Europe Idiopathic Pulmonary Fibrosis Treatment Market Size, Share, Trends and Forecast by Drug Class, End User, and Country, 2025-2033

Europe Idiopathic Pulmonary Fibrosis Treatment Market Size and Share:

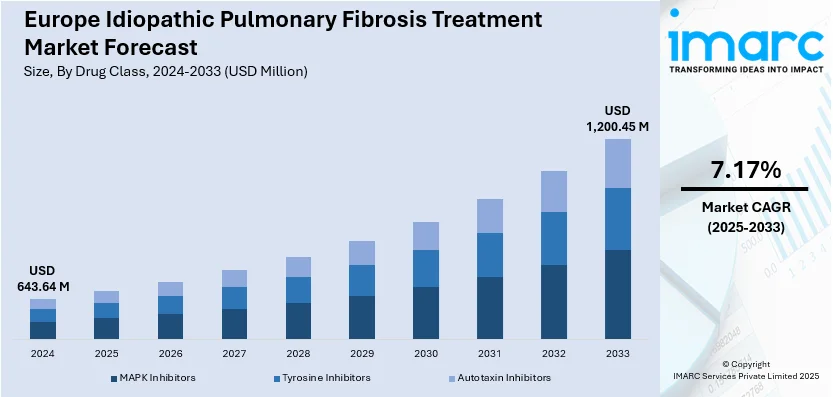

The Europe idiopathic pulmonary fibrosis treatment market size was valued at USD 643.64 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,200.45 Million by 2033, exhibiting a CAGR of 7.17% from 2025-2033. The increase in the occurrence of chronic lung and fibrotic diseases, specifically in the geriatric population, changing lifestyle habits, and high smoking rates among the masses are some of the factors propelling the European market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 643.64 Million |

|

Market Forecast in 2033

|

USD 1,200.45 Million |

| Market Growth Rate (2025-2033) | 7.17% |

Idiopathic pulmonary fibrosis (IPF) is currently occurring in innumerable individuals in Europe due to several factors. As the population of European countries is aging, the incidence of IPF has been steadily increasing. The number of diagnosed cases is growing, further driving the demand for effective treatments. This is also expanding healthcare costs associated with long-term IPF management, thus incentivizing the development of novel therapies. Moreover, the early diagnosis of IPF is crucial for timely intervention, which can majorly make the prognosis better. Previously diagnosing IPF was challenging due to nonspecific symptoms in the early stage of the disease, which often mimic other respiratory conditions. However, the advancement of diagnostic technologies like high resolution computed tomography (HRCT), bronchoscopy lung biopsies, and many more have led to more accurate and earlier diagnosis. The presentation of genetic testing is also enhancing the ability to identify patients at risk or in the initial phases of the disease.

On the research and development (R&D) side, currently, IPF treatment space is booming with research. The acceptance of new antifibrotic drugs such as Nintedanib (OFEV) and Pirfenidone (Esbriet) has offered significant therapeutic options for patients affected by IPF. These drugs slow the progression of the disease but do not cure it. Further studies of these drugs have led to the discovery of new treatments such as combination therapy and new biologics which act on specific molecular pathways related to fibrosis. The drug is already approved by significant agencies like European Medicines Agency (EMA) for market sales.

Europe Idiopathic Pulmonary Fibrosis Treatment Market Trends:

Increasing Incidence of Idiopathic Pulmonary Fibrosis (IPF)

One of the main reasons driving the IPF treatment market in Europe is the increasing prevalence of the ailment. Since IPF is mostly an age-related illness, it is also rising as the European population ages. Although the incidence is higher in people 60 years of age and older, IPF can also affect people over 50. The World Health Organization (WHO) predicts that by 2024, there will be more persons over 65 in the European region than there are under the age of 15. Because the number of IPF cases is directly correlated with the number of elderly people, there is a growing need for therapy. The growing patient population creates significant demand for effective therapies, hence increasing R&D efforts in the IPF treatment market.

Advancements in Treatment Options and Product Launches

Advancements in treatment options, especially the release of new drugs and therapies, are supporting the growth of the IPF treatment market in Europe. In the last few years, the treatment scenario for IPF has seen a sea change with the approval of multiple antifibrotic drugs such as Pirfenidone (Esbriet) and Nintedanib (OFEV). These treatments have proven to decelerate the progression of the disease, improve lung function, and increase the quality of life in patients. However, continued research into new treatments and new formulations of existing drugs has continued to attract attention in the European market. In 2024, important product launches have expanded treatment options for IPF patients. For instance, TheraVet announced a strategic transformation program with H4Orphan in 2024 to establish an IBF pioneer and supporting the development of its multi-target drug candidate. Additionally, the IRIS capital Investissement fund managed by Mr Fabrice EVANGELISTA intended to make a find of EUR 300,000 available to TheraVet relating to the outstanding convertible bond issue. Such innovative treatments are launched and are promising to better control the IPF, as these may have wider efficacy and minimal side effects than the earlier ones.

Growing Awareness and Advocacy for IPF

More than any of the above reasons, knowledge of the disease and its increased advocacy by patients toward better treatment has become one of the more crucial factors behind the growth of IPF in Europe. Historically, IPF is considered under-recognized and underdiagnosed for its overlap of symptoms with commonly diagnosed chronic obstructive pulmonary disease or COPD. However, during the last years, the efforts from patient advocacy groups, providers, and industry stakeholders are directed to public and medical education, and thus contributed a lot to diagnosis and intervention in earlier stages. In 2024, initiatives for awareness creation of IPF were made by different sources and were responsible for increasing the visibility of the disease. EU Pulmonary Fibrosis Federation (EU-PFF) and other patient support groups continue to promote and advocate for increased funding on the research, better diagnostic practices, and options for treatment of this fatal illness. Public awareness programs such as IPF Awareness Month of the EU-PF, now run for a month every year, have been effective in publicising symptoms and risks that develop, meaning more people are presented in advance for diagnosis and early treatments before being diagnosed with IPF. EU-PFF's Awareness month occurs during September every year.

Europe Idiopathic Pulmonary Fibrosis Treatment Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe idiopathic pulmonary fibrosis treatment market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on drug class and end user.

Analysis by Drug Class:

- MAPK Inhibitors

- Tyrosine Inhibitors

- Autotaxin Inhibitors

The largest segment comprises tyrosine inhibitors. Tyrosine inhibitors are a class of drugs that have garnered a lot of attention and press in recent years because of their ability to effectively target particular pathways in a variety of illnesses, including cancer. Enzymes called tyrosine kinases are involved in the activation of several cellular processes, including cell growth, survival, and division. In illnesses like cancer, these enzymes are frequently dysregulated, becoming overactive and causing unchecked cell proliferation. It has been discovered that tyrosine inhibitors, which block these kinases, are extremely useful as medicinal substances.

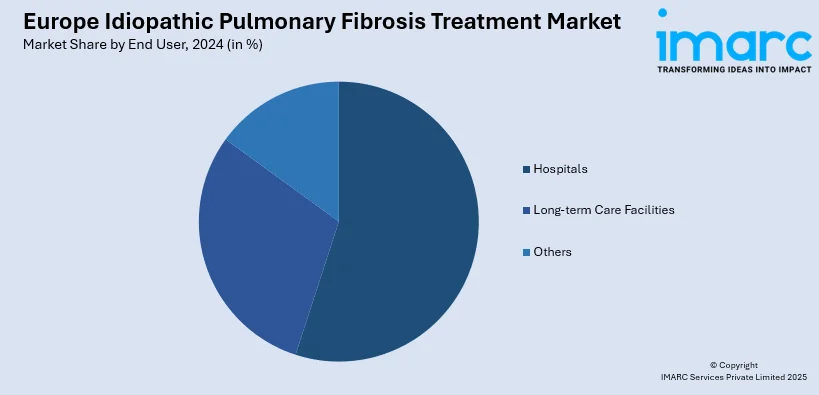

Analysis by End User:

- Hospitals

- Long-term Care Facilities

- Others

Hospitals comprise the biggest segment of the end-users. All treatments are delivered in hospitals, which primarily encompass advanced diagnostics, sophisticated treatments, and complex medication schedules, including tyrosine inhibitors, biologics, and other targeted therapy medicines. Such large infrastructure and the presence of multidisciplinary teams including oncologists, pulmonologists, and others allows hospitals to provide comprehensive and intensive care to patients, especially those with severe or complicated conditions. Additionally, most hospitals have access to the latest technology for diagnostic imaging, monitoring, and administering treatments, which will result in better patient outcomes. The demand for specialized therapies and the massive investments in healthcare make hospitals a prominent market among end-users, particularly in cities with a strong and established infrastructure of medical facilities.

Country Analysis:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

Germany represents one of the largest markets for healthcare products and treatments in Europe, driven by its robust healthcare infrastructure and a highly developed medical research sector. The country's advanced medical facilities, coupled with a strong emphasis on healthcare innovation, make it a key player in the market for conditions such as IPF and cancer. Germany also has a well-established reimbursement system that facilitates access to new therapies, including tyrosine inhibitors and biologic drugs.

France is another major market for medical treatments, characterized by its expansive healthcare network and significant investment in research and development. The country has a high demand for specialized healthcare services, including oncology and pulmonology, which drives the market for treatments like tyrosine inhibitors. France's healthcare system, known for its universal coverage, ensures that patients have access to the latest therapies, making it an attractive market for pharmaceutical companies.

The United Kingdom (UK) is a significant player in the European healthcare market, with a strong emphasis on research, technological advancements, and comprehensive healthcare services. The National Health Service (NHS) plays a crucial role in ensuring that treatments for diseases like IPF, cancer, and other chronic conditions are widely available, which directly impacts the market for specialized therapies. The UK has witnessed a steady rise in the prevalence of chronic diseases, particularly among its aging population, creating a growing demand for targeted treatments such as tyrosine inhibitors.

Italy’s healthcare market is characterized by both a strong public healthcare system and increasing private sector involvement. With a large, aging population and a rising burden of chronic diseases, particularly respiratory disorders like IPF, Italy has seen an increase in the demand for targeted therapies. The Italian healthcare system is generally efficient in providing treatments, but regional disparities in access to specialized care remain a challenge.

Spain has seen significant improvements in healthcare accessibility and quality, driven by both public and private healthcare sectors. The Spanish healthcare system is known for its comprehensive coverage, ensuring that patients with chronic conditions like IPF and cancer have access to necessary treatments. The market for specialized therapies, including tyrosine inhibitors, is expanding in Spain due to a growing elderly population and increasing awareness of these diseases.

Competitive Landscape:

Key market players in the European market are focusing on several strategies to improve their business and expand their market share. Leading pharmaceutical companies are heavily investing in research to discover more effective therapies for IPF. For instance, in 2024, Boehringer Ingelheim announced that FIBRONEER™-IPF trial met its primary endpoint and it will present the drug application of the new drug, Nerandomilast, for the treatment of IPF to the US Food & Drug Administration (FDA) and other Health Authorities worldwide. Additionally, these companies are focusing on expanding their product portfolios to offer broader treatment options, including oral medications, which increase patient compliance and convenience. Market leaders are also pursuing strategic collaborations, partnerships, and acquisitions to strengthen their R&D capabilities and expand into new markets. Furthermore, these companies are enhancing their presence in the European market through localized marketing and patient education initiatives aimed at improving awareness of IPF, its symptoms, and the importance of early diagnosis.

The report provides a comprehensive analysis of the competitive landscape in the Europe idiopathic pulmonary fibrosis treatment market with detailed profiles of all major companies.

Latest News and Developments:

-

September 2024: An international clinical trial conducted by Professor Toby Maher, which involved 17 centers in the UK, Italy, and Ukraine showed certain promising results for patients dealing with IPF. This clinical trial was a double-blind, randomised, placebo-controlled trial that will investigate the drug GLPG1690, which was introduced by Galapagos, which also funded the trial.

Europe Idiopathic Pulmonary Fibrosis Treatment Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Drug Classes Covered | MAPK Inhibitors, Tyrosine Inhibitors, Autotaxin Inhibitors |

| End Users Covered | Hospitals, Long-term Care Facilities, Others |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe idiopathic pulmonary fibrosis treatment market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe idiopathic pulmonary fibrosis treatment market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe idiopathic pulmonary fibrosis treatment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Idiopathic pulmonary fibrosis (IPF) treatment refers to therapies aimed at managing the symptoms and slowing the progression of IPF, a chronic lung disease that causes scarring in the lungs. These treatments, such as antifibrotic drugs, aim to improve lung function, reduce inflammation, and enhance the patient's quality of life.

The Europe idiopathic pulmonary fibrosis treatment market was valued at USD 643.64 Million in 2024.

IMARC estimates the Europe idiopathic pulmonary fibrosis treatment market to exhibit a CAGR of 7.17% during 2025-2033.

The key factors driving the market include an aging population, an increase in IPF diagnoses due to improved diagnostic technologies, the rise in chronic lung diseases, and the growing awareness of IPF, which all contribute to a higher demand for effective treatments.

In 2024, Tyrosine Inhibitors represented the largest segment by drug class, driven by their targeted action against specific molecular pathways involved in IPF and their ability to offer more selective treatment with fewer side effects compared to traditional therapies.

In 2024, hospitals represented the largest segment by end user, driven by their advanced infrastructure, specialized care, and comprehensive treatment capabilities for managing complex conditions like IPF.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)