GCC Construction Tractors Market Report by Type (Crawler Tractor, Wheeled Tractor), Drive Type (Two-Wheel Drive, Four-Wheel Drive), System Type (Without Loader, Front Loaders, Back-Hoe Loaders), Power Output (<30 hp, 31-100 hp, 101-200 hp, 201-300 hp, >300 hp), Application (Infrastructure, Residential Construction, Non-Residential Construction), Design Type (Tractor With CAB, Tractor Without CAB), and Country 2026-2034

Market Overview:

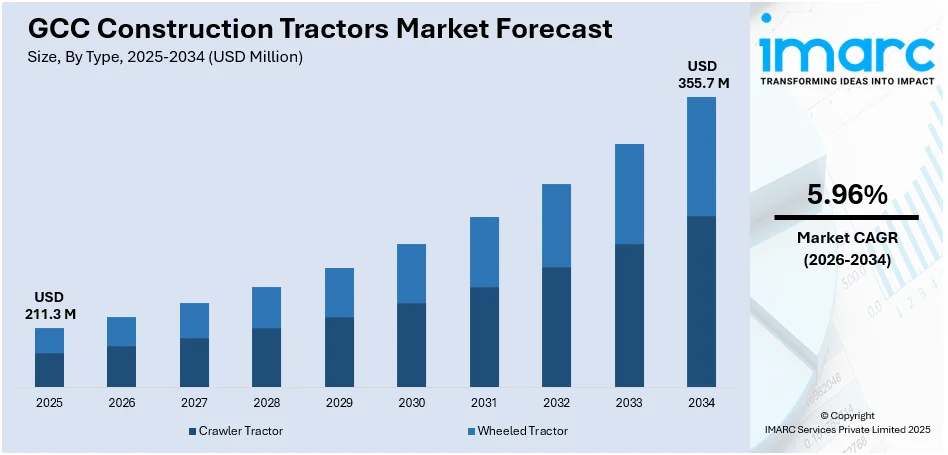

GCC construction tractors market size reached USD 211.3 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 355.7 Million by 2034, exhibiting a growth rate (CAGR) of 5.96% during 2026-2034. The emerging popularity of these machines with interchangeable attachments, such as rippers or backhoes, as they offer flexibility and cost-effectiveness on construction sites, is primarily augmenting the regional market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 211.3 Million |

| Market Forecast in 2034 | USD 355.7 Million |

| Market Growth Rate (2026-2034) | 5.96% |

Construction tractors are heavy-duty, specialized vehicles designed for use in various construction and engineering applications. Also known as bulldozers or crawler tractors, these machines play a crucial role in earthmoving, grading, and excavation tasks at construction sites. Construction tractors are equipped with a large metal blade at the front, often referred to as a dozer blade, which is used for pushing and moving soil, sand, or other materials. The tracked undercarriage provides stability and traction, making them well-suited for navigating challenging terrains. Some construction tractors are equipped with additional attachments like rippers or backhoes, expanding their versatility to handle different tasks on the construction site.

To get more information on this market Request Sample

GCC Construction Tractors Market Trends:

The GCC construction tractors market is witnessing notable growth, driven by key drivers and emerging trends that are shaping the industry. One significant driver is the continued expansion of construction activities. As the region invests in infrastructure projects and urban development, there is a rising demand for construction tractors to efficiently carry out earthmoving, grading, and excavation tasks. Besides this, a prominent trend in the GCC construction tractors market is the integration of advanced technologies. Moreover, manufacturers are incorporating features such as GPS systems, telematics, and automated control systems to enhance precision and efficiency in construction operations. These technological advancements not only improve the accuracy of grading and excavation but also contribute to time and cost savings. Apart from this, there is a growing emphasis on sustainability in construction practices, leading to a trend of using more fuel-efficient and environmentally friendly construction tractors. The integration of cleaner engine technologies and the exploration of alternative fuels align with the region's commitment to environmental responsibility. Additionally, the market is witnessing an increasing demand for versatile construction tractors that can be easily adapted for various tasks. Apart from this, as construction activities in the region continue to flourish, these drivers and trends are poised to shape the trajectory of the GCC construction tractors market in the foreseeable future.

GCC Construction Tractors Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional and country levels for 2026-2034. Our report has categorized the market based on type, drive type, system type, power output, application, and design type.

Type Insights:

- Crawler Tractor

- Wheeled Tractor

The report has provided a detailed breakup and analysis of the market based on the type. This includes crawler tractor and wheeled tractor.

Drive Type Insights:

- Two-Wheel Drive

- Four-Wheel Drive

A detailed breakup and analysis of the market based on the drive type have also been provided in the report. This includes two-wheel drive and four-wheel drive.

System Type Insights:

- Without Loader

- Front Loaders

- Back-Hoe Loaders

The report has provided a detailed breakup and analysis of the market based on the system type. This includes without loader, front loaders, and back-hoe loaders.

Power Output Insights:

- <30 hp

- 31-100 hp

- 101-200 hp

- 201-300 hp

- >300 hp

A detailed breakup and analysis of the market based on the Power Output have also been provided in the report. This includes <30 hp, 31-100 hp, 101-200 hp, 201-300 hp, and >300 hp.

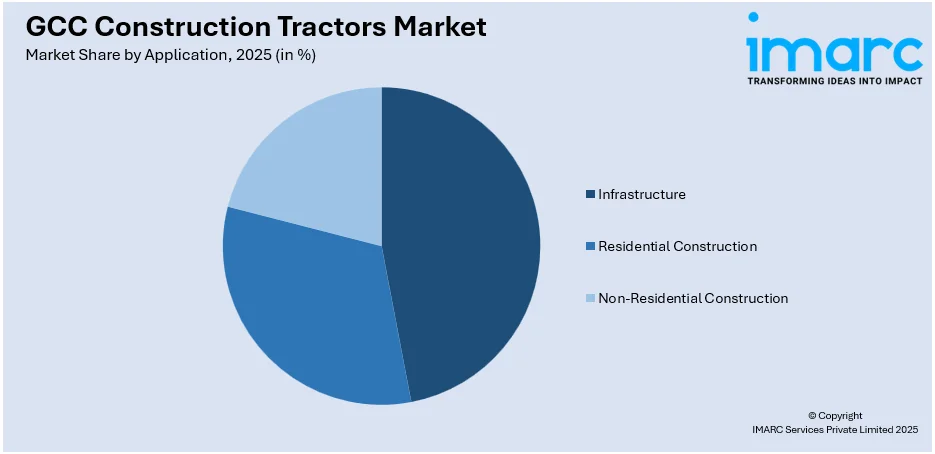

Application Insights:

Access the comprehensive market breakdown Request Sample

- Infrastructure

- Residential Construction

- Non-Residential Construction

The report has provided a detailed breakup and analysis of the market based on the application. This includes infrastructure, residential construction, and non-residential construction.

Design Type Insights:

- Tractor With CAB

- Tractor Without CAB

A detailed breakup and analysis of the market based on the design type have also been provided in the report. This includes tractor with cab and tractor without cab.

Country Insights:

- Saudi Arabia

- United Arab Emirates

- Qatar

- Kuwait

- Oman

- Bahrain

The report has also provided a comprehensive analysis of all the major regional markets, which include Saudi Arabia, United Arab Emirates, Qatar, Kuwait, Oman, and Bahrain.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

GCC Construction Tractors Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Crawler Tractor, Wheeled Tractor |

| Drive Types Covered | Two-Wheel Drive, Four-Wheel Drive |

| System Types Covered | Without Loader, Front Loaders, Back-Hoe Loaders |

| Power Outputs Covered | <30 hp, 31-100 hp, 101-200 hp, 201-300 hp, >300 hp |

| Applications Covered | Infrastructure, Residential Construction, Non-Residential Construction |

| Design Types Covered | Tractor With CAB, Tractor Without CAB |

| Countries Covered | Saudi Arabia, United Arab Emirates, Qatar, Kuwait, Oman, Bahrain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the GCC construction tractors market performed so far and how will it perform in the coming years?

- What is the breakup of the GCC construction tractors market on the basis of type?

- What is the breakup of the GCC construction tractors market on the basis of drive type?

- What is the breakup of the GCC construction tractors market on the basis of system type?

- What is the breakup of the GCC construction tractors market on the basis of power output?

- What is the breakup of the GCC construction tractors market on the basis of application?

- What is the breakup of the GCC construction tractors market on the basis of design type?

- What are the various stages in the value chain of the GCC construction tractors market?

- What are the key driving factors and challenges in the GCC construction tractors?

- What is the structure of the GCC construction tractors market and who are the key players?

- What is the degree of competition in the GCC construction tractors market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the GCC construction tractors market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the GCC construction tractors market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the GCC construction tractors industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)