Global 5G Chipset Market Expected to Reach USD 85.4 Billion by 2033 - IMARC Group

Global 5G Chipset Market Statistics, Outlook and Regional Analysis 2025-2033

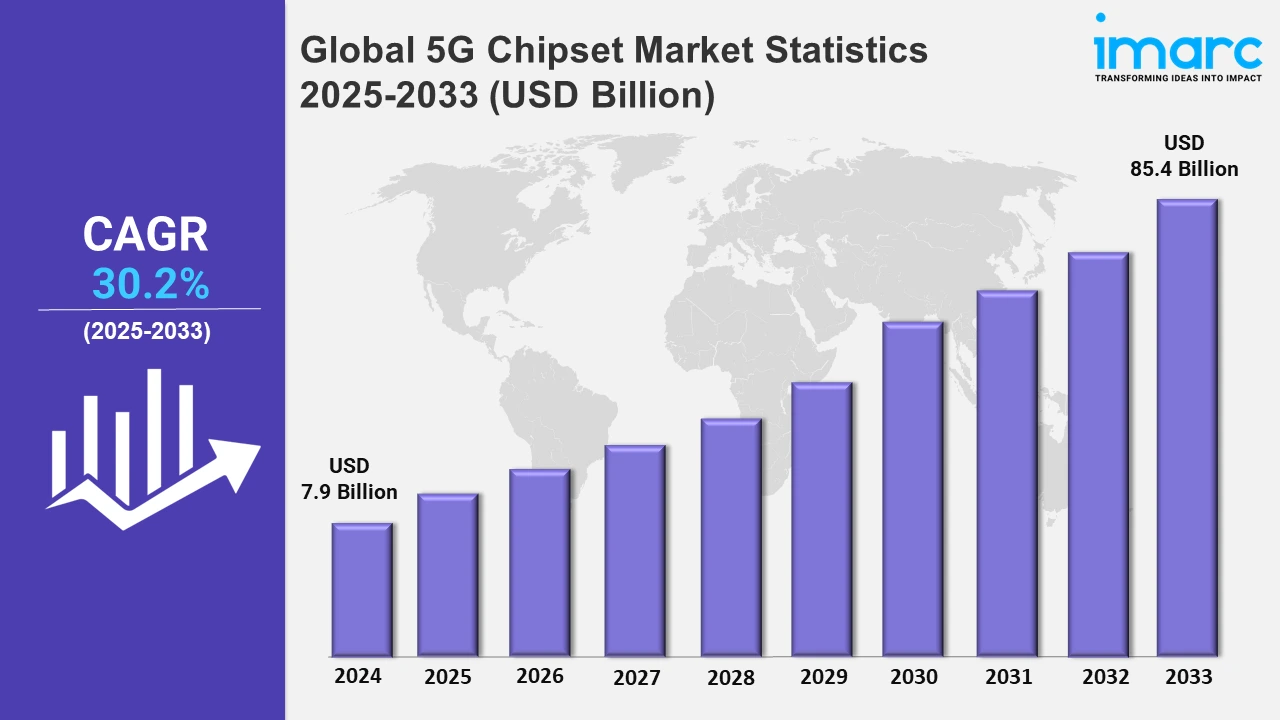

The global 5G chipset market size was valued at USD 7.9 Billion in 2024, and it is expected to reach USD 85.4 Billion by 2033, exhibiting a growth rate (CAGR) of 30.2% from 2025 to 2033.

To get more information on this market, Request Sample

The major growth driver for the global 5G chipset market is the growing demand for high-speed and low-latency communication. Increasing data-intensive applications such as video streaming, gaming, and virtual reality are driving the growing consumer expectations for faster and more reliable connectivity. This demand is leading to large investments in 5G infrastructure by telecom operators worldwide, driving the adoption of 5G chipsets. Additionally, the increasing penetration of Internet of Things (IoT) devices, including smart homes and industrial automation, requires robust and efficient communication networks. According to the IoT Analytics report 2024, there were 16.6 billion connected IoT devices by the end of 2023, which had grown by 15% from 2022. IoT Analytics projects this to rise 13% to 18.8 billion by the end of 2024. The number of connected IoT devices is estimated to grow to 40 billion by 2030. The ability of 5G chipsets to support these applications by enabling ultra-reliable, high-capacity, and real-time data transfer is accelerating their demand in modern connectivity.

In addition to this, the acceleration of digital transformation across industries is encouraging businesses to adopt 5G-enabled solutions. Sectors such as automotive, healthcare, and manufacturing are leveraging 5G chipsets to support advancements such as autonomous vehicles, telemedicine, and smart factories. Besides this, governments and private organizations are also promoting 5G development through funding and policy support to enhance economic competitiveness. On 21st October 2024, Ericsson announced today that its Nigerian unit signed a memorandum of understanding with the Nigerian government to form the basis of cooperation on developing, deploying, and innovating 5G technology. Based on the MoU signed, Ericsson Nigeria, and the government will agree upon ways the country could employ 5G toward aiding the government's efforts on digital transformation, such as fostering economic growth and providing enhanced public services. Moreover, the proliferation of edge computing and the increasing reliance on cloud services is further complementing the demand for 5G chipsets, as they ensure seamless integration of these technologies.

Global 5G Chipset Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia-Pacific accounted for the largest market share on account of rapid 5G deployment, strong government support, and the presence of major semiconductor manufacturers.

Asia-Pacific 5G Chipset Market Trends:

Asia Pacific is the largest contributor to the 5G chipset market, driven by rapid technological advancements, robust investments in 5G infrastructure, and the presence of major semiconductor manufacturers in the region. On August 14, 2024, the Asia-Pacific F5.5G All-Optical Summit was successfully hosted in Bangkok, themed "F5.5G All-Optical Access, Premium Transmission for Intelligence," attracting over 200 customers and partners from around Asia and the Pacific to share a glimpse of network technology innovation in all-optical network industries in the Asia-Pacific region. On the sidelines of the summit, Huawei launched F5.5G "All-Optical Access + Premium Transmission" network solution to lead intelligence transformation and grow a digital economy in the Asia-Pacific region.

Apart from this, the top countries in 5G adoption include China, South Korea, and Japan, which lead with huge government initiatives and public-private partnerships to accelerate deployment. China leads with aggressive network rollouts and the mass adoption of 5G-enabled devices. Apart from this, the growing consumer electronics industry in this region as well as the increasing IoT technology deployments in industrial processes boost demand for 5G chipsets. Furthermore, rapid penetration in smartphones coupled with a growing digital economy in developing countries such as India are positive for Asia Pacific's market dominance. According to GSMA's report "The Mobile Economy Asia Pacific 2024", 1.8 billion individuals in Asia Pacific are subscribed to a mobile service, this being 63% of the population. The growth of mobile internet penetration has been impressive. Mobile internet was adopted by 51% of the region's population at end 2023, some 1.4 billion users- triple the size of ten years ago. In 2023, mobile technologies and services generated 5.3% of Asia Pacific's GDP, a contribution that amounted to USD 880 billion of economic value added and supported around 13 million jobs across the region.

North America 5G Chipset Market Trends:

North America is one of the most significant markets for 5G chipsets, with early adoption of 5G technology and large investments by telecom giants. Extensive 5G rollouts in the United States spearhead this region, and that promotes IoT, augmented reality, and edge computing. Further, the region's tech-driven economy along with strong demand for connected devices is propelling the development and adoption of high-performance 5G chipsets.

Europe 5G Chipset Market Trends:

Europe's chipset market for 5G is driven by strong governmental initiatives, including funding for 5G infrastructure and research. Smart cities, automotive autonomous vehicles, and industrial automation are the drivers behind the demand for advanced chipsets in the region. Countries such as Germany, the UK, and France are leading in adopting 5G through early deployments and strong partnerships between telecom operators and technology providers, which keeps the region competitive in the global 5G ecosystem.

Latin America 5G Chipset Market Trends:

The 5G chipset market in Latin America is gradually increasing, supported by growing smartphone penetration and continued infrastructure development. Countries such as Brazil and Mexico are investing in the roll-out of 5G networks to enhance economic growth and digital connectivity. Apart from this, growing government support and private-sector collaboration are driving progress, allowing for the adoption of 5G chipsets across consumer and industrial sectors.

Middle East and Africa 5G Chipset Market Trends:

The Middle East and Africa region is gradually witnessing growth in its 5G chipset market, fueled by ambitious infrastructure projects and the increasing inclination toward digital transformation. Gulf countries are leading the 5G implementation process in the region, adopting it to further smart cities and industrial automation. This adoption may be slower in some regions, but escalating demand for connectivity and accommodating government policies is creating a positive market outlook.

Top Companies Leading in the 5G Chipset Industry

Some of the leading 5G chipset market companies include Advanced Micro Devices, Inc., Broadcom Inc., Huawei Technologies Co., Ltd., Intel Corporation, MediaTek, Nokia Corporation, Qorvo, Inc, Qualcomm Technologies, Inc., Samsung Electronics Co., Ltd., and UNISOC (Shanghai) Technologies Co., Ltd., among others. On July 30, 2024, Qualcomm announced the launch of its newest affordable, India-designed chipset: Snapdragon 4s Gen 2. It will allow mobile device manufacturers to sell 5G smartphones running on a standalone (SA) network at Rs 8,300 or less. The move is significant as the San Diego-based company is in direct competition with Taiwanese giant MediaTek for dominance in the 5G chipset market in India, particularly in the sub-Rs 10,000 segment.

Global 5G Chipset Market Segmentation Coverage

- On the basis of the chipset type, the market has been categorized into application-specific integrated circuits (ASIC), radio frequency integrated circuit (RFIC), millimeter wave technology chips, and field-programmable gate array (FPGA), wherein application-specific integrated circuits (ASIC) represent the leading segment. Application-specific integrated circuits (ASICs) lead the market due to their high efficiency and performance designed for 5G applications. Designed specifically for tasks such as network infrastructure and advanced mobile devices, ASICs provide superior speed and energy efficiency compared to general-purpose processors. Their widespread usage in base stations, IoT devices, and edge computing solutions ensures they remain critical for the rapid deployment and scalability of 5G networks across the globe.

- Based on the operational frequency, the market is classified into sub 6 GHz, between 26 and 39 Ghz, and above 39 GHz, amongst which sub 6 GHz dominates the market. The sub-6 GHz frequency band leads all other frequency bands in the market due to its reach, reliability, and versatility. It is the most widely deployed frequency range placed in both urban and rural areas. Additionally, it is ideal for early 5G rollouts as this frequency range balances speed and range effectively. Its ability to support high data transfer rates while maintaining broad penetration enhances its adoption in smartphones, IoT devices, and automation systems in industries globally.

- On the basis of the end-user, the market has been divided into consumer electronics, industrial automation, automotive and transportation, energy and utilities, healthcare, retail, and others. Among these, consumer electronics account for the majority of the market share. Consumer electronics primarily accounts for the leading sales of 5G chipsets due to the escalating demand for 5G-enabled smartphones, tablets, and wearables. The sector leads due to fast growth in demand for high-speed connectivity for high-definition streaming, gaming, and other augmented reality applications. With increasing smartphone penetration and rapid technology updates in devices, consumer electronics continues to lead in the adoption of 5G chipsets to meet the performance and user experience needs.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 7.9 Billion |

| Market Forecast in 2033 | USD 85.4 Billion |

| Market Growth Rate 2025-2033 | 30.2% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Chipset Types Covered | Application-Specific Integrated Circuits (ASIC), Radio Frequency Integrated Circuit (RFIC), Millimeter Wave Technology Chips, Field-Programmable Gate Array (FPGA) |

| Operational Frequencies Covered | Sub 6 GHz, Between 26 and 39 Ghz, Above 39 Ghz |

| End Users Covered | Consumer Electronics, Industrial Automation, Automotive and Transportation, Energy and Utilities, Healthcare, Retail, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Advanced Micro Devices, Inc., Broadcom Inc., Huawei Technologies Co., Ltd., Intel Corporation, MediaTek, Nokia Corporation, Qorvo, Inc, Qualcomm Technologies, Inc., Samsung Electronics Co., Ltd., UNISOC (Shanghai) Technologies Co., Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on 5G Chipset Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)