Europe Cryptocurrency Market Size, Share, Trends and Forecast by Type, Component, Process, Application, and Country, 2026-2034

Europe Cryptocurrency Market Summary:

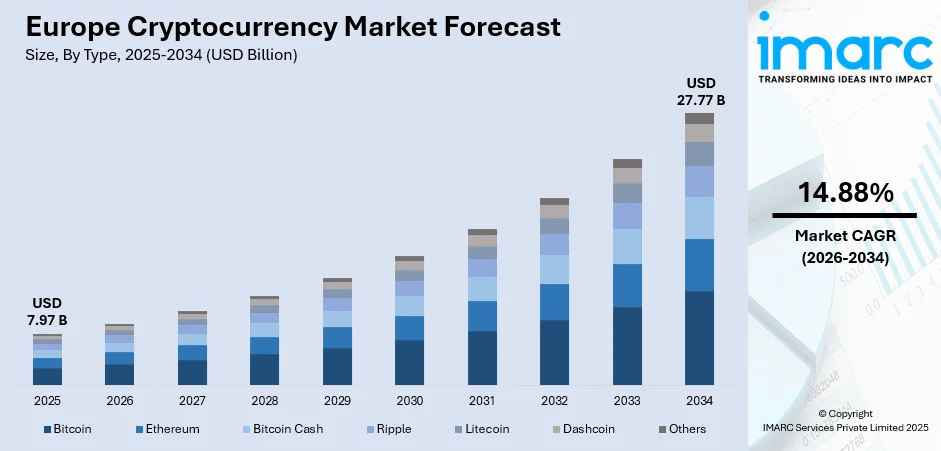

The Europe cryptocurrency market size was valued at USD 7.97 Billion in 2025 and is projected to reach USD 27.77 Billion by 2034, growing at a compound annual growth rate of 14.88% from 2026-2034.

The Europe cryptocurrency market is presently experiencing substantial momentum on account of the increasing institutional adoption of digital assets, supportive regulatory frameworks including the Markets in Crypto-Assets Regulation, and the growing recognition of blockchain technology's transformative potential across financial services. The escalating demand for decentralized finance solutions, enhanced payment systems, and cross-border transaction efficiency continues to bolster the Europe cryptocurrency market share.

Key Takeaways and Insights:

-

By Type: Bitcoin dominates the market with a share of 38.04% in 2025, owing to its established market position as the original cryptocurrency, widespread institutional acceptance, and its function as a store of value amid macroeconomic uncertainties. Growing regulatory clarity continues to support Bitcoin's integration into traditional finance.

-

By Component: Software leads the market with a share of 59.06% in 2025, reflecting the critical role of trading platforms, digital wallets, security solutions, and smart contract applications in enabling cryptocurrency transactions. Continuous innovation in blockchain software infrastructure drives adoption across institutional and retail segments.

-

By Process: Transaction represents the largest segment with a market share of 56.12% in 2025, driven by increasing use of cryptocurrencies for payments, remittances, and trading activities. The efficiency of blockchain-based transactions over traditional banking methods attracts businesses seeking faster settlement times.

-

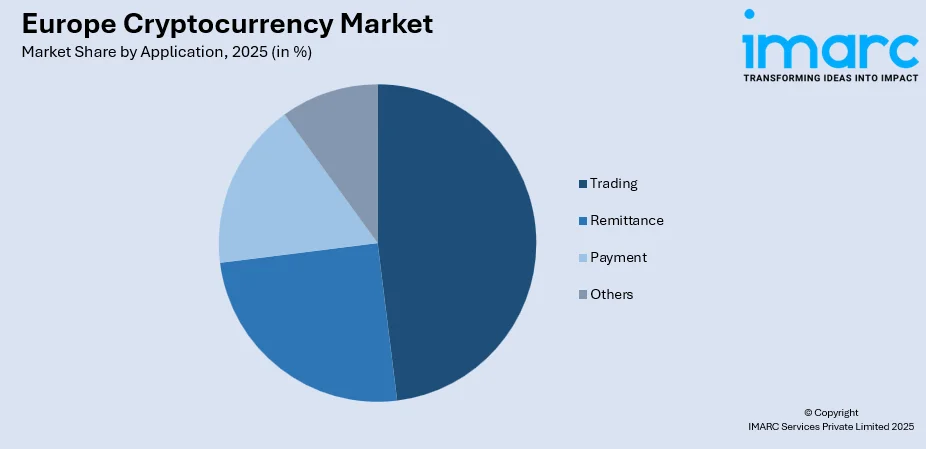

By Application: Trading dominates the market with a share of 48.05% in 2025, reflecting robust investor interest in cryptocurrency exchanges and derivative products. The proliferation of regulated trading platforms and introduction of crypto investment products enhance market accessibility.

-

By Country: Germany leads the market with 23% share in 2025, driven by progressive regulatory frameworks, strong institutional adoption, and a tech-savvy population embracing digital assets. Germany's favorable tax policies and established financial infrastructure position it as Europe's cryptocurrency hub.

-

Key Players: Key players drive the Europe cryptocurrency market by expanding trading infrastructure, enhancing security protocols, and developing innovative blockchain solutions. Their investments in regulatory compliance, institutional-grade custody services, and decentralized finance platforms accelerate mainstream adoption across diverse investor segments.

To get more information on this market Request Sample

The European cryptocurrency ecosystem is undergoing transformative evolution characterized by institutional integration, regulatory maturation, and technological advancement. The implementation of the Markets in Crypto-Assets Regulation has established a unified licensing framework across European Union member states, positioning Europe as a jurisdiction forging structured coexistence between legacy finance and cryptographic protocols. Major financial institutions are increasingly integrating digital assets into their portfolios, while decentralized finance platforms offer innovative lending, borrowing, and trading services with enhanced transparency. In December 2024, German fintech company 21X became the first entity to receive a license under the EU's DLT Pilot Regime to operate a fully regulated blockchain-based trading and settlement system, marking a milestone for tokenized capital markets. This regulatory clarity, combined with growing retail adoption and expanding blockchain infrastructure, positions Europe as a leader in the global cryptocurrency landscape.

Europe Cryptocurrency Market Trends:

Regulatory Harmonization Through MiCA Implementation

The Markets in Crypto-Assets Regulation has established a comprehensive legal framework unifying cryptocurrency oversight across European Union member states, replacing previously fragmented national approaches. This regulatory harmonization creates standardized requirements for crypto-asset service providers, enhancing investor protection while enabling seamless cross-border operations through passporting mechanisms. The framework addresses transparency, disclosure, authorization, and market abuse prevention requirements, fostering institutional confidence and market integrity. Clear compliance guidelines encourage traditional financial entities to engage with digital assets within a structured regulatory environment.

Institutional Integration into Traditional Finance

Major European financial institutions are increasingly incorporating cryptocurrency services into their traditional offerings, bridging conventional banking with digital assets through strategic partnerships and infrastructure development. Banks are collaborating with regulated crypto service providers to offer trading and custody solutions to corporate clients, while asset managers integrate digital assets into diversified portfolios seeking alternative returns. This institutional adoption reflects growing recognition of cryptocurrencies as legitimate investment instruments requiring regulated, secure infrastructure aligned with established financial standards and fiduciary responsibilities governing professional investment management.

Expansion of Tokenized Securities Infrastructure

The tokenization of traditional financial instruments is gaining momentum across European markets, driven by blockchain's efficiency in trading and settlement processes. Regulatory frameworks enable licensed exchanges to facilitate tokenized securities trading, representing digital versions of stocks, bonds, funds, and real-world assets on distributed ledger technology. This infrastructure development promises faster transaction settlement, reduced intermediary costs, enhanced transparency, and improved market accessibility for both institutional and retail participants seeking exposure to digitally native representations of conventional investment instruments.

Market Outlook 2026-2034:

The Europe cryptocurrency market is poised for expansion driven by regulatory clarity, institutional adoption, and technological innovation in blockchain infrastructure. Growing integration of digital assets into mainstream finance, coupled with the expansion of decentralized finance platforms, will accelerate market penetration across diverse investor segments. Enhanced security protocols, improved user interfaces, and sophisticated trading tools continue attracting both retail and institutional participants seeking exposure to digital assets. The market generated a revenue of USD 7.97 Billion in 2025 and is projected to reach a revenue of USD 27.77 Billion by 2034, growing at a compound annual growth rate of 14.88% from 2026-2034. Continued regulatory developments and cross-border payment innovations will further strengthen market fundamentals.

Europe Cryptocurrency Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Bitcoin | 38.04% |

| Component | Software | 59.06% |

| Process | Transaction | 56.12% |

| Application | Trading | 48.05% |

| Country | Germany | 23% |

Type Insights:

- Bitcoin

- Ethereum

- Bitcoin Cash

- Ripple

- Litecoin

- Dashcoin

- Others

Bitcoin dominates with a market share of 38.04% of the total Europe cryptocurrency market in 2025.

Bitcoin maintains its position as the leading cryptocurrency type across European markets, driven by its established reputation as the original digital currency and its widespread acceptance among institutional investors. The cryptocurrency's finite supply mechanism and decentralized architecture continue to attract investors seeking portfolio diversification and inflation hedging capabilities. Major European banks and asset managers increasingly incorporate Bitcoin into their digital asset offerings, reflecting growing mainstream acceptance. The regulatory clarity provided by MiCA has further enhanced confidence among institutional participants, enabling compliant Bitcoin investment products and services that meet stringent European financial standards and investor protection requirements.

The institutional adoption of Bitcoin has accelerated significantly, with financial institutions launching regulated trading and custody services for corporate clients across the region. In September 2024, Commerzbank partnered with Deutsche Börse subsidiary Crypto Finance to offer Bitcoin trading and custody services to its institutional clients. This integration into traditional banking infrastructure demonstrates Bitcoin's maturation as an established asset class within European financial markets.

Component Insights:

- Hardware

- Software

Software leads with a share of 59.06% of the total Europe cryptocurrency market in 2025.

The software segment encompasses trading platforms, digital wallets, security solutions, smart contract applications, and blockchain infrastructure that enable cryptocurrency operations across European markets. These solutions provide essential functionality for transaction processing, asset management, portfolio tracking, and compliance with regulatory requirements under the Markets in Crypto-Assets framework. The demand for sophisticated software solutions continues to grow as institutional investors require enterprise-grade platforms offering advanced analytics, real-time market data, and seamless integration with existing financial systems. Software providers are developing comprehensive solutions addressing the unique operational needs of regulated cryptocurrency service providers operating across multiple jurisdictions.

Innovation in cryptocurrency software is accelerating, with developers focusing on enhanced security protocols, improved user interfaces, multi-signature authentication, and regulatory compliance features essential for institutional adoption. The emergence of decentralized finance platforms has expanded software applications to include lending protocols, yield farming mechanisms, liquidity pools, and automated market makers serving diverse investor requirements. European fintech companies are at the forefront of developing MiCA-compliant software solutions, incorporating robust know-your-customer verification, anti-money laundering monitoring, and transaction surveillance capabilities that position the region as a leader in regulated cryptocurrency infrastructure development.

Process Insights:

- Mining

- Transaction

Transaction exhibits a clear dominance with a 56.12% share of the total Europe cryptocurrency market in 2025.

The transaction segment encompasses all cryptocurrency exchanges, transfers, payments, and settlements occurring across European markets through blockchain-based networks. Blockchain-based transactions offer significant advantages over traditional banking systems, including faster settlement times, reduced intermediary costs, enhanced transparency, and immutable record-keeping capabilities. The growing acceptance of cryptocurrencies for cross-border payments and remittances drives transaction volume growth across the region, as businesses and consumers seek efficient alternatives to conventional wire transfers. Smart contract automation further streamlines transaction execution, reducing manual processing requirements and minimizing operational errors in complex financial operations.

European transaction infrastructure has evolved significantly with the implementation of regulated cryptocurrency exchanges and payment service providers operating under unified regulatory frameworks ensuring consumer protection and market integrity. Stablecoin transactions have gained prominence, with MiCA-compliant digital currencies facilitating both retail and institutional payments through programmable money solutions. The integration of cryptocurrency payment rails into traditional commerce platforms continues to expand, with merchants across Europe increasingly accepting digital asset payments for goods and services. Payment processors are developing seamless point-of-sale solutions enabling instant cryptocurrency-to-fiat conversions for merchant convenience.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Trading

- Remittance

- Payment

- Others

Trading represents the leading segment with a 48.05% share of the total Europe cryptocurrency market in 2025.

The trading application segment encompasses spot trading, derivatives, futures contracts, options, and various investment products enabling market participants to speculate on cryptocurrency price movements and hedge portfolio exposures. European cryptocurrency exchanges offer increasingly sophisticated trading tools, including advanced charting capabilities, algorithmic trading support, portfolio management features, and risk assessment functionalities. Regulatory clarity under MiCA has enhanced investor confidence and attracted both retail and institutional participants seeking compliant trading environments. Market makers and liquidity providers contribute to efficient price discovery and tighter bid-ask spreads across major cryptocurrency pairs.

Institutional trading activity has surged across European markets, driven by growing recognition of cryptocurrencies as viable portfolio diversification instruments offering uncorrelated returns relative to traditional asset classes. The introduction of crypto exchange-traded products and institutional-grade custody solutions has lowered barriers for professional investors requiring regulated infrastructure and fiduciary-compliant frameworks. Trading volumes have demonstrated resilience, with European markets reaching significant monthly volumes as investors actively engage with both established cryptocurrencies and emerging digital assets across regulated platforms offering robust execution quality, transparent fee structures, and comprehensive reporting capabilities.

Country Insights:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

Germany holds the largest share with 23% of the total Europe cryptocurrency market in 2025.

Germany has emerged as Europe's leading cryptocurrency market, benefiting from progressive regulatory frameworks, strong institutional adoption, and a sophisticated financial services infrastructure supporting digital asset innovation. The country's favorable tax treatment of cryptocurrency holdings, including exemptions for long-term investments, combined with clear licensing requirements under the German Banking Act, has created an attractive environment for digital asset businesses seeking regulatory certainty. Germany's robust legal framework provides comprehensive guidelines for cryptocurrency custody, trading, and issuance activities, attracting both domestic enterprises and international firms establishing European operations within its jurisdiction.

The German cryptocurrency ecosystem demonstrates remarkable maturity, with major banks integrating digital asset services and fintech companies pioneering innovative blockchain solutions across trading, custody, and tokenization verticals. The country's regulatory leadership includes granting the first DLT Pilot Regime license for blockchain-based securities trading and settlement, positioning Germany at the forefront of tokenized finance innovation. Institutional investors, including pension funds, insurance companies, and asset managers, increasingly allocate to cryptocurrencies through regulated German service providers offering compliant custody, trading infrastructure, and comprehensive reporting capabilities meeting fiduciary standards.

Market Dynamics:

Growth Drivers:

Why is the Europe Cryptocurrency Market Growing?

Implementation of Comprehensive Regulatory Frameworks

The introduction of the Markets in Crypto-Assets Regulation represents a transformative development establishing unified cryptocurrency oversight across European Union member states. This comprehensive framework addresses critical aspects including authorization requirements for crypto-asset service providers, transparency and disclosure obligations, consumer protection measures, and market abuse prevention mechanisms. The regulatory clarity has significantly enhanced institutional confidence, as evidenced by growing participation from traditional financial institutions in digital asset markets. Major banks are now offering cryptocurrency services under clear compliance guidelines, while investment managers integrate digital assets into diversified portfolios with regulatory assurance. The harmonized approach eliminates fragmented national regulations, enabling businesses to operate seamlessly across borders through passporting mechanisms while maintaining consistent investor protections.

Accelerating Institutional Adoption and Traditional Finance Integration

European institutional investors are increasingly recognizing cryptocurrencies as legitimate alternative assets warranting allocation within diversified portfolios. This paradigm shift is evidenced by major banks launching cryptocurrency trading and custody services for corporate and institutional clients. Financial institutions are partnering with regulated cryptocurrency infrastructure providers to offer secure, compliant access to digital assets. The institutional adoption trend extends beyond trading to encompass strategic treasury considerations, with corporations evaluating cryptocurrency holdings as potential reserve assets. Pension funds, insurance companies, and family offices are engaging with digital assets through regulated channels, seeking diversification benefits and potential returns in an evolving financial landscape. This institutional integration validates cryptocurrencies as mature asset classes deserving serious consideration alongside traditional investments.

Expansion of Decentralized Finance and Blockchain Innovation

The growth of decentralized finance platforms is reshaping European cryptocurrency markets by offering innovative financial services outside traditional banking systems. These blockchain-based platforms provide lending, borrowing, staking, and trading services with enhanced transparency, accessibility, and cost efficiency. European users increasingly adopt DeFi solutions for their programmable finance capabilities and potential yield opportunities. The technology's ability to automate financial transactions through smart contracts reduces operational costs while improving execution speed and reliability. Concurrent advances in blockchain infrastructure, including layer-two scaling solutions and interoperability protocols, enhance network capacity and user experience. The tokenization of real-world assets including securities, real estate, and commodities represents an expanding frontier, with regulated platforms enabling compliant issuance and trading of digital representations of traditional financial instruments.

Market Restraints:

What Challenges the Europe Cryptocurrency Market is Facing?

Regulatory Compliance Costs and Operational Barriers

The implementation of comprehensive regulatory frameworks has significantly increased compliance costs for cryptocurrency service providers, with licensing, capital adequacy, and operational requirements creating substantial financial burdens. These elevated costs particularly impact smaller operators and startups lacking sufficient resources, potentially consolidating market activity among well-capitalized players while limiting innovation, reducing competitive diversity, and creating barriers to market entry for emerging businesses.

Market Volatility and Investor Risk Perception

Cryptocurrency markets continue to experience significant price volatility that may deter risk-averse investors and limit mainstream adoption for payment and commercial applications requiring price stability. This inherent volatility creates challenges for businesses considering cryptocurrency integration and investors evaluating portfolio allocations, potentially slowing market expansion despite growing institutional interest and hindering broader acceptance as reliable stores of value.

Banking Access Challenges for Crypto Businesses

Cryptocurrency businesses continue facing difficulties establishing and maintaining banking relationships as traditional financial institutions remain cautious about digital asset exposure and associated reputational risks. These banking access challenges complicate operational requirements for exchanges, custody providers, and blockchain startups, potentially driving businesses to seek accommodations in alternative jurisdictions offering more receptive banking sectors and supportive financial service partnerships.

Competitive Landscape:

The Europe cryptocurrency market exhibits a dynamic competitive structure characterized by established global exchanges, emerging regional platforms, and traditional financial institutions entering the digital asset space. Market participants compete on regulatory compliance capabilities, security infrastructure, product diversity, and user experience. The implementation of MiCA has accelerated consolidation as smaller operators struggle with compliance requirements while well-capitalized players expand through acquisitions and strategic partnerships. Competition increasingly focuses on institutional service offerings, including custody solutions, trading infrastructure, and regulatory compliance tools that meet enterprise-grade requirements.

Europe Cryptocurrency Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Bitcoin, Ethereum, Bitcoin Cash, Ripple, Litecoin, Dashcoin, Others |

| Components Covered | Hardware, Software |

| Processes Covered | Mining, Transaction |

| Applications Covered | Trading, Remittance, Payment, Others |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Europe cryptocurrency market size was valued at USD 7.97 Billion in 2025.

The Europe cryptocurrency market is expected to grow at a compound annual growth rate of 14.88% from 2026-2034 to reach USD 27.77 Billion by 2034.

Bitcoin dominated the market with a share of 38.04%, driven by its established market position, institutional acceptance, and recognition as a store of value and portfolio diversification instrument.

Key factors driving the Europe cryptocurrency market include implementation of comprehensive regulatory frameworks such as MiCA, accelerating institutional adoption, expansion of decentralized finance platforms, and growing integration with traditional financial services.

Major challenges include high regulatory compliance costs, market volatility deterring risk-averse investors, banking access difficulties for crypto businesses, cybersecurity threats, and evolving regulatory requirements creating operational uncertainties.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)