Brazil Residential Real Estate Market Report by Type (Villas and Landed Houses, Apartments and Condominiums), and Region 2026-2034

Market Overview:

Brazil residential real estate market size reached USD 63.2 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 102.6 Billion by 2034, exhibiting a growth rate (CAGR) of 5.52% during 2026-2034. The low-interest rates, the rapidly growing population, the strong job market, the increasing urbanization trends, the rising infrastructure development projects, and various investments by governing authorities are some of the key factors catalyzing the market demand.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 63.2 Billion |

|

Market Forecast in 2034

|

USD 102.6 Billion |

| Market Growth Rate 2026-2034 | 5.52% |

Residential real estate refers to properties designed and used for dwelling purposes. These include single-family homes, condominiums, apartments, townhouses, and other types of housing intended for individuals or families to reside in. The primary distinction between residential and other real estate categories, such as commercial or industrial, is the purpose of use – residential properties are meant for habitation. It serves as the cornerstone of the housing market, encompassing a broad spectrum of dwelling options to meet diverse housing needs. Single-family homes are standalone, while condominiums and apartments typically involve shared spaces. Townhouses share walls with adjacent units but maintain individual ownership. The value of residential real estate is influenced by various factors, including location, size, amenities, and prevailing market conditions. Residential properties are often bought and sold through real estate transactions involving buyers, sellers, agents, and, in many cases, mortgage lenders. Investors may also engage in residential real estate to generate rental income or capital appreciation over time. The residential real estate market is dynamic, responding to economic trends, demographic shifts, and governmental policies, making it a crucial component of a nation's economic landscape.

Brazil Residential Real Estate Market Trends:

Urbanization and Population Growth

Brazil’s rapid urbanization and population growth are primary drivers of the market. As more people migrate from rural areas to urban centers in search of employment, education, and better living conditions, demand for housing in cities like São Paulo, Rio de Janeiro, and Brasília is rising. Developers are increasingly focusing on creating multi-family homes and high-density residential projects to cater to growing urban populations. Additionally, the expanding middle class, particularly in urban areas, is contributing to a shift in housing preferences toward modern and well-located properties with access to amenities.

Government Housing Programs

Governing agencies are implementing various housing programs, which is offering a favorable Brazil residential real estate market outlook. One of the most influential programs is ‘Casa Verde e Amarela’ that provides subsidies and low-interest loans to eligible families, helping them purchase homes. In line with this, this program is increasing homeownership among lower-income groups, driving demand for affordable housing. The initiative is also encouraging private developers to participate by offering favorable conditions such as tax breaks and financing options to build low-cost housing units. By addressing the housing deficit, particularly in less-developed areas, favorable government programs benefit in increasing Brazil residential real estate market share. These programs not only provide housing for those who might otherwise struggle to afford it but also create jobs and economic growth.

Low-Interest Rates

Low-interest rates are making home loans more affordable and accessible to a larger portion of the population in the country. Historically high interest rates limit the affordability of mortgages, but recent efforts by Brazil’s Central Bank to lower interest rates is strengthening the market growth. Lower borrowing costs enable more people to qualify for home loans, which is bolstering the Brazil residential real estate market growth. This is resulting in a rise in the purchase of mid-tier and high-end properties, as well as greater demand for new developments. Developers, too, benefit from lower financing costs, allowing them to invest in larger projects and offer more competitive pricing. However, the market remains sensitive to interest rate fluctuations, as even small increases in rates can significantly affect mortgage affordability and buyer sentiment. Therefore, favorable interest rate policies remain critical to sustained market growth.

Brazil Residential Real Estate Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on type.

Type Insights:

- Villas and Landed Houses

- Apartments and Condominiums

The report has provided a detailed breakup and analysis of the market based on the type. This includes villas and landed houses and apartments and condominiums.

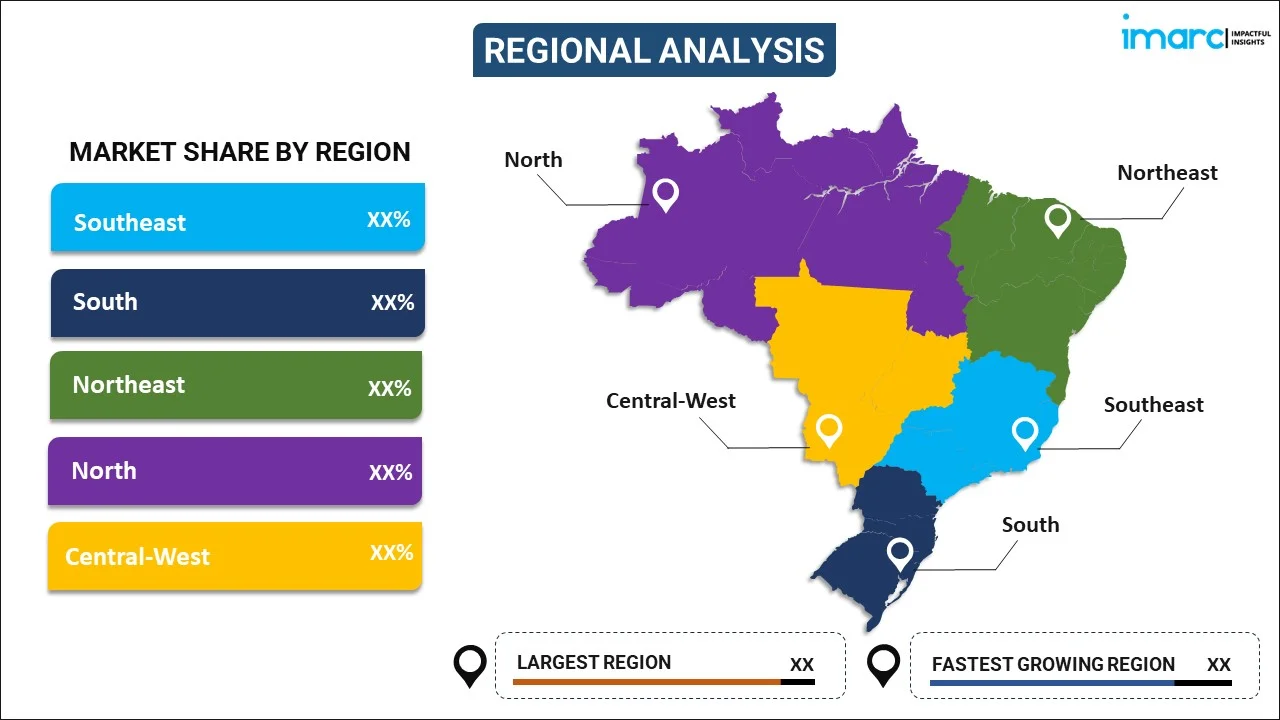

Regional Insights:

- Southeast

- South

- Northeast

- North

- Central-West

The report has also provided a comprehensive analysis of all the major regional markets, which include Southeast, South, Northeast, North, and Central-West.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Brazil Residential Real Estate Market Recent Developments:

- 7 December 2023: Credit Suisse unveiled a deal to sell its real estate fund management business in Brazil to asset manager Patria Investments for around US$ 130 million.

- 2 October 2024: Senna Tower in Balneário Camboriú, Brazil, is set to be the world’s tallest residential building at 1,670 feet. The tower blends urban ambition with a tribute to a national hero. Its striking design and cultural significance will enhance the city's skyline and attract global attention.

Brazil Residential Real Estate Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Villas and Landed Houses, Apartments and Condominiums |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Brazil residential real estate market performed so far and how will it perform in the coming years?

- What is the breakup of the Brazil residential real estate market on the basis of type?

- What are the various stages in the value chain of the Brazil residential real estate market?

- What are the key driving factors and challenges in the Brazil residential real estate?

- What is the structure of the Brazil residential real estate market and who are the key players?

- What is the degree of competition in the Brazil residential real estate market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Brazil residential real estate market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Brazil residential real estate market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Brazil residential real estate industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)