixed Wing Drone, Rotary Wing Drone), Application (Surveying Land, Infrastructure Inspection, Security and Surveillance, and Others), End User (Residential, Commercial, Industrial), and Country 2026-2034

Market Overview:

GCC construction drone market size reached USD 152.8 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 524.4 Million by 2034, exhibiting a growth rate (CAGR) of 14.68% during 2026-2034. The increasing demand for construction drones equipped with advanced sensors and cameras that can capture high-resolution images and generate accurate 3D models is driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 152.8 Million |

| Market Forecast in 2034 | USD 524.4 Million |

| Market Growth Rate (2026-2034) | 14.68% |

A construction drone is an unmanned aerial vehicle (UAV) equipped with specialized technology for various tasks within the construction industry. These drones are designed to enhance efficiency, safety, and accuracy in construction processes. Equipped with high-resolution cameras, LiDAR sensors, and other advanced tools, construction drones can quickly and accurately survey construction sites, monitor progress, and create detailed 3D maps. They are employed for tasks such as site inspection, topographical mapping, volumetric analysis, and monitoring project timelines. Construction drones contribute to increased productivity by providing real-time data, reducing the need for manual labor, and enhancing overall project management. Additionally, they play a crucial role in improving safety by assessing potentially hazardous areas and ensuring compliance with safety regulations. Overall, construction drones are a valuable technological asset, revolutionizing the construction industry through their versatility and efficiency.

To get more information on this market Request Sample

GCC Construction Drone Market Trends:

The construction drone market in GCC is experiencing unprecedented growth, primarily driven by a confluence of factors that collectively underscore the industry's transformative trajectory. Firstly, advancements in drone technology have propelled the construction sector towards increased efficiency and precision. Drones equipped with sophisticated sensors and imaging capabilities enable real-time data collection, facilitating comprehensive site surveys and progress monitoring. Moreover, the escalating demand for cost-effective and time-efficient construction solutions has positioned drones as indispensable tools in project management. Through seamless integration with Building Information Modeling (BIM) systems, drones streamline communication and collaboration among construction teams, reducing delays and enhancing overall project coordination. In addition, stringent safety regulations and a growing emphasis on minimizing on-site risks have spurred the adoption of construction drones. UAVs contribute to safer inspection procedures, especially in hazardous or hard-to-reach areas, mitigating potential accidents and ensuring worker well-being. Furthermore, the regional push towards sustainability and environmental consciousness has led construction companies to leverage drones for eco-friendly practices. Drones assist in monitoring environmental impacts, optimizing resource utilization, and promoting sustainable construction methodologies. As a result, the construction drone market in GCC is poised for sustained expansion, driven by a synergistic interplay of technological innovation, efficiency imperatives, safety considerations, and environmental responsibility.

GCC Construction Drone Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional and country levels for 2026-2034. Our report has categorized the market based on type, application, and end user.

Type Insights:

- Fixed Wing Drone

- Rotary Wing Drone

The report has provided a detailed breakup and analysis of the market based on the type. This includes fixed wing drone and rotary wing drone.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Surveying Land

- Infrastructure Inspection

- Security and Surveillance

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes surveying land, infrastructure inspection, security and surveillance, and others.

End User Insights:

- Residential

- Commercial

- Industrial

The report has provided a detailed breakup and analysis of the market based on the end user. This includes residential, commercial, and industrial.

Country Insights:

- Saudi Arabia

- United Arab Emirates

- Qatar

- Kuwait

- Oman

- Bahrain

The report has also provided a comprehensive analysis of all the major regional markets, which include Saudi Arabia, United Arab Emirates, Qatar, Kuwait, Oman, and Bahrain.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

GCC Construction Drone Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Fixed Wing Drone, Rotary Wing Drone |

| Applications Covered | Surveying Land, Infrastructure Inspection, Security and Surveillance, Others |

| End Users Covered | Residential, Commercial, Industrial |

| Countries Covered | Saudi Arabia, United Arab Emirates, Qatar, Kuwait, Oman, Bahrain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the GCC construction drone market performed so far and how will it perform in the coming years?

- What is the breakup of the GCC construction drone market on the basis of type?

- What is the breakup of the GCC construction drone market on the basis of application?

- What is the breakup of the GCC construction drone market on the basis of end user?

- What are the various stages in the value chain of the GCC construction drone market?

- What are the key driving factors and challenges in the GCC construction drone?

- What is the structure of the GCC construction drone market and who are the key players?

- What is the degree of competition in the GCC construction drone market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the GCC construction drone market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the GCC construction drone market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the GCC construction drone industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)