Global 3D Printing Plastics Market Expected to Reach USD 8,810.5 Million by 2033 | IMARC Group

Global 3D Printing Plastics Market Statistics, Outlook and Regional Analysis 2025-2033

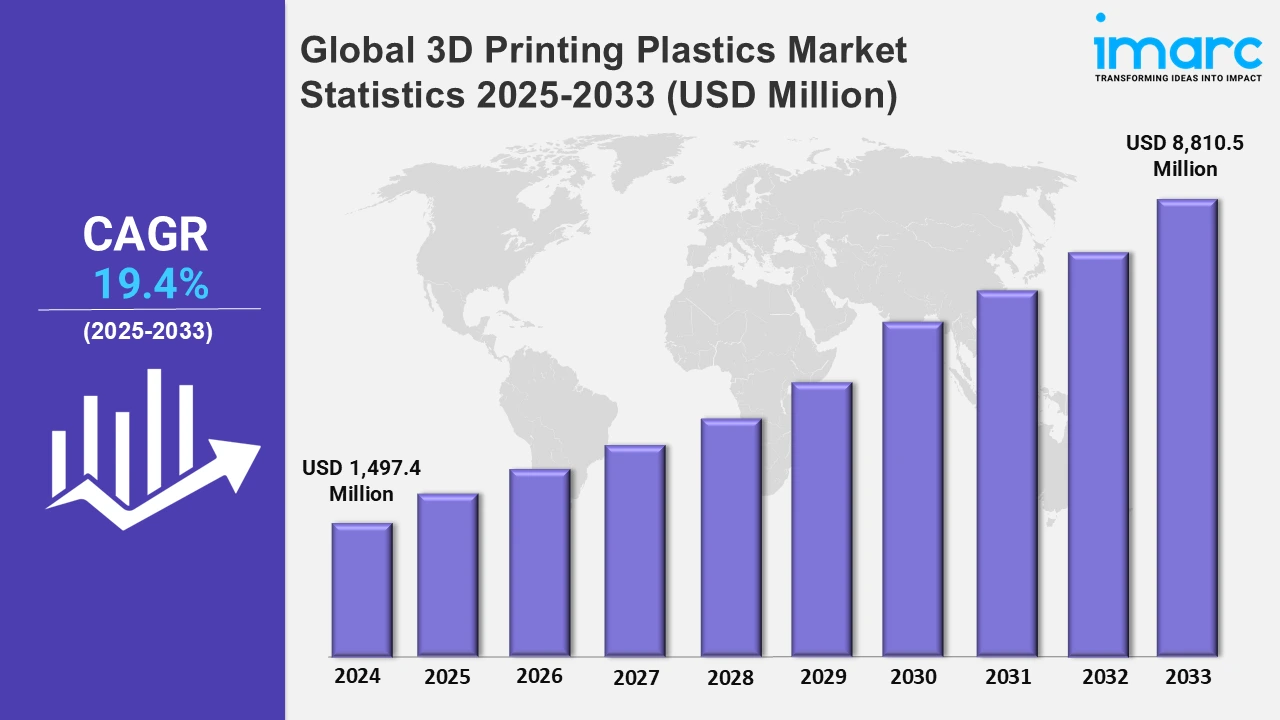

The global 3D printing plastics market size was valued at USD 1,497.4 Million in 2024, and it is expected to reach USD 8,810.5 Million by 2033, exhibiting a growth rate (CAGR) of 19.4% from 2025 to 2033.

To get more information on the this market, Request Sample

3D printer companies are starting recycling initiatives to recycle plastic waste, encouraging a circular economy. These efforts address rising concerns about 3D printing's environmental imprint by collecting and recycling print waste, reducing landfill input, and supporting sustainable production. For example, in April 2024, Filamentive, a UK-based 3D printing company, launched its free PLA 3D printing waste recycling scheme. This initiative seeks to address the critical issue of plastic waste in the 3D printing industry, with research indicating that up to 33% of 3D prints end up as waste, amounting to an estimated 400,000 kg of plastic waste annually in the UK alone from filament-based 3D printing.

New recycling facilities are converting electrical waste into useful 3D printing filament. This strategy addresses e-waste and supports sustainable manufacturing by converting hard plastics into useful 3D printing materials, promoting a circular economy, and reducing demand for raw materials for a more sustainable future. For example, according to the Global E-Waste Monitor 2020, published by the United Nations University (UNU), the International Telecommunication Union (ITU), and the International Solid Waste Association (ISWA), Australia generated approximately 554,000 metric tons of electronic waste in 2019. For instance, in July 2024, the city of Sydney, Australia, announced the launch of a new facility dedicated to recycling hard plastics from electronic waste into 3D printing filament. Furthermore, the 3D printing industry is expanding with larger-format and biocompatible 3D printers that can handle high-volume and specialized output. For example, in October 2024, Formlabs expanded its 3D printing portfolio with the launch of the new Form 4L, a large-format SLA 3D printer with a build volume nearly five times larger than its Form 4 machine.

Global 3D Printing Plastics Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share on account of robust technological advances, comprising research institutes and creative businesses.

North America 3D Printing Plastics Market Trends:

The broad manufacturing sector of the region, which includes aerospace and automotive, as well as healthcare and consumer products, assures that 3D printing plastics will find a wide range of uses. For example, in May 2024, U.S.-based 3D printer manufacturer 3D Systems Inc. launched its new multi-material 3D printed denture offering.

Asia-Pacific 3D Printing Plastics Market Trends:

In the Asia-Pacific region, the electronics sector, particularly Samsung in South Korea, is rapidly utilizing 3D printing, which increases demand for specialist polymers. This technique lowers production costs and accelerates development cycles, emphasizing the importance of 3D printing plastics in advanced manufacturing across the region.

Europe 3D Printing Plastics Market Trends:

Europe's aerospace sector is at the forefront of 3D printing with polymers, as evidenced by Airbus' usage of Ultem 9085 for lightweight aircraft parts. The shift to 3D-printed plastics reflects Europe's emphasis on efficiency and sustainability, which drives demand for innovative polymers in aircraft production.

Latin America 3D Printing Plastics Market Trends:

In Latin America, particularly Brazil, the healthcare industry is developing 3D-printed polymers for specialized medical items such as prosthetics. Brazilian hospitals employ this technology to deliver low-cost and patient-specific solutions, increasing accessibility and emphasizing the region's growing usage of 3D printing plastics in healthcare.

Middle East and Africa 3D Printing Plastics Market Trends:

The construction sector in the Middle East and Africa is embracing 3D printing with long-lasting polymers to expedite building production and reduce expenses. Dubai's 3D-printed workplace, constructed from high-strength plastic components, exemplifies the region's inventive approach to overcoming building obstacles.

Top Companies Leading in the 3D Printing Plastics Industry

Some of the leading 3D printing plastics market companies include 3D Systems Inc., Arkema S.A., BASF SE, CRP Technology srl, EOS GmbH - Electro Optical Systems, Evonik Industries AG, Henkel AG & Co. KGaA, Materialise NV, Shenzhen Esun Industrial Co. Ltd., Solvay S.A., Stratasys Ltd., and Toner Plastics, among many others. In June 2019, Stratasys Ltd. entered into partnerships with materials firms for big growth opportunities for additive manufacturing. As part of that approach, the company launched its authorized materials partner program at the trade show and disclosed its first partner, i.e., Solvay SA.

Global 3D Printing Plastics Market Segmentation Coverage

- On the basis of the type, the market has been bifurcated into photopolymers, ABS and ASA, polyamide/nylon, polylactic acid (PLA), and others, wherein photopolymers represent the most preferred segment. Photopolymers are notable for their ability to rapidly harden under light exposure, making them ideal for elaborate patterns and fine details.

- Based on the form, the market is categorized into filament, liquid/ink, and powder, amongst which filament dominates the market. Filament-based 3D printing is popular because it is easy to use and compatible with a wide range of 3D printers.

- On the basis of the application, the market has been divided into manufacturing and prototyping. Among these, prototyping exhibits a clear dominance in the market. Engineers and designers have long used these polymers for fast prototyping, which allows them to construct physical models of items for testing and validation swiftly.

- Based on the end user, the market is bifurcated into automotive, healthcare, aerospace and defense, and consumer goods. The automotive industry uses these materials to manufacture lightweight and durable parts. In healthcare, 3D printing plastics allow for the creation of unique prostheses, implants, and surgical equipment. The accuracy and versatility of 3D-printed plastics are beneficial to the aerospace and defense industries, while personalized items and prototypes find use in consumer goods.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 1,497.4 Million |

| Market Forecast in 2033 | USD 8,810.5 Million |

| Market Growth Rate 2025-2033 | 19.4% |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Photopolymers, ABS and ASA, Polyamide/Nylon, Polylactic Acid (PLA), Others |

| Forms Covered | Filament, Liquid/Ink, Powder |

| Applications Covered | Manufacturing, Prototyping |

| End Users Covered | Automotive, Healthcare, Aerospace and Defense, Consumer Goods |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | 3D Systems Inc., Arkema S.A., BASF SE, CRP Technology srl, EOS GmbH - Electro Optical Systems, Evonik Industries AG, Henkel AG & Co. KGaA, Materialise NV, Shenzhen Esun Industrial Co. Ltd., Solvay S.A., Stratasys Ltd., Toner Plastics, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on 3D Printing Plastics Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)