GCC Commercial Real Estate Market Size, Share, Trends and Forecast by Type, Solution, Application, and Country, 2025-2033

GCC Commercial Real Estate Market Size and Share:

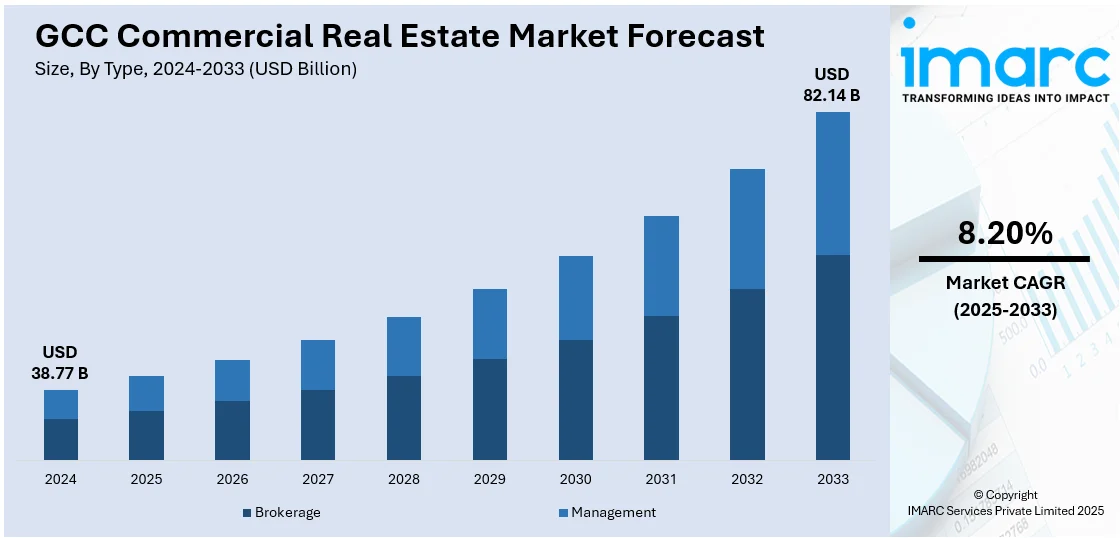

The GCC commercial real estate market size was valued at USD 38.77 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 82.14 Billion by 2033, exhibiting a CAGR of 8.20% from 2025-2033. The market is significantly driven by flourishing industrial and logistics sectors, increasing investments in the GCC region, increasing shift towards remote work that can impact demand for office space, rapid expansion of small and medium enterprises, and growing tourism and hospitality sector.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 38.77 Billion |

| Market Forecast in 2033 | USD 82.14 Billion |

| Market Growth Rate (2025-2033) | 8.20% |

The GCC market is primarily driven by the considerable growth in trade, manufacturing, and e-commerce resulting in industrial parks, logistics centers, and storage facilities. The influx of global investors further reinforces the market’s growth potential, driving development and fostering a competitive commercial real estate environment. For instance, In November 2024, The Avighna Group, through its UAE arm, Avighna Invest, has acquired the Emaar Business Park-Building 3 in Dubai from Bank Muscat’s Izdihar Real Estate Fund for Rs 555 crore. This marks the group's entry into the Gulf Cooperation Council and reflects its vision to expand real estate holdings. The property, located on Sheikh Zayed Road, is a grade A commercial tower with 150,000 sq ft of office and retail spaces, leased to top multinational and regional companies.

The GCC commercial real estate market is benefiting from a strategic shift of capital by leading investment firms towards regional opportunities. Investors are now seeking alternative destinations other than traditional global markets to capitalize on the GCC's solid economic foundation, supportive policies, and increasing demand for commercial infrastructure. Bahrain-based Investcorp is refocusing on inward GCC investments after previously prioritizing the US and European markets. It has announced a $4 billion investment pipeline, including commercial real estate ventures. This strategic shift underscores increasing opportunities within the GCC region, bolstering long-term regional economic growth and real estate sector advancements. Besides, rapid digital transformation and adoption of advanced technologies. More and more businesses want to have smart offices with modern infrastructure, such as IoT systems, automated workflows, and high-speed internet.

GCC Commercial Real Estate Market Trends:

Increasing Investments in the GCC Region

The region is seeing a growing interest in commercial real estate investments due to robust economic growth, increasing investor confidence, and properties with stable rental income. Strategic buying and selling of prime assets help funds optimize their portfolios for sustainable long-term profits. Dubai's booming commercial market, bolstered by its business-friendly policies and strong infrastructure, continues to draw both regional and global investors. Furthermore, the emphasis on high-occupancy properties ensures steady rental yields, making commercial real estate an appealing investment option across the GCC. For instance, in December 2024, Izdihar Real Estate Fund, managed by Bank Muscat, successfully finalized the transfer of ownership for Emaar Business Park – Building 3 in Dubai. The asset is part of the commercial real estate sector, and the transaction aligns with the fund’s strategy to deliver sustainable, long-term returns by investing in well-tenanted properties across the GCC region.

Rapid expansion of Small and Medium Enterprises

The government supports entrepreneurship, innovation through funding programs for entrepreneurship, business incubation facilities, and policy reform initiatives. Affordable and flexible office space, co-working facilities, and commercial spaces for the growth of small and medium enterprises are inevitable. A spurt in growth in technology, retail and professional services start-ups escalates demand. Flexible workspaces, especially in urban centers, such as Dubai and Riyadh, are changing to meet SME needs, providing cost-efficient and scalable real estate alternatives. This trend promotes the growth of a vibrant commercial real estate ecosystem, for the benefit of developers, landlords, and investors; it also supports regional economic growth and job creation.

Growing Tourism and Hospitality Sector

The expanding health and tourism sector is escalating demand for commercial real estate, especially in retail, office, and entertainment spaces. Big events like Expo 2020 Dubai, the FIFA World Cup in Qatar, and upcoming global happenings are drawing tons of visitors and businesses to the region. This uptick is leading to more investments in shopping malls, mixed-use spaces, and offices to support tourism companies like travel agencies, hotels, and retail brands. Moreover, governments are working to diversify their attractions by pushing luxury tourism, cultural hotspots, and entertainment venues, thus contributing to the growth of the market. The rise of tourism activities promotes commercial property development with immense opportunities for investors and developers to capture the growing demand in the market.

GCC Commercial Real Estate Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the GCC commercial real estate market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on type, solution, and application.

Analysis by Type:

- Brokerage

- Management

Brokerage is an essential part of the GCC commercial real estate market, connecting investors with landlords and tenants. Experienced brokers provide market intelligence, valuation of properties, and negotiation skills to ensure the most favorable transactions. Having local knowledge of the regulations helps brokers simplify complicated deals so that businesses can acquire prime commercial spaces that fit into their operation goals and long-term growth strategies.

Effective property management is important for maintaining and enhancing asset value in the GCC commercial real estate market. Professional management ensures smooth operation, tenant satisfaction, and compliance with legal requirements. Managers overseeing maintenance, lease administration, and financial performance optimize occupancy rates and rental yields. Their strategic approach attracts global investors, sustaining the region's competitive edge as a prominent commercial real estate hub.

Analysis by Solution:

- Sales

- Leasing

- Others

Sales are essential for growth and liquidity in the GCC commercial real estate market. Successful property sales drive investments and infrastructure projects, aiding economic diversification. Increasing demand for quality commercial spaces supports developers in monetising assets and allows investors to seize profitable opportunities, enhancing the region's status as a global business hub.

Leasing serves as a foundation of the GCC commercial real estate market, providing businesses with flexible options for establishing operations without significant upfront costs. Both long-term and short-term leases offer landlords steady income, while tenants enjoy prime locations and affordable occupancy. Customized leasing strategies geared towards market trends attract multinational corporations, bolstering the region's image as a competitive economic center.

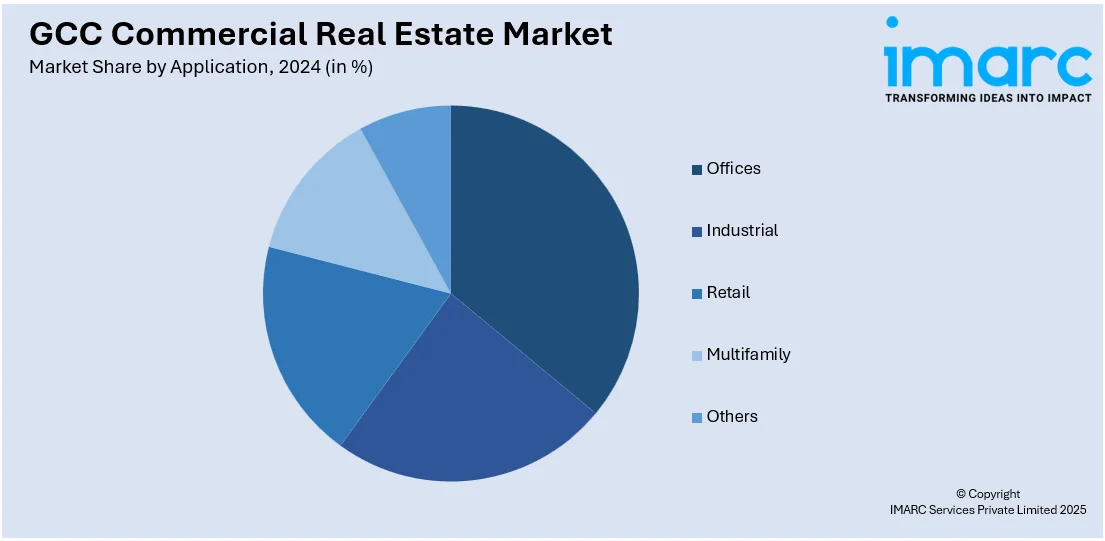

Analysis by Application:

- Offices

- Industrial

- Retail

- Multifamily

- Others

Fueled by economic diversification and business hubs in the GCC commercial real estate market, the office sector plays an important role. Demand for modern office space by both multinationals and start-ups continues to rise in Dubai, Riyadh, and Doha cities. Free zones, coupled with business-friendly regulations and super infrastructure, attract global companies, and thus boost economic growth to position the GCC as a commercial hub.

Industrial real estate is witnessing growth in the GCC as fast-tracked development takes place in logistics, manufacturing, and e-commerce. The region has strategic importance as a global gateway for trade, which makes it an ideal location for warehousing, distribution centers, and production facilities. This increased demand for industrial space has supported sustainable growth across all sectors, such as energy, logistics, and technology.

Retail forms a crucial part of the commercial real estate market in the GCC, due to high consumer spending, tourism, and lifestyle-driven economies. There is a plethora of luxury malls, entertainment centers, and retail hubs across the region that cater to residents and international tourists alike. The innovation of experiential shopping and mixed-use developments continue to drive retail growth and keep the GCC at the top of the league as a vibrant retail destination that attracts global brands and investors.

Country Analysis:

- Saudi Arabia

- United Arab Emirates

- Qatar

- Kuwait

- Oman

- Bahrain

Saudi Arabia is a major player in the GCC commercial real estate market, given the impetus from Vision 2030 that seeks to diversify the economy and spur infrastructure development. Foreign interest in the kingdom's investments in megaprojects such as NEOM and The Red Sea Project is high. Commercial activity continues to be a mainstay in Riyadh and Jeddah, offering high returns for businesses and investors alike in retail, office, and industrial real estate.

The UAE, especially Dubai and Abu Dhabi, has excellent infrastructure, business-friendly policies, and free zones make it attractive to global companies and investors. Developments such as Expo 2020 and growth in hospitality, office spaces, and logistics keep the UAE vital for commercial real estate innovation in the region.

Qatar, especially after hosting FIFA World Cup 2022, holds a major place in the GCC commercial real estate market. Huge investments into infrastructure, retail, and hospitality projects has pushed the demand for commercial spaces upwards. The Doha skyline, combined with growth in offices and industry segments, underlines the country's quest for economic diversification and acting as a regional trade and tourism center.

Due to Kuwait Vision 2035 initiatives, especially through the development of infrastructure projects, the commercial real estate market of Kuwait remains stable and growing. The commercial centers, shopping malls, and office spaces have developed to support the developing business environment in the country. Corporate activity continues to be centralized in the capital city due to the economy's further push towards diversification and urban development, leading to growing demand for premium office spaces and retail establishments.

Oman's commercial real estate market is gaining momentum through strategic infrastructure investments and tourism-focused projects. Muscat is the main center for commercial activity, seeing rising demand for office spaces, industrial areas, and retail establishments. Government initiatives like Vision 2040 aim to enhance economic diversification, positioning Oman as an emerging player in the regional real estate market and fostering business growth and foreign investment.

Bahrain is a growing market in the GCC commercial real estate landscape, with the added advantage of its business-friendly environment and strategic location. Manama is the central place for commercial activity, where there are affordable office spaces and an advanced logistics infrastructure. With foreign business attraction and economic diversification as part of the government agenda, Bahrain continues to grow its commercial real estate sector, opening up both for investors and corporate occupiers.

Competitive Landscape:

Key players in the GCC commercial real estate sector are increasingly adopting strategies to boost competitiveness and meet changing market needs. They are investing in innovative, sustainable projects that align with regional goals for economic diversification and environmental sustainability. Developers are concentrating on mixed-use projects that integrate residential, office, retail, and leisure areas to appeal to a diverse range of investors and tenants. Moreover, there is a rising focus on employing advanced technologies, such as smart building systems and digital property management tools, to enhance operational efficiency and tenant experiences. Major stakeholders are also collaborating with international investors and financial institutions to raise capital and support large-scale infrastructure initiatives. This strategic approach demonstrates the industry's commitment to driving growth, boosting asset values, and establishing the GCC as a global real estate center.

The report provides a comprehensive analysis of the competitive landscape in the GCC commercial real estate market with detailed profiles of all major companies.

Latest News and Developments:

- On 11th September 2024, Pune-based VTP Realty has entered the GCC commercial real estate market by opening a new office in Dubai. The expansion aligns with the company’s goal to cater to Non-Resident Indian (NRI) investors and global clients, enhancing its international presence and promoting Indian real estate to a wider audience.

GCC Commercial Real Estate Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Brokerage, Management |

| Solutions Covered | Sales, Leasing, Others |

| Applications Covered | Offices, Industrial, Retail, Multifamily, Others |

| Countries Covered | Saudi Arabia, United Arab Emirates, Qatar, Kuwait, Oman, Bahrain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the GCC commercial real estate market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the GCC commercial real estate market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the GCC commercial real estate industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The commercial real estate refers to the development, leasing, and management of commercial properties, including offices, retail spaces, industrial zones, and multifamily units, across Gulf Cooperation Council countries. Applications include providing business infrastructure, industrial facilities, and retail hubs to support economic diversification and regional growth.

The GCC commercial real estate market was valued at USD 38.77 Billion in 2024.

IMARC estimates the GCC commercial real estate market to exhibit a CAGR of 8.20% during 2025-2033.

Key drivers include robust industrial and logistics sector growth, increasing investments from global and regional investors, rising demand for smart infrastructure, government-backed economic diversification programs, SME expansion, and booming tourism, which elevate demand for retail, office, and entertainment spaces.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)